The staggering cost of Elizabeth Warren’s plans: $4.2 trillion per year

Elizabeth Warren has a plan for everything. Some of those plans are expensive. With Warren emerging as a front-runner in the Democratic presidential contest, Yahoo Finance tallied the cost of her plans.

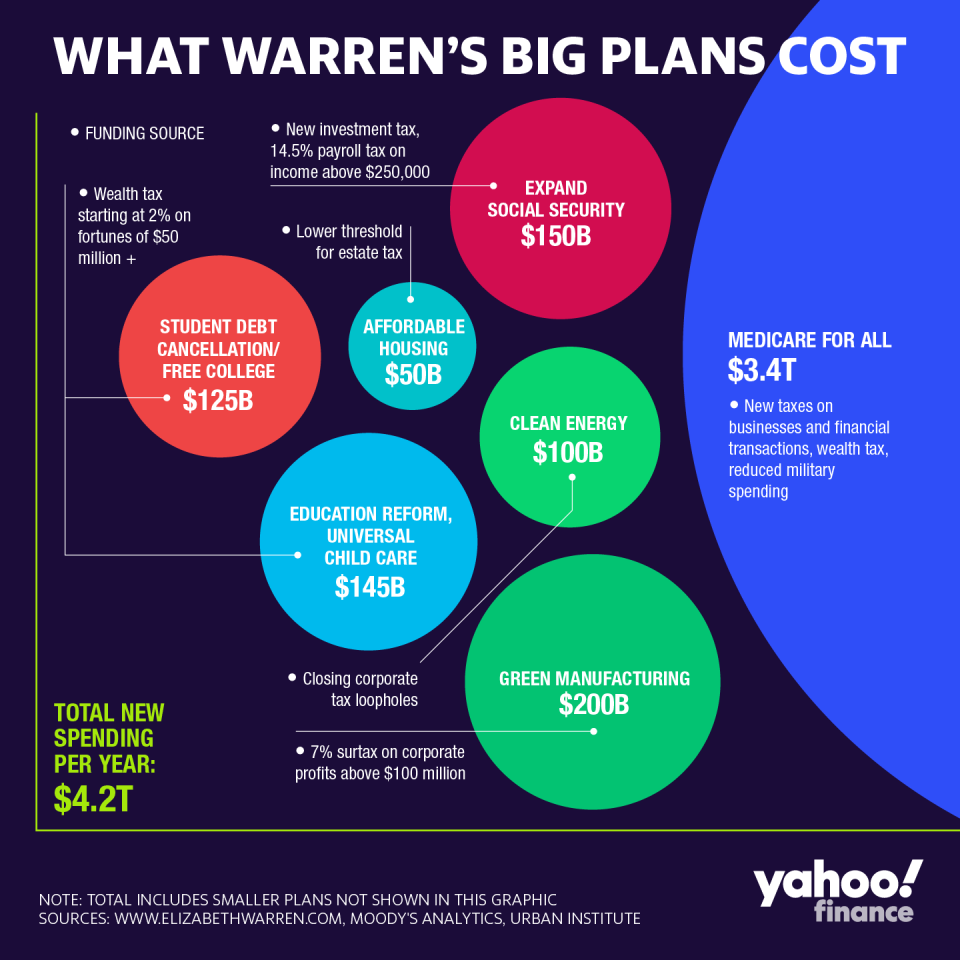

Altogether, the Massachusetts senator’s agenda would require $4.2 trillion per year in new federal spending, and a like amount in new taxes, if she paid for everything without issuing new debt. The federal government currently spends about $4.4 trillion per year, so Warren’s plans would nearly double federal spending.

The Treasury takes in about $3.4 trillion in tax revenue each year, so if Warren levied new taxes to pay for everything, federal taxation would rise by 124%. She could pay for some of her plans by issuing new debt instead of raising taxes, but with annual deficits close to $1 trillion already, that might be unwise.

The biggest chunk of new spending in Warren’s agenda, by far, would be Medicare for all, the single-payer health plan she would impose to replace all private insurance. Warren explains how she would pay for all of her plans—except this one. With fellow Democratic candidates pressing her for details, Warren says she’ll provide financing options for Medicare for all soon.

A single-payer plan covering every American would cost about $3.4 trillion per year, according to the Urban Institute and other analysts. Again: that’s equal to all federal tax revenue in 2019. Warren says “costs” would go down for middle-class families under Medicare for all, because all care would be free and families would end up paying less in new taxes than they now pay for health care. But that doesn’t mean Americans would be comfortable with the tradeoffs.

Analysis by the Committee for a Responsible Federal Budget finds that “it is clear that taxes on the middle class would have to rise” to cover the cost of Medicare for all. That could still be a bargain for some people, but an effort to pass a single-payer health plan in Vermont failed in 2014 because the new tax burden would have been too severe on businesses and families. And under any scenario, transitioning to Medicare for all would be turbulent. “There would be massive disruption in terms of winners and losers,” says Kenneth Thorpe, chairman of the health policy department at Emory University.

Warren would pay for most of her other plans with taxes on corporations and wealthy Americans. Her “ultra-millionaire tax,” for instance, would be a 2% annual fee on wealth of $50 million or more, with an additional 1% fee on wealth above $1 billion. She says that would raise about $275 billion per year. She’d use that money to cancel a majority of student debt, cover college costs for students from lower-income families, pay for universal child care and make other reforms to public schools.

Warren’s “real corporate profits tax” would be a 7% surtax on profit above $100 million at all big companies. This is meant to squeeze some tax revenue out of companies that otherwise use tax credits and loopholes to push their tax liability close to 0, even when they report handsome profits to shareholders. Warren says this would raise $100 billion per year, which she’d use to fund a transition to green manufacturing. But she wants to spend twice as much on this transition, leaving part of her green agenda unfunded.

Warren would raise Social Security payments for everybody in the program by $200 per month, which would cost $150 billion per year. She’d come up with the funds by imposing a 14.8% payroll tax on all income above $250,000 and a similar tax on investment income for the wealthiest Americans. She’d also fund $50 billion per year in new affordable housing subsidies by lowering the threshold for the estate tax, essentially making wealthy families pay more.

With the exception of Medicare for all, Warren’s tax hikes are targeted at businesses and the wealthy, on the theory that transferring wealth from the top to the middle will boost the economy, on balance. But economists are split on that question. Some programs, like improved education and universal child care, might yield a high return on investment, if administered properly. But some of her taxes could sap investment income that fund businesses, entrepreneurship and risk-taking.

Whatever the effect, it’s unlikely most, or even some, of Warren’s agenda, would become reality if she became president. She’d need Democratic control of both houses of government, and even then, a few centrist Dems, aligned with Republicans, could block many measures. But that doesn’t concern her now.

Rick Newman is the author of four books, including “Rebounders: How Winners Pivot from Setback to Success.” Follow him on Twitter: @rickjnewman. Confidential tip line: rickjnewman@yahoo.com. Encrypted communication available. Click here to get Rick’s stories by email.

Read more:

Elizabeth Warren is a prophet of doom

Joe Biden’s health plan looks like the winner

There aren’t enough doctors for Medicare for all

Why Democrats bomb with rural voters

4 problems with Andrew Yang’s free money drop

Read the latest financial and business news from Yahoo Finance

Follow Yahoo Finance on Twitter, Facebook, Instagram, Flipboard, SmartNews, LinkedIn, YouTube, and reddit.