Tax relief for Massachusetts residents is on its way. The questions are when, and how much?

- Oops!Something went wrong.Please try again later.

- Oops!Something went wrong.Please try again later.

- Oops!Something went wrong.Please try again later.

BOSTON — Tax relief for all Massachusetts residents who filed 2021 returns is on the horizon, at least according to promises made Monday by the state leadership.

After meeting in a closed-door session with Gov. Charlie Baker to discuss the stalled economic development bill, the governor’s close-out budget and other matters, House Speaker Ronald Mariano, D-Quincy, and Senate President Karen Spilka, D-Ashland, confirmed that “there will be tax relief no matter what.”

The relief, some $3 billion, will find its way to taxpayers' pockets (and bank accounts) sometime before the end of the year.

Baker, who had hoped it would be distributed by Thanksgiving, expects it will offset, somewhat, increases in the cost of heating, fuel and holiday expenses.

The return will not take the form originally envisioned by the state Legislature and included in the economic development bill touted in July. The Senate had included $1 billion in relief in that bill: A half billion dollars in direct payments to the state’s lowest earners, and another half billion in tax credits for the middle class.

More: Massachusetts collected more taxes than is allowed in 2021, here's when you'll get it back

The measure stalled when Baker announced that the state had collected too much money in taxes and must return $2.9 billion to residents, under a law known as Chapter 62F, passed by ballot initiative in 1986.

More: Checks for low, median income residents could come if legislature passes spending package

That announcement put a hold on the $4 billion-plus economic development bill that also included funds for local infrastructure projects, hospitals, housing production, the Unemployment Insurance Trust Fund and money for child care providers and the hotel industry.

That measure is still in limbo, although legislative leaders hope to find consensus and pass some of its provisions before the year ends.

Spilka indicated that the result of Question 1, which would raise tax rates on incomes above $1 million, could influence lawmakers in updating the economic development bill.

A bill filed last week by progressives in both the House and the Senate would have tweaked the redistribution of the funds under Chapter 62F.

The bill suggested capping the return at $6,500 for the state’s top earners; under the current law, the top filers could receive up to $32,000. It also changes the formula to ensure than low-income and middle-class families get more money back.

Return calculator

The governor’s office has launched a return calculator: Taxpayers will see about 13% of their 2021 tax bill back in their pockets. The state’s lowest wage earners, those who earn less than $8,000 and do not pay income tax, will not receive any of the windfall.

These low wage earners tend to pay proportionately more of their income in taxes — sales and gasoline taxes, excise taxes and use taxes — than higher wage earners.

Mariano said the bill will not be addressed by the lame-duck legislature.

“In this time of widespread economic hardship for so many people, my focus continues to be on advocating for good economic policy,” said Rep. Michael Connolly, D-Cambridge, who advanced the bill to recalculate the way the state returns the $2.9 billion.

Rep. Jamie Zahlaway Belsito, D-Topsfield, said she had worked with Connolly and Sen. Jamie Eldridge, D-Acton, to create equity in tax rebates related to Chapter 62F.

“My mother is telling me that her friends in her senior housing complex can't even buy food that they normally could have bought six to 12 months ago because of inflation —we're not going to cut a $25,000 check for top earners in our state and turn around and say to our seniors, who are barely keeping it together, here's a $9 check for you,” Belsito said.

The 1986 law, she said, is "a Reaganomics, trickle-down, Voodoo-economics hangover from 1986."

More: State House progressives file bill to cap tax refund for millionaires, give more to poor

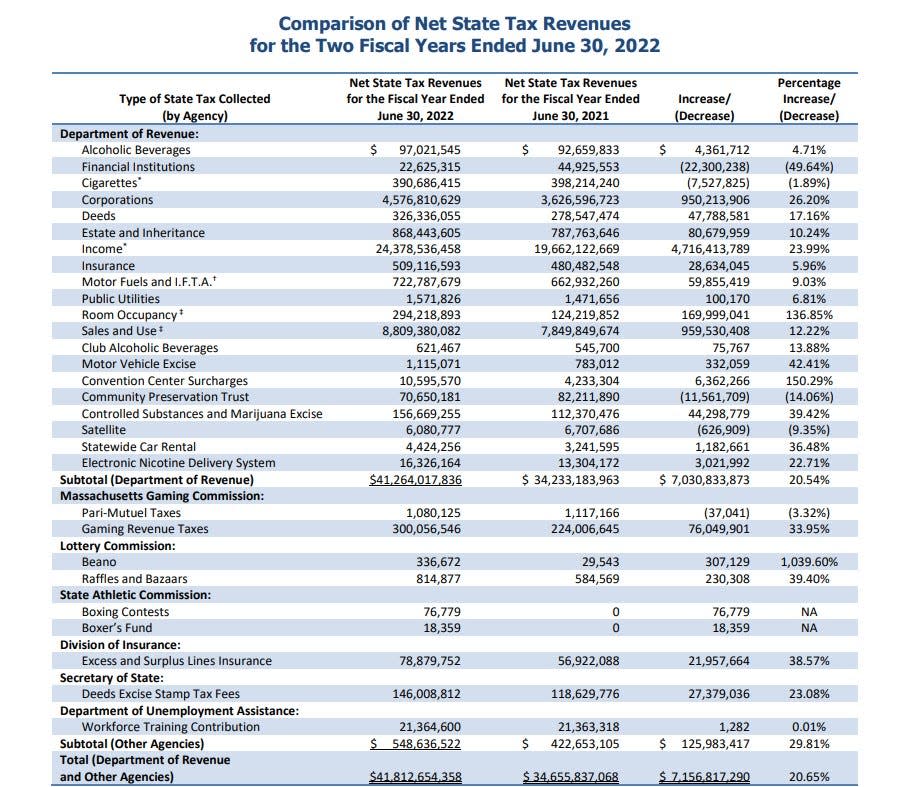

The overage represents all taxes paid in Massachusetts, not just income tax, including the lottery, convention and use taxes, excise taxes and other categories of revenue collection.

In a statement, Baker's administration said: “Returning excess revenues to taxpayers by check and direct deposit ensures that taxpayers get their refunds this fall as residents families continue to face high costs, instead of making taxpayers wait until next year to receive their share of the excess revenue collected.”

This article originally appeared on Telegram & Gazette: Massachusetts must return a ton of collected tax money to residents