Tech Stock Faces Off With Bearish Trendline

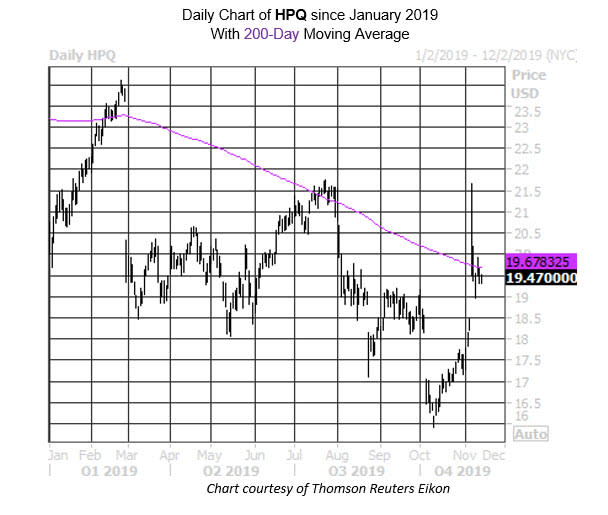

A week ago today, the shares of HP Inc (NYSE:HPQ) gapped higher amid reports of Xerox's (XRX) bid to take over HP is a cash-and-stock offer of $22 per share. Since then, however, the stock has cooled on news that the sale is facing some uncertainty -- and to make matters worse -- HPQ is sitting just below a historically bearish trendline.

In other words, the equity is within striking distance of its 200-day moving average. There have been two similar run-ups after a lengthy stretch below the trendline, defined for this study as having traded south of the moving average 60% of the time in the past two months and in eight of the last 10 trading days. After which, the shares averaged a one-month loss of 14.9% and were lower both times, per data from Schaeffer's Senior Quantitative Analyst Rocky White.

At last check, HPQ was trading at $19.47, so a similar 15% pullback would mean the $16.50 region is once more in play, and the stock's 11.8% month-to-date lead would be erased. Just below there sits its Oct. 10 two-year low of $15.93. Plus, heading into today's trading, the tech stock is firmly in overbought territory, per its 14-day Relative Strength Index (RSI) of 71, which further underscores a short-term breather is in the cards.

Should the stock once again backpedal, there's plenty of room aboard the bearish bandwagon, as only a slim 1.3% of HPQ's total available float is sold short. Options traders, on the other hand, appear to be targeting puts. Peak front-month open interest is found at the November 19.50 put, indicating options traders aren't banking on any more rallies from HPQ by this week's end, when the options expire.