Can You Get a Tax Deduction for Your 401(k)?

Planning for retirement takes some level of strategy because it requires us to consider not only how to build wealth but how to protect it as well. Employers offer 401(k)s to address the first need, but careful planning can help us ensure our money stays with us. While you can’t get a 401(k) tax deduction, 401(k) plans make it possible to lower your taxable income. So, you face fewer income taxes come time to withdraw. A financial advisor could help you put a tax strategy together for your investments and retirement savings. Here’s how you can reduce your tax liability with your 401(k) and focus on savings.

How 401(K) Contributions Can Reduce Your Tax Liability?

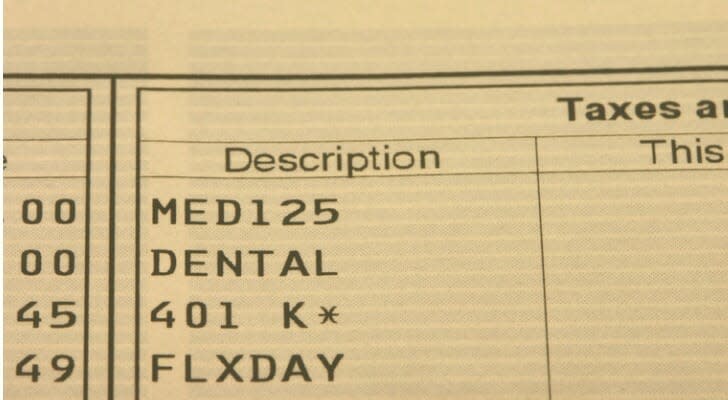

When you make contributions to your 401(k), you do it on a pretax basis. Essentially, some of the money earned through your work goes directly into the account before taxes can take a bite out of it. That reduction from your take-home pay shrinks your taxable income. As a result, you pay less income tax.

For example, let’s say you earn a salary of $40,000. According to the IRS’s marginal rates for the 2021 tax year, that puts you in the 12% tax bracket.

You decide to take advantage of your employer’s 401(k) matching program. They offer a dollar-for-dollar match up to 3% of your annual salary, so you meet them at 3%. Together, you contribute a total of 6% of your annual salary, which is $2,400. Subtracting that value from $40,000, you get your taxable income of $37,600.

The income tax on your full salary is $4,800. That’s $288 more than the tax on $37,600, at $4,512. Thus, saving you money every year you contribute to your 401(k). In addition, any interest made on those contributions also grows tax-deferred.

401(k) Distributions Timing to Cut Taxes

While 401(k)s help reduce your tax liability today, you will eventually face taxes. This is because owners of 401(k)s get hit with income taxes when they make a withdrawal from the account.

The good news is that you’ll likely face lower taxes at that time than you would today. Most retirees drop into a lower tax bracket since their income decreases. So, any distributions you take from your account get taxed at a much lower rate.

Waiting until after you’re 59 ½ years old will also reduce costs. Withdrawing too early, before that age, normally results in taxes and a penalty of 10%. But, on the other hand, you must start making withdrawals, called required minimum distributions (RMDs), once you hit age 72.

How Roth 401(k)s Cut Your Tax Liability in Retirement

Roth 401(k)s come with many of the perks a traditional 401(k) provides. Like the latter, employers sponsor these retirement plans. However, you use after-tax money to contribute to them instead of pretax money. As a result, they have no impact on your current taxable income. So, you continue to pay taxes on your full paycheck as you contribute. However, you won’t face any income taxes when you withdraw in the future.

Because of this, the tax savings you get through a Roth 401(k) depend on your current and future tax rates. It’s possible to earn more in your retirement, putting you in a higher tax bracket. If so, a Roth 401(k) would benefit you since you avoid paying higher income taxes on your withdrawals during that time. In contrast, if you believe your income tax will drop in retirement, you’re likely better off with a traditional 401(k).

You also have the option to use both. Taxpayers can fund a traditional, tax-deferred 401(k) as well as a Roth version. However, keep in mind that both normally require you to be at least 59 ½ to withdraw without penalty and require minimum distributions after you turn 72.

Other Tax Benefits for Saving

If you’re focused on lowering your tax bill, there is another way. The Saver’s Credit, originally called the Retirement Savings Contributions Credit, gives eligible taxpayers a break. Specifically, it’s designed for those who earn a low to moderate income.

Essentially, the Saver’s Credit lowers your taxable income by a percentage of your contribution. Depending on your filing status and adjusted gross income, you can claim it for 10%, 20% or 50% of the first $2,000 you put into your retirement account annually. So, the maximum amount you can claim through the credit is $200, $400 and $1,000, respectively. However, married couples filing jointly the maximum they can claim is $2,000.

Full-time students and dependents are not eligible for this credit, and you must meet the income requirements. The maximum adjusted gross income limits are $66,000 for couples filing jointly, $49,500 for a head of household and $33,000 for all other taxpayers. You can also claim the Saver’s Credit on other accounts, such as a 403(b), 457 plan, simple IRA or a SEP IRA.

Bottom Line

Unfortunately, contributing to a 401(k) doesn’t allow you to make any tax deductions. However, these retirement accounts allow for other tax benefits. Contributing pretax into a traditional 401(k) lets you lower your taxable income. So, you only face income taxes come retirement when your tax bracket drops. But if you believe you’ll earn more in your later years, there’s still the option of Roth 401(k)s. There are also other ways to reduce your taxable income, such as making charitable donations to nonprofits.

Tips for Retirement

What do your plans look like for retirement? Will building your 401(k) be enough to support you during it? These are tough questions, but a financial advisor can guide you through them. SmartAsset’s free tool matches you with up to three financial advisors in your area, and you can interview your advisor matches at no cost to decide which one is right for you. If you’re ready to find an advisor who can help you achieve your financial goals, get started now.

A 401(k) is a great way to build funds to support you through your retirement. But retirees are often caught off guard by unexpected costs like emergencies and medical bills. These can drain your reserve of funds. So, every working adult should consider planning for these potential healthcare expenses. A health savings account (HSA) is one way to do that. They’re tax-deferred like 401(k)s but lack taxes on qualified withdrawals. You can check out our guide on HSAs to see if they’re right for you.

Photo credit: ©iStock.com/DNY59, ©iStock.com/RBFried, ©iStock.com/alfexe

The post Can You Get a Tax Deduction for Your 401(k)? appeared first on SmartAsset Blog.