Texas House Democrats unveil $20.9 billion tax relief plan with room for renters

House Democrats on Thursday unveiled a $20.9 billion plan to deliver property tax relief to Texans through tax compression, increasing the homestead exemption and offering renters annual rebates. The new plan would also build annual teacher pay raises into the state's school financing system.

Part of an omnibus package touching on many of the property tax proposals that lawmakers have discussed but couldn't come to terms with during the regular and first special sessions, the bill proposed by Rep. John Bryant, D-Dallas, combines ideas from the previous House and Senate plans, adds renters to the mix, and looks to shore up teacher pay.

In a news conference Thursday announcing House Bill 62 and its companion joint resolution, House Democrats said the proposal would allow for continued and sustainable relief for homeowners as well as for teachers.

"Our effort is one that recognizes that you can't talk about property taxes without talking about public education," Bryant said of his proposal to raise the state's basic allotment for school funding by $1,000.

The allotment increase, which would be tied to and move with inflation, also directs that future increases to the allotment continue to account for raising teacher pay. Thus, Democrats said, the plan would result in a permanent annual raise of $4,300 for teachers through a $15 billion expenditure.

Last week, the Senate advanced a tax proposal that would increase the homestead exemption to $100,000 and give a $2,000 pay increase to teachers in urban districts and a $6,000 increase to teachers in rural areas over the next two years.

However, Bryant said of his House proposal, "It results in a permanent increase in teacher salaries of $4,300 a year, not a temporary one-time proposal for a certain amount for one type of school district and more for another type of school district."

Like the Senate's tax proposal, the newly proposed House package also addresses a homestead exemption, something the lower chamber has been hesitant to support and ultimately unwilling to pass this year in favor of reducing the cap on annual property appraisal increases and compressing tax rates.

Under the property tax package, homeowners would be eligible for a homestead exemption of $100,000 or an amount equivalent to 25% of their home's value — though that exemption would be capped at $200,000 — whichever figure results in the higher savings.

Lt. Gov. Dan Patrick, who has been unabashed in advocating for a $100,000 homestead exemption as opposed to other plans, did not respond to an American-Statesman request for comment.

However, the most notable difference between the plan proposed Thursday and previously considered property tax bills is that renters, who make up 38% of Texans, would now be offered a slice of the pie.

Through Bryant's bill, those who have rented their primary residence from the same landlord over a 12-month period would be eligible for a tax rebate of 10% of the annual rent they have paid.

"We cannot ignore the fact that renters have been left out of this conversation from the very beginning," Rep. Christina Morales, D-Houston, said at the news conference. "Renters deserve to receive their fair share of tax relief especially as rents have skyrocketed in the past few years."

To receive the rebate, landlords would provide a "certificate of rent paid" to renters, who in turn would submit the notice to the state's comptroller office and apply for the 10% rebate. Payouts would be dependent on the amount of applications and the ability of the allocated $1.9 billion to cover the cost in a given year.

More: Paxton will not 'dignify' impeachment trial by testifying, attorney says

Citing figures that show consistent rent increases across Texas' major metropolitan areas, Rep. Vikki Goodwin, D-Austin, said that the Democrats' bill would be a response to help Austinites grapple with skyrocketing rent costs.

"We can choose to address the burden of escalating rents and provide meaningful relief to our renters, or we can choose to continue down a path that exacerbates inequality and hardship," Goodwin said.

Lacking the votes to advance a bill in the House without Republican support, Bryant said he hopes and anticipates the legislation will be amicable to members in the majority as it provides incentives for tax relief and teacher pay.

Bryant said the coalition presenting the property tax bill intends to reach out to House Speaker Dade Phelan, R-Beaumont, "immediately" about their proposal.

Additionally, Bryant said that if the legislation was unable to move as one bill, he expects elements of the proposal to be offered as amendments to other bills being considered in the House.

The House speaker's office declined an American-Statesman request for comment.

Gov. Greg Abbott last week called a second special session on tax relief after lawmakers were unable to agree on a bill in the first special session. Abbott has asked lawmakers to work toward completely eliminating the state's property tax, which has members on both sides of the political aisle pushing back.

Previously, Patrick, a Republican who presides over the Senate, has said cutting out property taxes altogether is not something his chamber will take seriously.

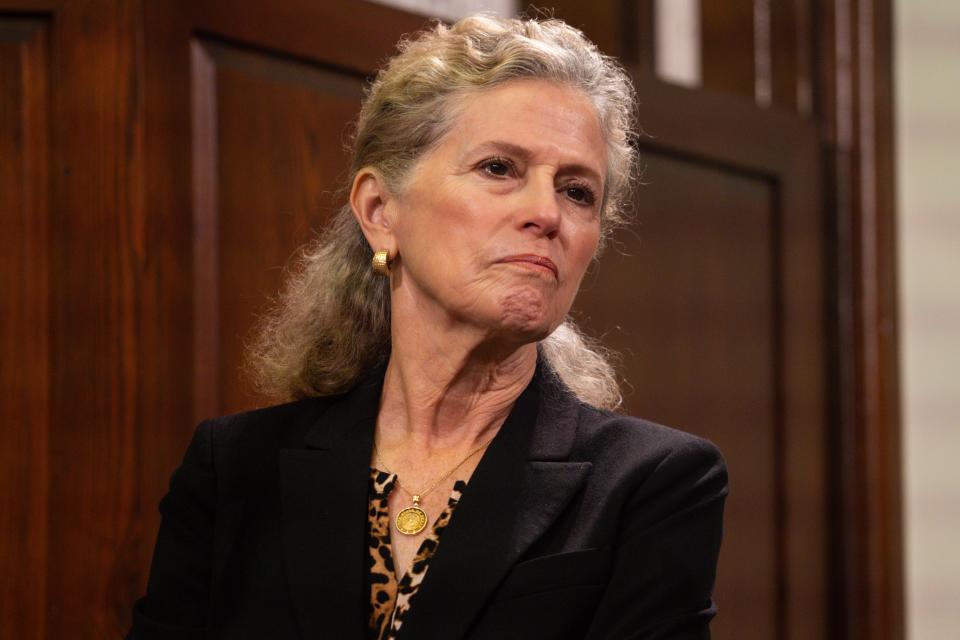

In very much the same vein, Rep. Donna Howard, D-Austin, echoed that sentiment Thursday while supporting the measures for increased teacher pay and rental relief.

"This is unrealistic, it's unsustainable, and it again holds our schools hostage to what the state decides to do instead of their local communities," Howard said of eliminating property taxes.

For Rep. Ana-Maria Ramos, D-Richardson, the reason previous tax relief plans have failed to gain the Legislature's approval is due to Republican infighting and a growing chasm across the rotunda because lawmakers know the proposals have not been good enough.

Ramos said that including rental relief, a teacher pay raise and a homestead exemption with tax compression will be the avenue to finally come to a consensus on a seemingly unending debate about property taxes.

"This is what you've been waiting for," Ramos said.

This article originally appeared on Austin American-Statesman: Texas Legislature: House Democrats offer $20.9 billion tax relief bill