Texas student loan borrowers get loans forgiven through Biden's SAVE Plan. What to know

- Oops!Something went wrong.Please try again later.

While the Supreme Court denied the Biden Administration's bigger loan forgiveness plan last year, President Biden found another way to cancel debt through executive action.

On Feb. 21, the U.S. Education Department zeroed out loan balances for nearly 153,000 borrowers — nearly $1.2 billion worth of debt. They are people who borrowed $12,000 or less, have been paying their student loans for at least 10 years, and enrolled in the Biden administration's new repayment plan called SAVE launched last summer.

The Biden administration also has another plan in place to relieve more student-loan borrowers. While still in the works, an Education Department proposal could forgive student loans for a broad range of struggling borrowers. The plan would "would ensure automatic relief for borrowers experiencing economic hardship."

How much student loan debt do Texans have?

The U.S. Department of Education reports that Texans have the second-highest amount of student debt, behind Californians. 3.8 million students owe $33,400 on average. Fewer than 20% of Texas borrowers are on an income-driven repayment plan.

What is the SAVE Plan?

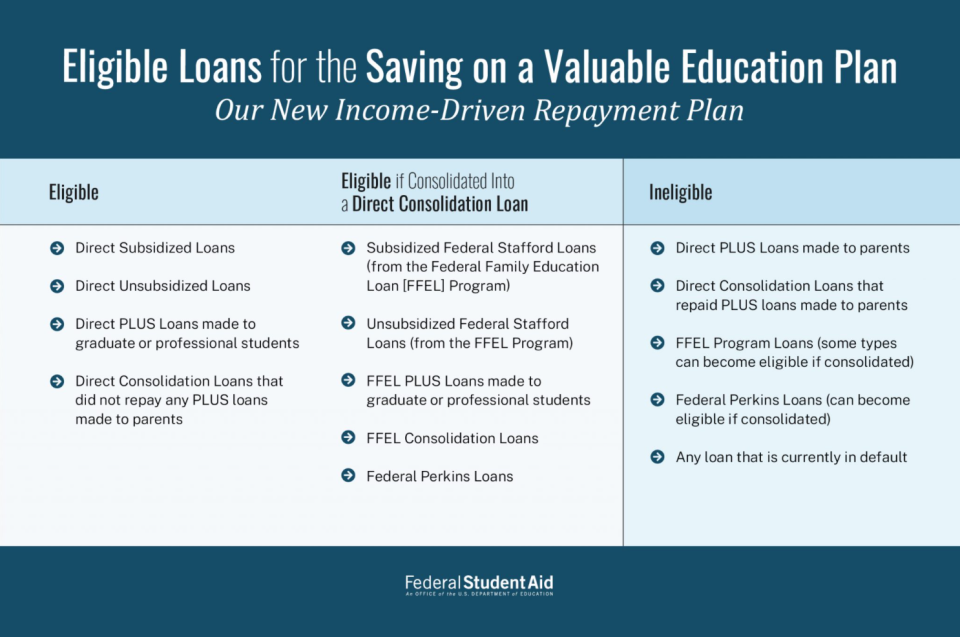

The SAVE Plan lowers payments for most borrowers, compared to other income-driven repayment (IDR) plans, because payments are based on monthly income and family size.

Beginning in February 2024, the SAVE Plan will give borrowers who originally borrowed $12,000 or less forgiveness after as few as 10 years, according to studentaid.gov.

The Saving on a Valuable Education replaced the Revised Pay As You Earn (REPAYE) Plan. Borrowers on the REPAYE Plan automatically get the benefits of the new SAVE Plan.

More than 590,000 Texans are enrolled in the SAVE Plan, according to The Texas Tribune. Nearly 14,510 Texans no longer owe student loans thanks to the program, forgiving nearly $117 million in debt — more than any other state, The Dallas Morning News reported.

How much will I pay with SAVE Plan?

The SAVE Plan decreases monthly payments by increasing the income exemption from 150% to 225% of the poverty line, Student Aid said.

Studentaid.gov shared a case of how much money borrowers can save:

"For example, 225% of the Poverty Guideline amount for a family size of one (in the 48 contiguous states) is $32,800, which means that if your annual income is equal to or less than $32,800 and your family size is just yourself, your discretionary income is $0 and your monthly payment will be $0. The same is true for a family size of four with an annual income of $67,500 or less," it said.

Can Texans still apply for the SAVE Plan student loan repayment program? Is there an income limit?

Borrowers can still apply for the SAVE program. There is no income limit to be eligible for the SAVE Plan. However, depending on the amount of loan debt, it might not be the best plan for a borrower’s situation.

According to the plan, there will be more benefits coming this summer. “The SAVE Plan includes additional benefits that will go into effect in July 2024. These additional benefits will likely reduce payments further and make it easier to manage repayment,” the program said.

If Texas residents applied for the SAVE program, be sure to check the email account (and Spam folder) used to register for the program. Borrowers can also check studentaid.gov.

This article originally appeared on Austin American-Statesman: Biden plan forgives student loans for 153,000 borrowers: What to know