Tax Talk finishes the season with pros and cons of requesting an extension to file

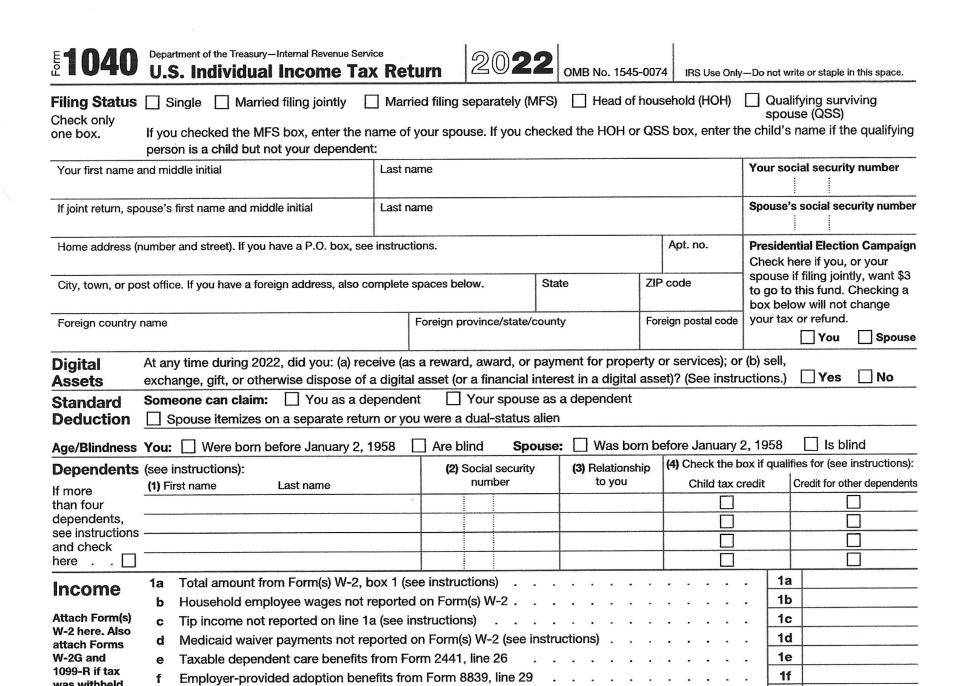

We promised a column on the benefits of requesting an automatic six-month extension to file your federal income tax return. The below effort lists the pros and cons of asking for more time.

Here's our TOP TEN (in alphabetical order) reasons for completing Form 4868 — Application for Automatic Extension of Time To File U.S. Individual Income Tax Return.

Tax Talk: The Bible is a 'Who's Who' of the good, bad, and ugly when it comes to tax compliance

Accuracy of the return will most likely improve. The IRS estimates the average return takes over 13 hours to complete. Cramming those hours into a short time frame more-often-than-not will cause errors to occur.

Better understanding of various income tax elements may occur. Like a lot of life's components, spending and spreading out the time spent on a topic enhances one’s ability to work with its nitty-gritty and nuances.

Computation errors are less likely. See item A.

Documentation or paper trail is likely to be more readily available or robust. As you sort through your records, important income, deduction and/or credit documents often surface and are saved.

Extension request does NOT make it more likely that your return will be audited. Let's put that "urban legend" to rest since the overall audit rate for individuals is about 0.4%.

Market Basket: House Wins brings a mix of old and new furniture and housewares to downtown South Bend

Failure to file penalty or late filing penalty is avoided. Since this "extra charge" can add up quickly, avoiding it is prudent.

Greater chance of discovering or uncovering an important element that should be part of the income tax return. See item D.

Help from CPAs or other tax advisors is easier to find after the "traditional tax season" closes. And it may not cost as much given the impact of supply and demand.

Interest on any underpayment of tax may be avoided. Because the request may include a payment, the interest charge is not in play.

Just about every state accepts the federal extension request and allows the taxpayer additional time to file his/her state income tax return. No less than seven states have certain areas with unique weather-related extensions rules this year. These can affect the final tax return payments as well as the 2023 estimated payments. The list — www.irs.gov/newsroom/tax-relief-in-disaster-situations — is amazingly diverse. Its range of natural calamities includes floods, snowstorms, tornadoes, landslides, mudslides and straight-line winds. Speaking of biblical — phew!!

Farm and Food: Woe is WOTUS: When lawmakers make water policy through lawsuits

Here are the CONS of requesting an extension.

Check, credit/debit card or some other type of payment must occur if the Form 4868 reports a balance due.

Only the filing time is extended. This statement bears repeating because many folks think the extension also applies to paying taxes.

No surprise! States have their own specific rules. For example, Indiana Form IT-9 provides a 60-day extension of time to file. Form 4868 will be recognized by Indiana if the taxpayer paid at least 90% of taxes owed to the Hoosier state.

Sluggishness in April may still be part of one's approach to taxes in October.

Ken & Klee's Tax Notebook — The Form 4868 cited above gives a taxpayer until Monday, October 16, 2023, to file their income tax return; the failure-to-file penalty is 5% of the balance due for every month (or part of a month) in which taxes go unpaid with a maximum amount of 25% of your unpaid taxes; the interest rate being charged by the IRS on late payments is 7%. This rate is set quarterly by the Feds. Also, there’s a failure-to-pay late payment penalty which is usually half of 1% of any tax owed and not paid on April 18.

Whether you defer filing or not, this is a good time (even if you are receiving a refund) to gauge if your payroll withholding taxes need to be adjusted at either the federal or state level. Adjusting federal income tax withholding with an employer is easy. Using the Tax Withholding Estimator tool at www.irs.gov can help you determine if the correct amount is being withheld. This is especially important when there's been a change in jobs, income or other life events such as marriage or divorce, childbirth, an adoption or a home purchase.

This is the final Tax Talk column of the 2022-23 tax season. We hope you enjoyed/endured our ideas, insights, instructions and other informative messages. God willing, look for Tax Talk on or about Dec. 10, 2023.

Rick Klee served as the tax director at the University of Notre Dame from 1998 through August 2019. A retired CPA, Klee is a graduate of Notre Dame. You can contact him at rklee@nd.edu.

Ken Milani is a professor of accountancy at Notre Dame where he served as the faculty coordinator of the Notre Dame Tax Assistance Program. Contact him at milani.1@nd.edu.

E-mail questions to either.

This article originally appeared on South Bend Tribune: Pros and cons of a tax return filing extension with the IRS & Indiana