Tech Curbs and Bank Tax: An Investor’s Guide to Dutch Election

- Oops!Something went wrong.Please try again later.

(Bloomberg) -- Investors are counting on Wednesday’s election in the Netherlands for clarity on policies targeting banks, technology firms, real estate and airlines.

Most Read from Bloomberg

Sam Altman, OpenAI Board Open Talks to Negotiate His Possible Return

Nvidia Fails to Satisfy Lofty Investor Expectations for AI Boom

McKinsey and Its Peers Are Facing the Wildest Headwinds in Years

Binance Pleads Guilty, Loses CZ, Pays Fines to End Legal Woes

After the collapse of Prime Minister Mark Rutte’s government in July, the makeup of the next coalition will determine various issues currently in play.

Under scrutiny will be the country’s role in supporting US efforts to curb exports of cutting-edge technology to China. These have weighed on the largest Dutch stock ASML Holding NV — Europe’s most valuable tech company. A restrictive aviation policy threatens the Dutch arm of Air France-KLM, while lenders ING Groep NV and ABN Amro Bank NV face the prospect of higher taxes and a levy on share buybacks.

Tax breaks for expatriates and other policies key to the Netherlands as a destination for skilled workers will also be in focus for companies.

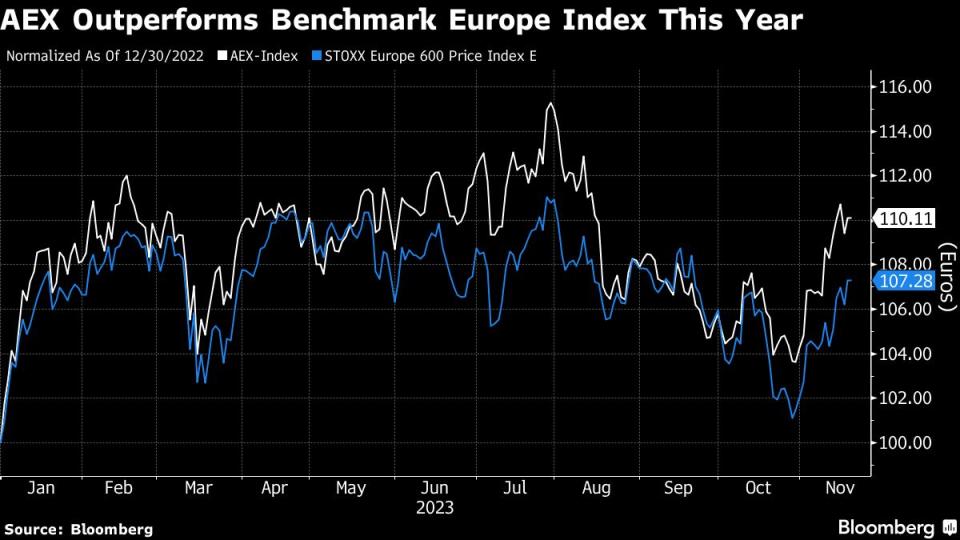

Amid this year’s upheaval, the AEX index of the 25 largest stocks listed on the Euronext Amsterdam has risen about 10%, outperforming the Stoxx Europe 600 — boosted by tech shares.

Here are some key issues and corporations to watch ahead of the Dutch election:

ASML Restrictions

How the new Dutch government forges ties with the US will be crucial to ASML. Pressure from Washington pushed the Netherlands last summer to announce plans to prohibit the maker of cutting-edge chip machinery from shipping some of its lithography devices to China.

An election frontrunner Dilan Yesilgoz-Zegerius, who leads Rutte’s liberal People’s Party for Freedom and Democracy, is generally pro-US and favors maintaining the status quo of close cooperation and alignment.

ASML China Export Curbs Came Too Late, Dutch PM Frontrunner Says

Her rival Pieter Omtzigt, leader of the newly-launched New Social Contract which is also polling among the top parties, is more skeptical of the US and calls for European cooperation and prioritizing national sovereignty.

Chip-gear makers have surged this year. BE Semiconductor Industries NV’s roughly 120% gain has made it the second-best performer in Europe this year, while ASML shares are about 26% higher.

Bank Stocks

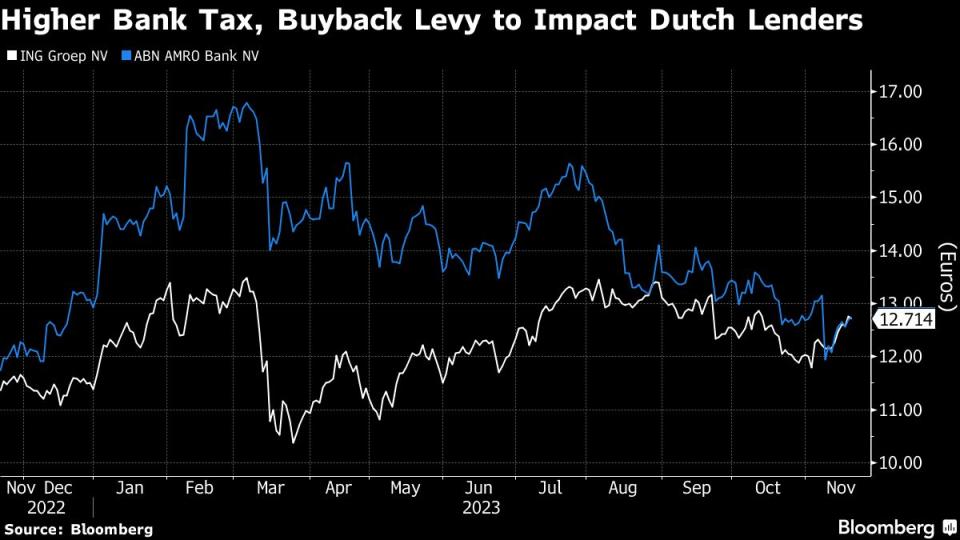

Banks including ING and ABN Amro will be watching how the new cabinet addresses the lower house of parliament’s plan to raise taxes on lenders and add a levy on share buybacks. The proposal was brought forward by the Green Left and Labor parties to enable an increase in the minimum wage and is now subject to senate approval.

The Dutch Banking Association has blasted the proposal. Outgoing premier Rutte also expressed objections in parliament, warning lawmakers that the tax would make banks flee the Netherlands and ultimately drain revenue from government coffers.

“Banks will probably be most impacted,” said Corné van Zeijl, a strategist at Cardano Asset Management. “Most parties want to have an extra tax on banking profits in their programs,” he said. ABN Amro shares are down by around 2% this year, while ING is up 12%.

Where Dutch Voters Go, Others Will Follow: Lionel Laurent

ABN Amro Sale

The government bailed out ABN Amro at the height of the financial crisis in 2008 in a €22 billion ($24.1 billion) package, transforming it from one of the world’s biggest banks to a consumer-focused lender for the domestic market.

It returned as a publicly traded company in November 2015, after the government sold a 23% stake in an initial offering. It has since began a gradual exit from the lender through share disposals, and it recently cut its holdings to below 50% for the first time since the bailout.

As one of the few lenders still under government control after the crisis, ABN Amro has attracted interest from rivals such as BNP Paribas SA, though takeover talks haven’t progressed meaningfully. The new government will have to decide on steps that may move the bank closer to full private ownership.

Aviation Measures

The Dutch government wants to reduce flights at Amsterdam’s Schiphol Airport next year to lower noise pollution, a move that has met opposition from Dutch flag carrier KLM and global airline lobby IATA.

Earlier this month, the Netherlands abandoned the first stage of the plan to reduce capacity at the airport, bowing to pressure from the European Union and the US, which threatened to retaliate after JetBlue Airways Corp. was barred from Schiphol over the restrictions.

Dutch Back Down in JetBlue Flap That Risked KLM Ouster at JFK

The government’s plan to reduce flights at Schiphol Airport by 10% from November next year still stands.

Real Estate

While housing scarcity had made the Netherlands a key market for real estate investors, new rent regulations and increases in property transfer tax have created uncertainty.

After several years in which both domestic and foreign investors invested massively in Dutch homes, the property sector has become a key issue among an electorate grappling with rising living costs.

Sweden’s Heimstaden Bostad AB and Canadian investor European Residential Real Estate Investment Trust, which own residential property in the country, are considering asset sales, partly due to policy risk.

Expat Tax & Tech Jobs

After Brexit drove companies to European hubs such as Amsterdam, the election is set to reflect domestic concerns. Far-right populist Geert Wilders has seen a late surge in polls.

Proposals to control an influx of international students, and efforts by Omtzigt’s NSC to also make Dutch the language of instruction at universities, have raised concerns about a potential shrinking of the international talent pool, particularly for tech jobs.

Companies are also seeking clarity over a bill passed by parliament’s lower house to drastically shrink tax relief for expatriates, also led by Omtzigt.

If the bill turns into law after the elections, it is expected to affect technology-led jobs, impacting ASML, BE Semiconductor Industries NV, financial technology company Adyen NV, medical technology firm Royal Philips NV and online travel company Booking Holdings Inc. — which has significant operations in the country.

Netherlands-headquartered and US-listed NXP Semiconductors NV director Jean Schreurs told Dutch daily Het Financieele Dagblad recently that such policy proposals makes the choice of Netherlands “more unattractive.”

TenneT Sale

The Netherlands is on the cusp of a deal to sell Germany’s largest power grid, owned by Tennet Holding BV, to the German government for just over €22 billion. Negotiations are still ongoing and could drag on.

Germany was trying to clinch the long-awaited deal just weeks before Dutch general elections scheduled for Nov. 22 but the transaction has faced multiple delays with both governments haggling over the price. The Dutch caretaker government was given the green light by parliament to continue discussions on Germany’s buyout of its biggest power grid operator from the Netherlands. A deal could still be announced before the formation of a new government.

Most Read from Bloomberg Businessweek

How Elon Musk Spent Three Years Falling Down a Red-Pilled Rabbit Hole

More Americans on Ozempic Means Smaller Plates at Thanksgiving

Guatemalan Town Invests Remittance Dollars to Deter Migration

©2023 Bloomberg L.P.