We Think ADF Group (TSE:DRX) Can Stay On Top Of Its Debt

Howard Marks put it nicely when he said that, rather than worrying about share price volatility, 'The possibility of permanent loss is the risk I worry about... and every practical investor I know worries about. So it might be obvious that you need to consider debt, when you think about how risky any given stock is, because too much debt can sink a company. Importantly, ADF Group Inc. (TSE:DRX) does carry debt. But should shareholders be worried about its use of debt?

When Is Debt A Problem?

Debt assists a business until the business has trouble paying it off, either with new capital or with free cash flow. In the worst case scenario, a company can go bankrupt if it cannot pay its creditors. However, a more frequent (but still costly) occurrence is where a company must issue shares at bargain-basement prices, permanently diluting shareholders, just to shore up its balance sheet. Of course, debt can be an important tool in businesses, particularly capital heavy businesses. The first thing to do when considering how much debt a business uses is to look at its cash and debt together.

See our latest analysis for ADF Group

How Much Debt Does ADF Group Carry?

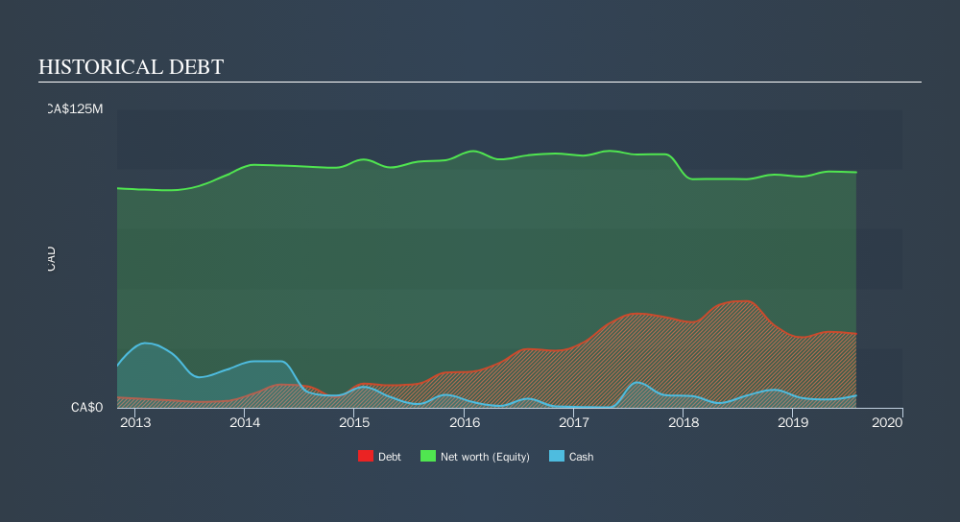

As you can see below, ADF Group had CA$31.0m of debt at July 2019, down from CA$44.7m a year prior. However, it does have CA$5.16m in cash offsetting this, leading to net debt of about CA$25.9m.

A Look At ADF Group's Liabilities

The latest balance sheet data shows that ADF Group had liabilities of CA$59.5m due within a year, and liabilities of CA$29.7m falling due after that. On the other hand, it had cash of CA$5.16m and CA$79.2m worth of receivables due within a year. So its liabilities total CA$4.75m more than the combination of its cash and short-term receivables.

Given ADF Group has a market capitalization of CA$37.5m, it's hard to believe these liabilities pose much threat. Having said that, it's clear that we should continue to monitor its balance sheet, lest it change for the worse.

In order to size up a company's debt relative to its earnings, we calculate its net debt divided by its earnings before interest, tax, depreciation, and amortization (EBITDA) and its earnings before interest and tax (EBIT) divided by its interest expense (its interest cover). The advantage of this approach is that we take into account both the absolute quantum of debt (with net debt to EBITDA) and the actual interest expenses associated with that debt (with its interest cover ratio).

ADF Group has a debt to EBITDA ratio of 3.2 and its EBIT covered its interest expense 2.5 times. This suggests that while the debt levels are significant, we'd stop short of calling them problematic. However, the silver lining was that ADF Group achieved a positive EBIT of CA$4.4m in the last twelve months, an improvement on the prior year's loss. There's no doubt that we learn most about debt from the balance sheet. But it is ADF Group's earnings that will influence how the balance sheet holds up in the future. So if you're keen to discover more about its earnings, it might be worth checking out this graph of its long term earnings trend.

Finally, while the tax-man may adore accounting profits, lenders only accept cold hard cash. So it's worth checking how much of the earnings before interest and tax (EBIT) is backed by free cash flow. Over the last year, ADF Group actually produced more free cash flow than EBIT. There's nothing better than incoming cash when it comes to staying in your lenders' good graces.

Our View

On our analysis ADF Group's conversion of EBIT to free cash flow should signal that it won't have too much trouble with its debt. However, our other observations weren't so heartening. To be specific, it seems about as good at covering its interest expense with its EBIT as wet socks are at keeping your feet warm. When we consider all the elements mentioned above, it seems to us that ADF Group is managing its debt quite well. But a word of caution: we think debt levels are high enough to justify ongoing monitoring. Over time, share prices tend to follow earnings per share, so if you're interested in ADF Group, you may well want to click here to check an interactive graph of its earnings per share history.

Of course, if you're the type of investor who prefers buying stocks without the burden of debt, then don't hesitate to discover our exclusive list of net cash growth stocks, today.

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned. Thank you for reading.