Teladoc Health, Inc. (NYSE:TDOC) Reported High Q2 Growth, Still has a Long Way to Investors' Confidence

This article was originally published on Simply Wall St News

Last week saw the newest second-quarter earnings release from Teladoc Health, Inc. ( NYSE:TDOC ). The company posted revenues in line with expectations, at US$503m, while statutory losses ballooned to US$0.86 per share.

Teladoc is mitigating the expenses caused by the acquisition of Livongo Health, Inc. around a year ago. Net loss was US$(333.5)m for the first half of 2021 compared to US$(55.3)m for the first half of 2020. The second quarter and first half of 2021 include stock-based compensation expense of US$83m and US$169.3m, respectively, an increase of US$61m and US$129m, respectively, from the second quarter and first half of 2020, substantially reflecting higher expense associated with Livongo stock awards that continue to vest after the merger. It is clear that integrating a US$15.9b dollar project will have some medium term lasting implications and shareholders can only hope that this big move pays off down the line.

On a more optimistic note, Teladoc recently announced a strategic alliance with Microsoft Corporation ( NASDAQ:MSFT ), where they will provide extended use of the Microsoft Teams video conferencing platform for commercial purposes. Microsoft is slowly angling the healthcare industry and may consider further supporting similar projects.

Teladoc Health growth opportunities will be further supported by their recently announced deal with HCSC - a large health insurance company in the USA. Beginning next year, Teladoc services for diabetes and hypertension will be available to HCSC members.

It is apparent that Teladoc is still developing their business model, and is incurring large costs as a result. On the other hand, we should look at how much growth they are delivering to shareholders

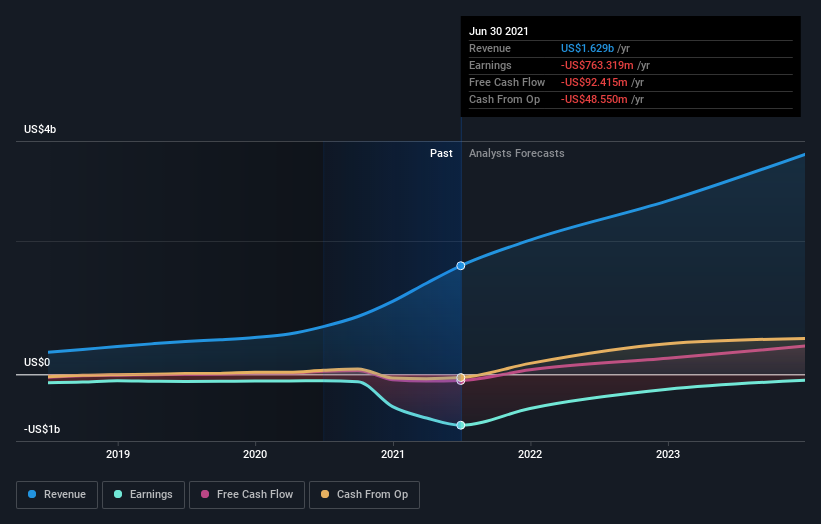

Following the latest earnings result, the analysts have updated their earnings model, and we've gathered the most recent statutory forecasts in the chart below.

Check out our latest analysis for Teladoc Health

Taking into account the latest results, the consensus forecast from Teladoc Health's 27 analysts is for revenues of US$2.01b in 2021, which would reflect a substantial 24% improvement in sales compared to the last 12 months.

The loss per share is expected to greatly reduce in the near future, narrowing 42% to US$3.42.

With the increase in forecast losses for next year, it's perhaps no surprise to see that the average price target dipped 10% to US$203, with the analysts signalling that losses would be a definite concern.

That's not the only conclusion we can draw from this data however, as some investors also like to consider the spread in estimates when evaluating analyst price targets.Currently, the most bullish analyst prices Teladoc Health at US$291 per share, while the most bearish at US$140.

This is a fairly broad spread of estimates, suggesting that analysts are forecasting a wide range of possible outcomes for the business.

Another way we can view these estimates is in the context of the bigger picture, such as how the forecasts stack up against past performance, and whether predictions are more or less bullish relative to other companies in the industry.

The period to the end of 2021 brings more of the same, according to the analysts, with revenue forecast to display 53% growth on an annualized basis. That is in line with its 48% annual growth over the past five years.By contrast, our data suggests that other companies (with analyst coverage) in a similar industry are forecast to see their revenues grow 17% per year.So it's pretty clear that Teladoc Health is forecast to grow substantially faster than its industry.

The Bottom Line

Teladoc is growing in the US, and finding even more coverage opportunities with new partners like Microsoft and HCSC. The company is still stabilizing from last year's US$15.9b acquisition of Livongo Health Inc - a move which may still be straining the stock price.

Teladoc reconfirmed their revenue numbers, suggesting sales are tracking in line with expectations - and our data suggests that revenues are expected to grow faster than the wider industry.

The consensus price target fell measurably, with the analysts seemingly not reassured by the latest results, leading to a lower estimate of Teladoc Health's future valuation.

Keeping that in mind, we still think that the longer term trajectory of the business is much more important for investors to consider. At Simply Wall St, we have a full range of analyst estimates for Teladoc Health going out to 2023, and you can see them free on our platform here. .

We don't want to rain on the parade too much, but we did also find 3 warning signs for Teladoc Health (1 is significant!) that you need to be mindful of.

Simply Wall St analyst Goran Damchevski and Simply Wall St have no position in any of the companies mentioned. This article is general in nature. It does not constitute a recommendation to buy or sell any stock and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com