Texas House, Senate chiefs announce $18B property tax relief plan. Here's what's proposed.

- Oops!Something went wrong.Please try again later.

- Oops!Something went wrong.Please try again later.

- Oops!Something went wrong.Please try again later.

In a joint statement Monday morning, Lt. Gov. Dan Patrick and House Speaker Dade Phelan announced an agreement on a tax relief plan they say "will deliver the biggest property tax cut in Texas history," ending a monthslong impasse that has had GOP leaders legislating and attacking one another on social media.

The proposal would allocate $18 billion for tax relief policies, with the bulk going toward school property tax compression. The compromise between the two legislative leaders will incorporate elements that senators and state representatives have fought for since the regular session began in January and through two called special sessions.

A $100,000 homestead exemption — a tax break that removes $100,000 from a home's taxable value — has been a marquee issue for Patrick through this year's legislative cycle and is included in the agreed-upon legislation filed Monday and expected to be passed by both chambers this week, according to the announcement.

The current homestead exemption sits at $40,000 and applies to roughly 5.7 million homeowners. The House had been against increasing the homestead exemption, choosing instead to push for lowering the annual cap for home appraisal increases during the regular session and tax compression during both special sessions.

"Speaker Phelan and I worked diligently together over the last week on the final bill. It made the difference," Patrick said in the announcement. "It may have taken overtime, but the process has produced a great bill for homeowners and businesses.”

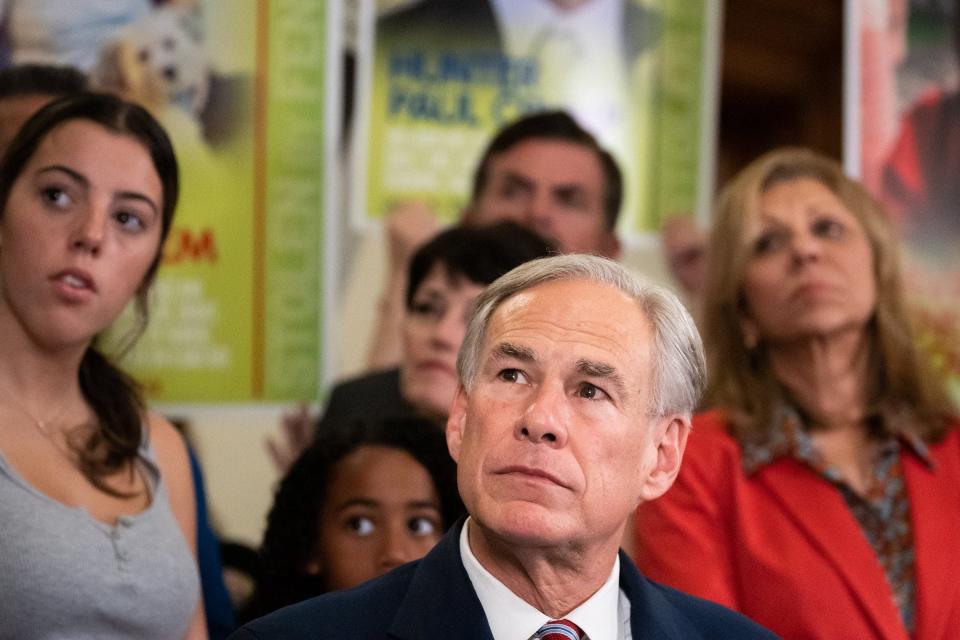

A $12 billion slice of the plan would go toward tax rate compression, or lowering the tax rate as property values increase, which has been the House's preferred avenue for relief during both special sessions, as well as that of Gov. Greg Abbott, who endorsed the House's plan.

For the first special session he called, Abbott asked lawmakers to focus solely on tax compression. The House obliged him, passing a compression bill and subsequently adjourning, putting the Senate in a "take it or leave it" position.

More: $18M grant to help improve Austin's mass transit. Here's what's proposed for the Red Line.

Patrick and the Senate left it, instead pushing forward a bill to increase the homestead exemption.

Abbott applauded the House for advancing tax compression but signaled he would not sign a tax relief bill into law until both chambers agreed on a proposal centered on compression. After lawmakers remained at an impasse, Abbott called a second special session and again asked for tax rate relief as part of a broader plan to permanently eliminate the state's property tax.

Republicans and Democrats have pushed back on the idea of eliminating property taxes, and though the agreement flaunted by Patrick and Phelan on Monday does deal in large part with tax rate decreases, it does not indicate an interest in totally removing property taxes.

"I promised during my campaign that the state would return to property taxpayers at least half of the largest budget surplus we have ever had," Abbott said in a statement Monday. "Today’s agreement between the House and the Senate is a step toward delivering on that promise. I look forward to this legislation reaching my desk, so I can sign into law the largest property tax cut in Texas history."

In addition to compression and the homestead exemption, the new agreement would give a tax break to commercial, residential and nonhomesteaded properties through a 20% "circuit breaker" on appraised values as part of a three-year pilot program.

"Reducing property taxes, providing relief to small business owners, and reforming our appraisal system will ensure economic growth and prosperity, and this agreement is a significant victory for all Texans,” said Phelan, R-Beaumont.

The omnibus property tax bill will originate in the Senate, according to the announcement. A proposal to exempt from taxes businesses that owe $1,000 or less in taxes or that make $2.47 million in taxable revenue or less will also start in the Senate.

As the tax plan will require a change to the state constitution, the House will file the companion joint resolution in hopes of placing the proposal on the ballot in November.

On Monday, the House briefly convened to move the property tax legislation to the House Ways and Means Committee for consideration. The committee is scheduled to meet at 12:15 p.m. Tuesday to consider the two bills and a joint resolution that will carry the proposals, and the Senate is expected to file the same legislation.

"Negotiations with the Lieutenant Governor have been extremely productive, and by coming together and finding common ground, the House and Senate are one step closer to providing much-needed, much-deserved relief," Phelan said in the statement. "I look forward to the passage of this package in the coming days and delivering on our commitment to the people of Texas."

As a tax plan impasse between the two chambers had remained in recent weeks, the Senate altered its homestead exemption proposal late last month with an amendment from Sen. Roland Gutierrez, D-San Antonio, to include a pay raise for teachers, in hopes of attracting support from House members.

House Democrats followed suit last week with a $20.9 billion tax relief plan of their own that included a teacher pay raise as well as money dedicated to give renters a yearly 10% rebate on any rent they've paid over a 12-month period.

Neither the teacher pay raise nor the renter relief plan is included in the new tax plan.

On Tuesday, the House will convene at 2 p.m., and the Senate is set to gavel in at 3 p.m.

This article originally appeared on Austin American-Statesman: Texas Legislature: House, Senate chiefs agree on $18B tax relief plan