The economy is at a tipping point: Morning Brief

Tuesday, September 10, 2019

Get the Morning Brief sent directly to your inbox every Monday to Friday by 6:30 a.m. ET. Subscribe

The trade war has the economy at a tipping point

"We had a deal," said Peter Navarro, Trump's top trade advisor, in an interview on The Final Round last Friday.

"We had a 150-page plus agreement that was in these seven verticals that dealt with each of these issues plus enforcement... But the Chinese walked away from that. And in many ways, this deal will be determined by what the Chinese want to do."

This rhetoric from the administration pretty neatly sums up why the trade war's role in the global investing environment has shifted from seeming like a temporary annoyance to a near-universal belief that this fight will be permanent.

And it's why economists at Deutsche Bank now think the U.S. economy is staring down the barrel of a likely recession.

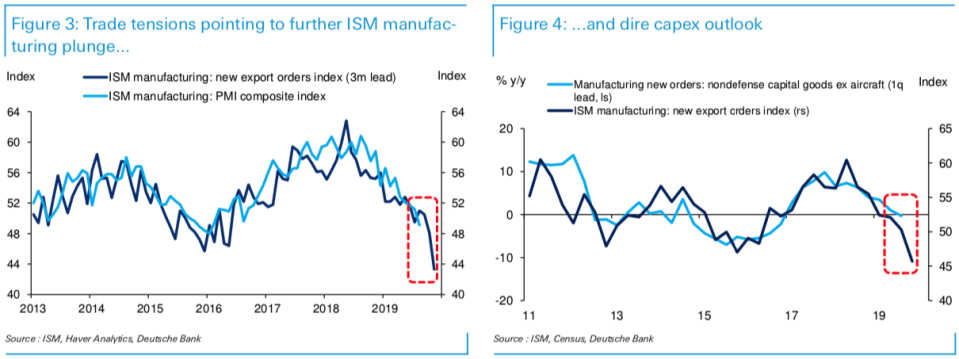

"Recent data suggest that trade tensions may already be moving the economy close to a tipping point," write economists at Deutsche Bank. "It is now our view that at this point, only a meaningful de-escalation or reversal of trade tensions is likely to be enough to short-circuit this downtrend."

Under the assumption of the U.S. and China having irreconcilable differences, Deutsche Bank's view is that a recession is coming — the firm's in-house recessionary probability models put the odds of a downturn within 24 months at 80%.

And the simplest reason why is that the trade war looks set to finally impact the crown jewel of the economic expansion: U.S consumers.

In the second quarter, personal consumption increased at an annualized rate of 4.7%, the best reading since 2014 and one of the strongest quarters of this expansion. But consumers continuing to spend requires that consumers keep finding work. And with Deutsche Bank expecting GDP growth to move below potential over the next 18 months, "there should be a marked deterioration in the pace of hiring."

New exports orders in August hit their lowest level since April 2009, according to the Institute for Supply Management's manufacturing PMI. For the team at Deutsche Bank, this is a sign that global capex spending is on the path towards impacting the labor market. And declining health in the U.S. labor market ultimately hurts consumer spending. Because in case you've missed it, almost every bull case for the economy right now comes back to consumer spending remaining strong.

Now, economic bulls may point to the Federal Reserve as being part of a global central bank easing cycle that can buoy the economy. When the Federal Reserve meets next week, markets expect the central bank will announce another 25 basis point cut in its benchmark interest rate.

In expectation of this move, Treasury yields have come down markedly, lowering borrowing costs for companies and consumers. But will central bank action be enough to avoid the global recession that so many fear? Deutsche Bank says no.

Seen this way, then, the economy isn't even at a tipping point. It has already tipped.

By Myles Udland, reporter and co-anchor of The Final Round. Follow him @MylesUdland

What to watch today

Earnings

Post-market

Economy

6 a.m. ET: NFIB Small Business Optimism, August (103.5 expected, 104.7 in July)

10 a.m. ET: JOLTS Jobs Openings, July (7331 expected, 7348 in July)

From Yahoo Finance

Tech editor Daniel Howley will be covering Apple’s Special Event in Cupertino, Calif. at 1 p.m. ET. Watch his live hits from the event throughout the day on Yahoo Finance. And read his preview of it all here.

Top News

SoftBank pushes WeWork to postpone its contentious IPO [Bloomberg]

Recession fears fade as UK employment still at record high [Yahoo Finance]

China factory deflation deepens signaling worsening economic slowdown [Bloomberg]

State attorneys general join forces to take on Google [Yahoo Finance]

YAHOO FINANCE HIGHLIGHTS

AT&T jumps as Elliott Management takes big stake, says stock could double

Huggies diapers made of plant-based materials lead Kimberly-Clark's turnaround

We need more monopolies like Google

Follow Yahoo Finance on Twitter, Facebook, Instagram, Flipboard, SmartNews, LinkedIn, YouTube, and reddit.