'My taxes on my home went up over $100K' Shiloh resident says of 'unjust' appraisals

Two serious, overlapping efforts investigating racial and economic disparities in Buncombe County kicked off in November, and they' are already fielding public outcry on the topic.

Buncombe's newly formed Ad Hoc Reappraisal Committee and a Dogwood Health Trust grant-funded, UNC Asheville-led cooperative project are seeking to address racial and economic disparity in tax assessment.

In its second meeting Dec. 8, the ad hoc committee, made of eight residents and no commissioners, heard public comment on tax assessment issues for the first time.

"I live in the Biltmore, Shiloh area," said resident Samuel Morgan, the first person to speak. "My taxes on the appraisal on my home went up over $100,000 from last appraisal. Anyone in here want to justify that?"

More: Sidney Powell's Biltmore Forest home up 25% in tax value; small house in a Black area, 44%

Morgan said there were "no improvements" to the neighborhood and he believed the high assessment was "wrong" and that there was an effort to "price people out."

Morgan's frustrations echo ongoing concerns this year that tax increases will hit historically black neighborhoods hard and go easier on wealthy communities.

Not only has this prompted the formation of the reappraisal committee, it's also spurned investment in equity-oriented research.

An early November news release announced Dogwood had awarded an $850,000 grant to UNCA Department of Health and Wellness' work with the Just Accounting for Health consortium, a group that includes the university, Asheville Racial Justice Coalition, Strong Towns and and Asheville-based researchers Urban3.

UNCA representatives were not immediately able to comment.

Related: Many elderly benefit from popular Asheville, Buncombe tax giveback program

Two Urban3 employees, Joe Minicozzi and Ori Baber, recently conducted preliminary studies indicating "low-income households were being overvalued in their tax assessments in Western North Carolina, while higher- and middle-income households were being undervalued," according to a release about the grant.

Baber is one of the golden threads between the UNCA-led project and the ad hoc committee: He's one of its eight members.

Also on the committee are DeWayne McAfee, Debbie Lane, Miriam McKinney, Melanie Pitrolo, Bobbette Mays, Jonathan Hunter and Brenda Mills - the newly appointed director of Asheville's Equity and Inclusion Office.

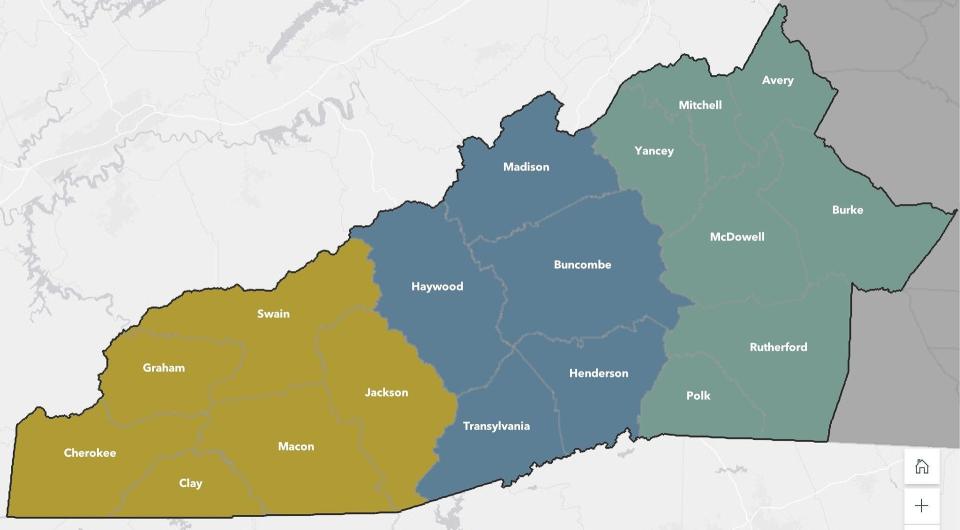

Set to put "extensive analysis of tax procedures in 18 North Carolina counties over the next 18 months," the project seeks to address issues across WNC that are also intimate to Buncombe.

Related: New Asheville director of equity & inclusion to lead reparations, bring on new staff

A webinar introducing and explaining the project is set for Jan. 27.

Those 18 months will include several community summits "focused on identifying actionable solutions," according to the release.

Ultimately, JAfH will use studies and feedback to "develop a toolkit for local advocates and government officials to help them pursue more equitable policies."

People directly affected by property tax hikes are questioning whether studies and committees will address what's become a very immediate concern.

"I think it's a positive thing that they're making the effort to look into it," said Raymond Harrell, another Shiloh community member whose 0.3-acre property value rose 44% in value from $101,600 to $146,800.

"But I see it pretty much as a bureaucratic rats nest and probably little to nothing that will affect me will happen."

More: Record-setting $9.5M Asheville area home got tens of thousands of dollars in tax breaks

Baber said he's heard that sentiment before. When asked to respond to it, he was optimistic.

"I see very practical solutions that our local government can take that will help mitigate and address these disparities," he said. "We're not talking about big-lift, long-term, state-level legislation that needs to be changed. There are some very simple strategies that could be put into place and adopted here locally."

More: Say what?!? Asheville makes 'worst place to live' list, based on standard of living

As the efforts to address economic inequality and adjacent racial issues in Buncombe and beyond, questions about immediate issues of affordability remain.

"I can afford to pay my taxes. A lot of people can't," Morgan said, adding skepticism about the narrative that everybody wanted to live in the Shiloh area. "It's unreal. That's all I got to say."

Andrew Jones is Buncombe County government and health care reporter for the Asheville Citizen Times, part of the USA TODAY Network. Follow or reach him at @arjonesreports on Facebook and Twitter. Email him at arjones@citizentimes.com.

This article originally appeared on Asheville Citizen Times: New Buncombe County committee on tax appraisal inequity