Texas Is Melting: The Lone Star State’s Power Prices Are Soaring Amid Heat Wave – And These 2 Stocks Are Set to Benefit

The heatwave in Texas has sent temperatures off the charts. Triple digits have been reached across the state, hitting 125F in Corpus Christi and 118F in Rio Grande, as recorded by the heat index – which provides a combination of temperature and humidity.

Meanwhile, the need for air conditioning has seen demand for power spike – and so has the price. Electricity prices doubled, and earlier this week got as high as $5,000 per megawatt-hour. Making matters worse, especially near the Gulf Coast, is unusually high humidity. Forecasters predict the temperatures are set to rise higher and last into the week of 4 July, meaning there is no prospect of early relief.

But dangerous situations, which this heat wave certainly is, can also bring opportunities – and investors can capitalize on the Texas crisis. The high utility prices are one obvious boon, as power companies on the Texas grid will likely see a cash windfall in the aftermath, but renewable energy companies also stand to gain long-term, as the State of Texas faces the need to expand its power generation capacity.

So, let’s take a look at some power companies that can post gains on their Texas business. Here are the details, drawn from the TipRanks data files, along with comments from the Street’s analysts.

Vistra Energy (VST)

We’ll start with Vistra Energy, a utility company based in Irving, Texas, and one of the largest utility-scale power generation companies in the US. Vistra employs more than 5,000 people and boasts over 37,000 megawatts of total generation capacity – and approximately 3,400 megawatts of that total come from zero-carbon renewable sources. In addition, Vistra owns an energy storage system in Moss Landing, California that is rated at 750-MW/3,000MWhbattery, making it the world’s largest such facility.

Vistra’s demonstrated generation capacity allows it to market electricity in 20 states plus DC. The company serves more than 4.3 million residential, commercial, and industrial customers. Vistra’s generation portfolio includes a mix of natural gas, nuclear, and solar production, and it is also a major purchaser of wind power.

While Vistra operates across the US, its Texas operations make up the single largest component of its adjusted EBITDA, at $383 million out of $541 million consolidated in 1Q23, although the figure fell short of the Street’s $575 million target for the quarter. On the other hand, the company had total revenues of $4.43 billion, up 41.5% year-over-year and beating the forecast by some $2.5 billion.

Vistra also pays a dividend and declared the latest payment of $0.204 per common share for 2Q23. This represents a 3.3% increase from the prior payout and provides a yield of ~3.20%.

While the adjusted EBITDA result fell short of expectations, BMO analyst James Thalacker’s believes this stock is attractively priced and he sees the company as a competitive player In the industry. Thalacker writes, “We view Vistra’s 1Q23 positively and we continue to be buyers of the name at a sub 5x EV/EBITDA multiple and 30%+ FCFY. While 1Q23 results were light of consensus, management had a positive forward outlook pointing to upside in the company’s stand-alone 2024/2025 Ongoing Operations Adjusted EBITDA opportunities midpoint range of $3,500-3,700mm. The upside is due to opportunistic hedging since May 2022 and continued robust forward power curves which are allowing EBITDA to track closer to ~$3,700-3,800mm range.”

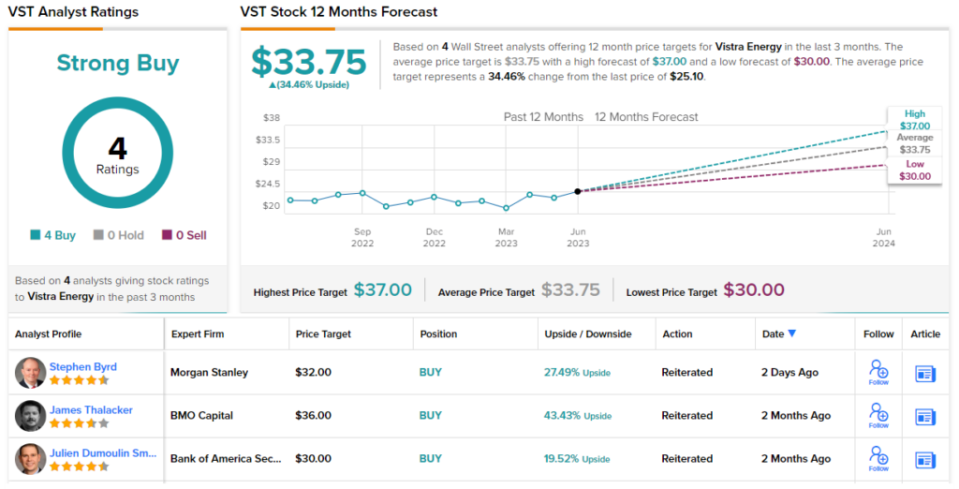

The analyst goes on to give these shares an Outperform (Buy) rating, and his $36 price target indicates his confidence in a one-year upside potential of 43%. (To watch Thalacker’s track record, click here.)

While Vistra only has 4 recent analyst reviews, they are all positive – giving the stock its unanimous Strong Buy consensus rating. The shares are selling for $25.1o and have an average one-year price target of $33.75, implying a gain of 34% in the next 12 months. (See Vistra’s stock forecast)

NextEra Energy (NEE)

The second stock on our list is NextEra Energy, a major player in the US market for clean and renewable power generation. NextEra is based in Florida, and its main subsidiary is Florida Power & Light (FPL), through which it has more than 5.8 million active customers. Overall, the company provides power to more than 12 million people in its home state.

NextEra is also active in Texas, where it maintains a substantial network of wind, solar, and natural gas power generation facilities, as well as a power transmission line and substations in the center of the state, connecting several of the windfarms to the Dallas-Fort Worth area. The company is also expanding its presence in Texas; last year, it contracted with a division of the UK-based petrochemical firm Ineos to build a 310 MW solar power facility in the state. The new facility, planned to start operations in 2025, will dedicate its full power output to Ineos O&P USA manufacturing, fractionation, and storage operations.

Zooming out for a wider look at the company, we find that NextEra showed $6.72 billion in revenue in 1Q23, $1.42 billion above the estimates. The company’s non-GAAP earnings, at 84 cents per share, came in 8 cents better than expected.

This success in the green economy underlies HSBC analyst Meike Becker’s review of NextEra shares. She writes, “We believe NextEra is an excellent capital allocator in the fast growing, low-risk, high-margin US network and renewables market. On our estimates, Florida Power & Light (FPL) – a fully regulated utility – will deliver 7-12% EPS CAGR in 2025-2030e, with investments in renewables and electricity networks and excellent returns for a great service at low cost. We forecast NextEra Energy Resources to reach EPS CAGR of 4-10% for 2025-30e as the leading renewables developer in the highly attractive US market. The inflation reduction act has improved the outlook further.”

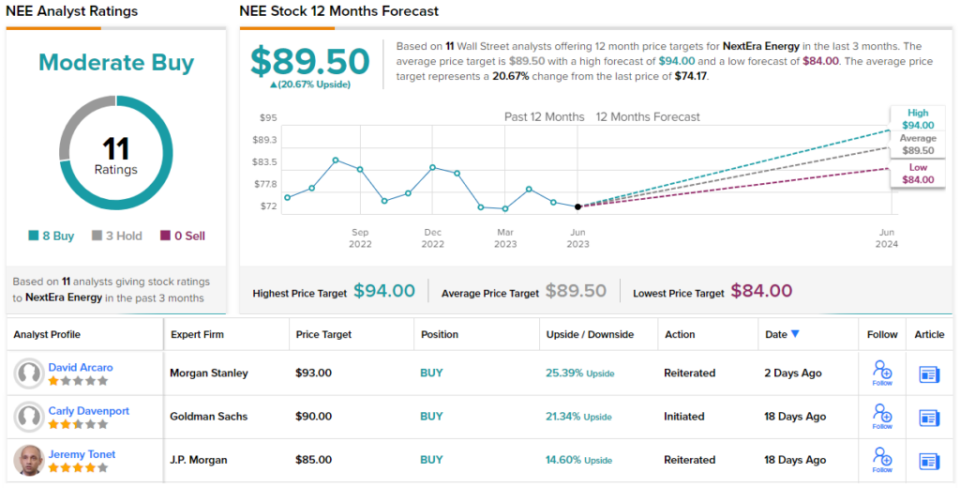

Looking ahead, Becker gives NEE a Buy rating, and her target price of $90 implies a gain of 21% out to the one-year time horizon. (To watch Becker’s track record, click here.)

There are 11 recent analyst reviews on file for NextEra and these include 8 to Buy and 3 to Hold, to give the stock its consensus rating of Moderate Buy. The shares, which are trading for $74.17, have an average price target of $89.50, suggesting a 12-month gain of 21%. (See NextEra’s stock forecast)

To find good ideas for stocks trading at attractive valuations, visit TipRanks’ Best Stocks to Buy, a newly launched tool that unites all of TipRanks’ equity insights.

Disclaimer: The opinions expressed in this article are solely those of the featured analysts. The content is intended to be used for informational purposes only. It is very important to do your own analysis before making any investment.