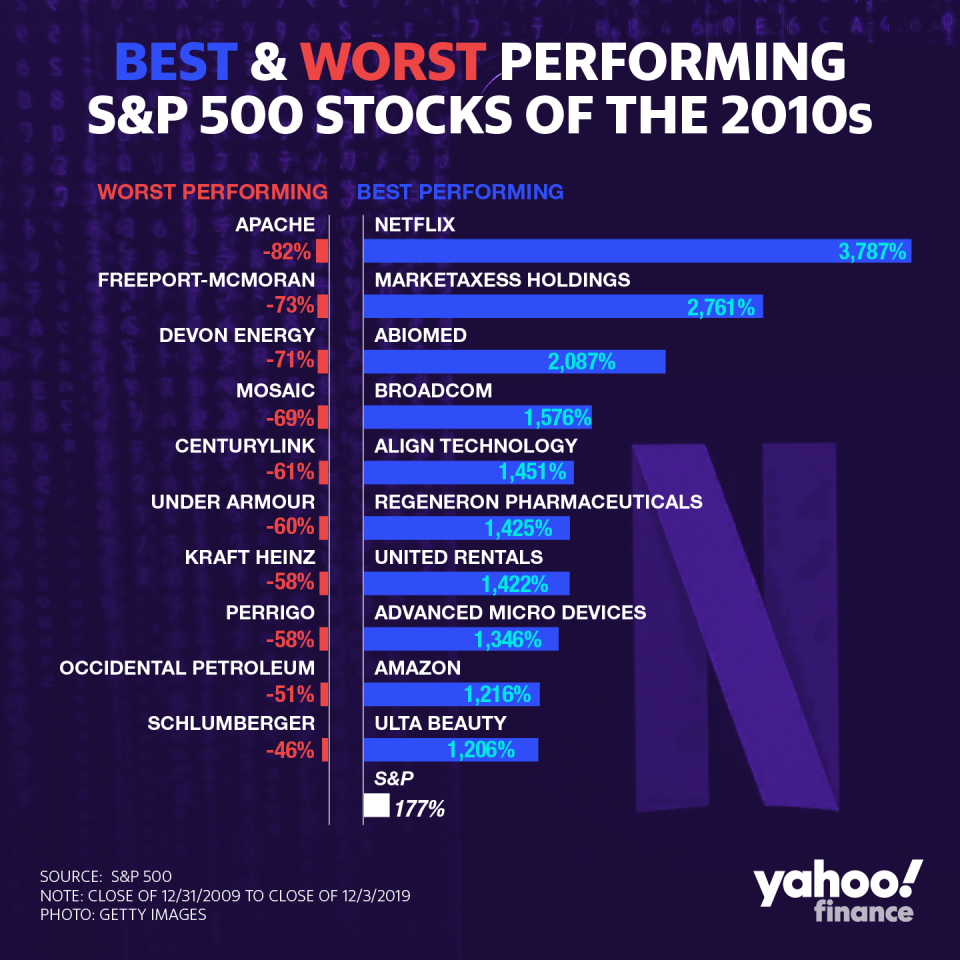

The stock market's biggest winners and losers of the past decade

With the 2010s officially drawing to a close, Yahoo Finance took a look at some of the biggest S&P 500 winners and losers of the past decade based on price returns from January 1, 2010 to December 3, 2019.

Best-performing stocks

Netflix (NFLX) +3,787%

It wasn’t even close. Netflix stock was just $7.87 at the start of 2010; however since then, the stock has surged a whopping 3,787% and closed at $306.16 per share Tuesday. The streaming giant hit the public markets on May 23, 2002, at $15 per share, and it wasn’t always smooth sailing for the company. What was once a DVD-by-mail company, Netflix introduced a streaming-only plan in 2010, and eventually started creating its own scripted shows and films in 2013. The streaming company even has a few Oscars to boast. Nevertheless, Netflix faces its next big test in the coming decade as new entrants into the streaming space threaten its once-dominant presence. Netflix stock hit an all-time high of $423.21 per share on June 21, 2018.

Marketaxess Holdings (MKTX) +2,761%

Marketaxess Holdings flew under the radar during the past decade to take the number two spot on the list. A lesser known name compared to Netflix, Marketaxess is a fixed-income electronic trading platform for institutional investors. Marketaxess listed on the Nasdaq in November of 2005. The company derives about 85% of revenue from monthly distribution fees and commission for transactions made on its platform.

Shares started at $13.90 per share and soared an impressive 2,761% to end the decade. The main reason for the stock’s outperformance is largely because the bond market became more attractive to investors over the past several years which boosted the company’s commission income and post-trade services income.

Abiomed (ABMD) +2,087%

Medical device company Abiomed is third on the list of biggest winners. The company was founded in 1981 and went public six years later in 1987. Over the years, Abiomed passed big milestones, both financially and medically. In 2011, the company achieved non-GAAP profitability while generating $5 million in cash. Then a year later, in 2012, Abiomed’s ImpellaCP heart pump received FDA clearance in the U.S.

The stock was on a tear, eventually hitting record highs of $459.75 per share on October 1, 2018. Over the past decade the stock soared 2,087% and closed at $191.15 per share on Tuesday.

Broadcom (AVGO) +1,576%

Formerly known as Avago Technologies, Broadcom Limited as we know it today was formed after Avago acquired Broadcom Corp in 2016. Broadcom Limited hit the public market in August of 2009. Chip stocks broadly have had a nice run over the past decade. Of those semiconductor companies, Broadcom was a standout and jumped 1,576%. The Philadelphia Semiconductor Index (^SOXX) rose 360% in the same time period. The main challenge recently for the semiconductor industry has been the ongoing trade war between the U.S. and China. Chips are often looked to as a proxy for the health of the global economy. As the trade war drags on with no clear end in sight, that could in turn weigh more heavily on the entire group.

Align Technology (ALGN) +1,451%

Orthodontics maker, Align Technology, made its public debut in January 2001, and its technology was seen as completely transformative at the time. The Aligner was a new way to approach orthodontics, and over the past decade, investors have reaped the rewards. Align brings in about 86% of total revenue from the Invisalign product, while scanners and services account for about 14%.

The stock was on a meteoric rise and hit all-time highs of $398.88 on September 28, 2018. However, Align’s stock is off 31% from those highs as new competition entered the space in 2019. Align and SmileDirectClub (SDC) entered into a supply agreement in July of 2016 to manufacture non-Invisalign clear aligners for SmileDirectClub. SmileDirectClub started trading on the Nasdaq in September 2019.

Regeneron Pharmaceuticals (REGN) +1,426%

Regeneron is the only biotech company to make the list of the 10 best-performing stocks of the past 10 years. The biotech giant was founded in 1988 by Leonard Schleifer, and the name was derived from the company’s focus at the time to use gene technology to regenerate neurons. Regeneron became a public company in 1991. During the last decade, Regeneron launched four FDA approved drugs, which helped boost revenue growth for the company. Net income has also risen during the time period. Regeneron’s stock rallied 1,426% over the past decade.

United Rentals (URI) +1,421%

Industrial and construction equipment rental company United Rentals is the only industrial company to make the top 10 winners list in the past decade. United Rentals focuses on renting equipment to construction and industrial companies, but the industrial giant also sells new and used equipment. United Rentals listed on the New York Stock Exchange in December of 1997. Over the past decade, United Rentals noted in its annual financial filings that according to the company’s industry forecasts and macroeconomic indicators, solid demand for rental services was expected.

Even as the trade war threatens business investment, United Rentals predicted that its North American industry equipment rental revenue would increase. Shares of United Rentals have surged 1,421% over the past decade.

Advanced Micro Devices (AMD) +1,346%

AMD is the second semiconductor company to make the list of winners of the past decade. The chipmaker has been a public company for 47 years. After hitting a record high of $48.50 on June 5, 2000, the stock has yet to reclaim those levels. Nevertheless, AMD was the best-performing stock in the S&P 500 in 2018 and is currently on pace to claim the top spot again in 2019. It’s been a solid run for the company over the past couple years and even the decade as the chip giant looks to become a dominant force in the PC chip market.

Amazon (AMZN) +1,216%

It’s been a remarkable story for Amazon. The company started in a garage by founder Jeff Bezos in Bellevue, Washington, in 1994 and hit the public markets in May of 1997. After selling just books online, Amazon has become a force to be reckoned with, disrupting countless industries along the way. Over the past decade, Amazon bought robotics Kiva Systems, video-game streaming site Twitch, and Whole Foods. (And Jeff Bezos purchased The Washington Post.) The stock has also had a massive run and hit an all-time high of $2,050.50 per share on September 4, 2018. That day, the company surpassed $1 trillion in market cap for the first time. Though shares have retreated from those levels, the stock rose a stunning 1,216% over the past 10 years.

Ulta Beauty (ULTA) +1,206%

Ulta opened the doors to its first store in 1990. Over its nearly 30-year history, the company grew to well over 1,000 store locations and is the largest U.S. beauty retailer. Ulta debuted on the public market in October 2007, and the stock steadily gained and hit record highs of $368.83 on July 15, 2019. The U.S. prestige beauty industry is booming and reached $18.8 billion in 2018, according to market research firm NPD Group. According to the NPD Group, skincare grew 13% and contributed to 60% of the U.S. prestige beauty industry’s total gains in 2018. A recent teen survey from Piper Jaffray revealed Ulta (ULTA) continued its dominance as the favorite beauty destination among female teens with 38% share compared to 34% last year. The beauty industry caught on fire and so did Ulta stock, rising 1,206% over the past decade.

Worst-performing stocks

Apache (APA) -82%

It has been a rough decade for the energy sector. Oil and gas exploration company Apache was the worst-performing stock of the past decade and is one of four energy companies on the biggest losers of the decade list. Apache has a rich history and became a public company in 1978. Its financial performance, like other energy companies, was rocked when oil prices plunged from 2014 to 2016. The energy giant lost approximately $20 billion over a three-year period.

Though the environment started turning around in 2017 after commodity prices started stabilizing following a tax cut, Apache stock is still down 82% over the past decade.

Freeport-McMoRan (FCX) -73%

Formerly known as Freeport-McMoRan Copper & Gold Inc, the company formally changed its name to Freeport-McMoRan in 2014. The mining giant, with holdings in copper, molybdenum and gold, has mines in the Americas and Indonesia. Though it has customers across the Americas, Europe and Asia, Freeport’s biggest market is home in the U.S., which represents more than 30% of the company’s total revenue.

Freeport-McMoRan’s revenue is highly levered to global copper prices, and thus, the collapse of copper prices between 2014 to 2016 over concerns surrounded a strong U.S. dollar and growth rates in China resulted in a sharp drop in sales for the company. Shares of Freeport-McMoRan have tumbled 73% over the past decade.

Devon Energy (DVN) -71%

Founded in 1971, independent energy giant Devon focuses on exploration, development and production, and the transportation of oil and gas. The Oklahoma-based company debuted on the public market in 1998. Devon’s upstream activities represent about 60% of the company’s total sales and marketing revenue represents the other 40% of sales.

Like other energy companies, Devon’s financial performance is closely tied to global oil prices, and therefore, revenue plummeted sharply in the mid 2010s following the collapse of oil prices. Profits also faced a similar fate but returned to profitability in 2017. Nevertheless, shares are still down 71% over the past decade.

Mosaic (MOS) -69%

Mosaic produces and distributes crop nutrients to agricultural communities. It is the largest producer of phosphate and potash. Mosaic produces 75% of phosphate and 40% of potash annually. The raw materials are mined in Canada and the U.S. In the past five years, revenue declined two years in a row before bottoming out and then rebounded for two consecutive years of gains.

Shares started the decade at $59.73 and fell 69% to $18.43 as of Tuesday’s close.

CenturyLink (CTL) -61%

Communications company CenturyLink provides cyber links throughout the U.S. on one of the longest fiber networks in the country. It is one of the nation’s largest wireline telecom companies. CenturyLink has two main segments: Business and Consumer. Its business segment accounts for 75% of sales, while the consumer segment represents the remaining 25%. CenturyLink has been struggling during the past decade as it saw a decline in consumer sales.

Between 2014 to 2017, revenue fell a total of $439 million and in 2018, the company lost $1.5 million. CenturyLink also sits on long-term debt of about $35.6 billion and shares have taken a hit as a result of the underperformance. Over the past decade, CenturyLink stock fell 61%.

Under Armour (UAA) -60%

Under Armour was started by founder Kevin Plank in his grandmother’s basement in Washington D.C. in 1996. The company then went public November 18, 2005 and was the first U.S. company in five years to double on its first day of trading. Following its IPO, Under Armour stock skyrocketed and hit all-time highs of $52.94 per share on September 14, 2015. However, after hitting those levels, the stock has been on a steady descent ever since. After aggressive sales growth for a couple years, Under Armour’s streak ended at the end of 2016 when sales growth fell below 20%. Sales in North America, which account for about 70% of total sales, were under pressure in 2017 and 2018.

Founder Kevin Plank stepped down from his role as CEO in late October, and the company also recently revealed that it is under investigation for its accounting practices. Over the past decade, shares of the sportswear maker have tumbled 60%.

Kraft Heinz (KHC) -58%

Heinz bought Kraft in July 2015 and the combined company became one of the largest food and beverage companies in the world. At the time, Warren Buffett’s Berkshire Hathaway and Brazilian investment firm 3G Capital owned 51% of Kraft Heinz and six of the 11 board seats. Kraft independently traded on the Nasdaq before the merger, and Kraft Heinz began trading as a merged company shortly after the deal was finalized in 2015.

However, it’s been a rocky road for the company ever since, and 2019 was particularly difficult for Kraft Heinz. First-quarter earnings results were delayed due to an SEC investigation into its accounting and procurement practices. In February, Kraft Heinz revealed a massive $15 billion write down of its Kraft and Oscar Mayer brands and slashed its dividend by 36% to 40 cents per share from 62.5 cents per share. The company also got a new CEO on July 1. As a result of the ongoing difficulties at the company, shares have plunged 58% over the past decade.

Perrigo (PRGO) -58%

Over a 132 year period, Perrigo eventually grew to become the biggest private manufacturer of over-the-counter pharmaceuticals. Perrigo’s consumer healthcare segment is the largest unit and generates about 60% of the company’s total revenue. Roughly a fifth of Perrigo’s sales come from its international businesses.

The Dublin-based company went public in 1991, and things were looking pretty good at the start of the decade. From 2010 to 2015, the stock was on a tear. Shares rose 442% during the five year run before taking a turn for the worst. After hitting an all-time high of $215.73 on April 6, 2015, the stock has tumbled 77% from those levels as of Tuesday’s closing price.

Occidental Petroleum (OXY) -51%

Even as the broader energy sector struggled over the past decade, Occidental Petroleum’s problems got particularly bad in 2019. Shares are down 36% so far in 2019 and 51% over the past decade. Occidental stock hit an all-time high of $112.95 on May 2, 2011 and traded in a range before free falling this year. In an attempt to compete with the larger players, Occidental bought Anadarko Petroleum in August for $57 billion. However, in order to finance the deal, Occidental agreed to a $10 billion financing agreement with Warren Buffett’s Berkshire Hathaway. The agreement forces Occidental to pay an 8% dividend for the next 10 years. Activist investor and Occidental shareholder Carl Icahn has been a vocal critic of the merger and recently stepped up his fight with the company. Icahn is looking to overhaul the entire 10-person board and remove current CEO Vicki Hollub. Icahn owns about $1 billion worth of Occidental shares and explained his intent in a November 8 letter outlining his decision to launch a proxy battle.

Schlumberger (SLB) -46%

Oil services giant Schlumberger is one of the largest oilfield services companies in the world with a plethora of business units. Schlumberger has been a public company since 1978, and during that time, the company has expanded and now has operations in 85 countries. Broadly, Schlumberger’s net sales have been in a steady uptrend since 2010. Pumping activity increases and demand for drilling were the biggest positive contributors to Schlumberger’s financial performance.

Much like its peers in the energy space, Schlumberger shares hit record highs in 2014, but have been on a precipitous decline since then. Over the past decade, the stock slumped 46%.

*The list of worst-performing stocks does not include companies that have been removed from the S&P 500 or have gone out of business.

*Exact performances are subject to change as the year comes to a close.

—

Heidi Chung is a reporter at Yahoo Finance. Follow her on Twitter: @heidi_chung.

More from Heidi:

New NYC coffee chain aims to undercut Starbucks with China-inspired model

Taco Bell dives into the fried chicken wars with its Crispy Tortilla Chicken

'We’re seeing a good forecast for the holiday season': Former Saks CEO

Find live stock market quotes and the latest business and finance news