The risk for markets if Biden beats Trump

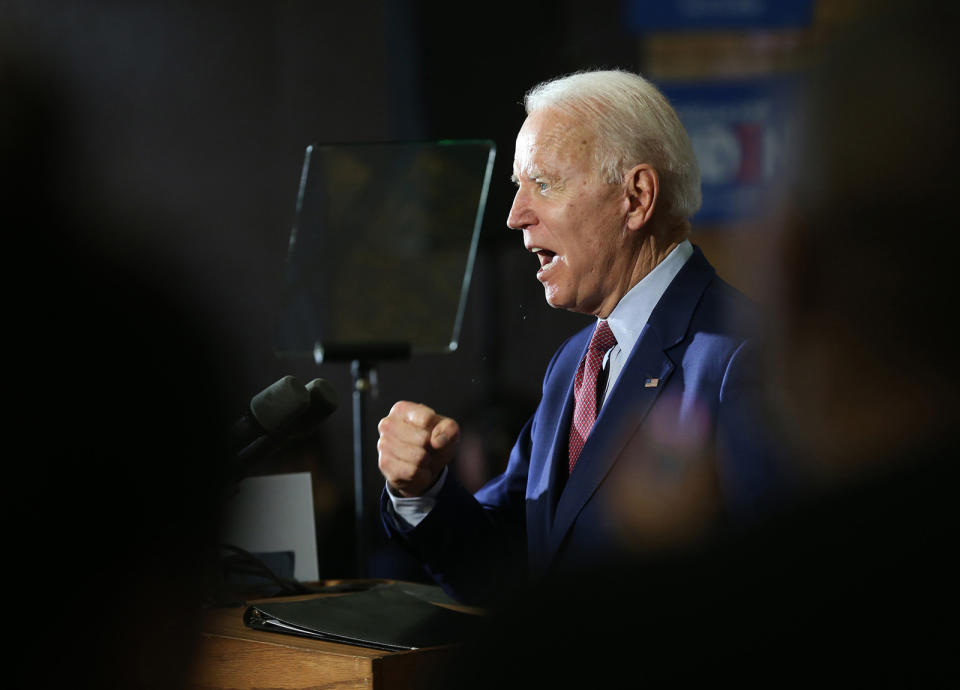

Financial markets seemed relieved when Bernie Sanders dropped from the race and Joe Biden became the de facto Democratic presidential nominee. But markets will have to adjust if Biden actually beats President Trump in November and moves into the White House next year.

There are two President Biden scenarios: one in which Republicans retain control of the Senate, and one in which Democrats pick up four seats or more, and squeak to a majority. Since the House is likely to remain Democratic, a Democratic takeover of the Senate paired with a Biden win would give the party complete control of the government for the first time in a decade.

“If the Senate goes back to Democrats, that’s a real concern for markets because you’ll get much more pressure for Medicare for all, for the Green New Deal, for big new tax increases,” Greg Valliere, chief US policy strategist for AGF Investments, said on the latest episode of the Yahoo Finance Electionomics podcast. “If the Senate stays Republican, that’s the firewall to prevent any activist legislation leaving the House, which will stay Democrat.”

The odds of a complete Democratic takeover of government seemed low at the start of the year, when Bernie Sanders, the most leftist candidate, had a shot at winning the nomination and Trump had a sound economy to run on. But Biden’s surge gives the Democrats a relative moderate who can appeal to swing voters, and the sudden collapse of the economy amid the coronavirus pandemic has obliterated Trump’s strategy of running on a strong job market and rising stocks.

Biden leads Trump in most national polls, and also in most swing states that will determine the winner in November. Democrats won’t take the Senate if Trump wins, but a Biden win could produce a “coattails” effect and Democratic gains in the Senate. There’s a reasonable chance Democrats could win Senate races in Arizona, Colorado, Maine, North Carolina and possibly Montana. They’ll probably lose a Senate seat in Alabama. A lot can change in the six months prior to the election, but for now, a Democratic sweep is plausible.

Biden would raise taxes on businesses and wealthy individuals, to help pay for expanded health care, more aid for college students, new environmental policies and other things. He doesn’t support Medicare for all, the costly health plan for everybody that would eliminate private insurance. And his environmental plan is less expansive than the Green New Deal, which would involve far-reaching government intervention in the energy and transportation sectors.

If Biden wins and the Senate does flip to the Democrats, it’s still no guarantee liberal policies will automatically pass. There are many moderate Democrats in Congress who wouldn’t eagerly back tax hikes, and some bills in the Senate require 60 votes, effectively giving the minority a veto. Democratic senators who win Republican seats may be unwilling to go too far to the left and alienate Independents and Republicans who may have voted for them.

Biden’s agenda, if he wins, would also take a back seat to whatever still needs to be done to recover from the coronavirus recession. Tax hikes typically don’t help when the economy is recovering from a sharp downturn. So Biden’s agenda could be quite different if voters upgrade him from candidate to president.

Biden could be good for markets, too. “What the markets would like with Biden is that he's a moderate on trade,” Valliere says. “He's not a tariff guy like Trump. And he's more predictable. I think Biden would be a very predictable president, whereas Trump is maybe the least predictable president I have ever followed in my career.” Markets have gotten used to Trump, but probably wouldn’t mind a little less excitement.

Rick Newman is the author of four books, including “Rebounders: How Winners Pivot from Setback to Success.” Follow him on Twitter: @rickjnewman. Confidential tip line: rickjnewman@yahoo.com. Encrypted communication available. Click here to get Rick’s stories by email.

Read more:

Why China tolerates animal markets that produce deadly viruses

These Republican states are ignoring Trump’s reopening guidelines

Get the latest financial and business news from Yahoo Finance

Follow Yahoo Finance on Twitter, Facebook, Instagram, Flipboard, SmartNews, LinkedIn, YouTube, and reddit.