We Think City Pub Group (LON:CPC) Is Taking Some Risk With Its Debt

Warren Buffett famously said, 'Volatility is far from synonymous with risk.' When we think about how risky a company is, we always like to look at its use of debt, since debt overload can lead to ruin. As with many other companies The City Pub Group plc (LON:CPC) makes use of debt. But is this debt a concern to shareholders?

When Is Debt A Problem?

Debt and other liabilities become risky for a business when it cannot easily fulfill those obligations, either with free cash flow or by raising capital at an attractive price. In the worst case scenario, a company can go bankrupt if it cannot pay its creditors. However, a more common (but still painful) scenario is that it has to raise new equity capital at a low price, thus permanently diluting shareholders. By replacing dilution, though, debt can be an extremely good tool for businesses that need capital to invest in growth at high rates of return. When we examine debt levels, we first consider both cash and debt levels, together.

See our latest analysis for City Pub Group

How Much Debt Does City Pub Group Carry?

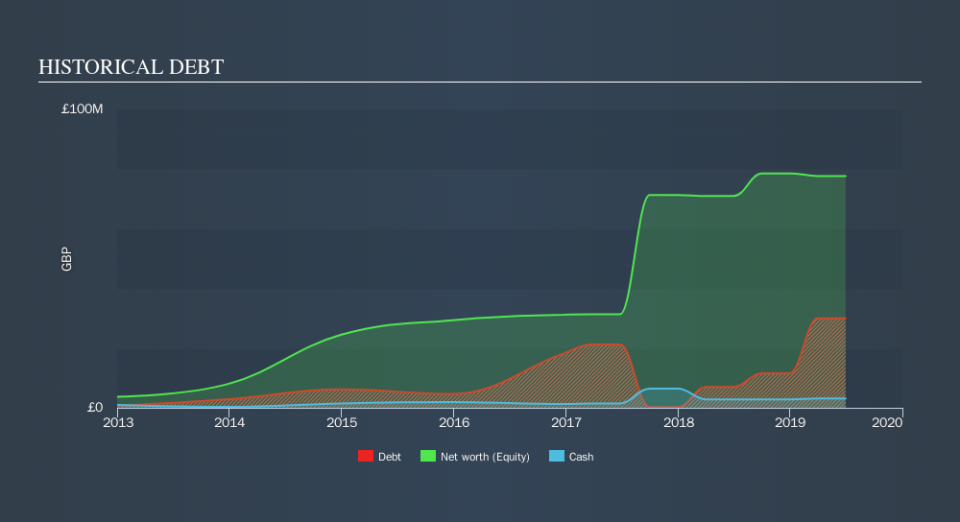

The image below, which you can click on for greater detail, shows that at June 2019 City Pub Group had debt of UK£30.0m, up from UK£7.00m in one year. However, because it has a cash reserve of UK£3.11m, its net debt is less, at about UK£26.9m.

How Healthy Is City Pub Group's Balance Sheet?

We can see from the most recent balance sheet that City Pub Group had liabilities of UK£9.18m falling due within a year, and liabilities of UK£31.9m due beyond that. Offsetting these obligations, it had cash of UK£3.11m as well as receivables valued at UK£2.89m due within 12 months. So it has liabilities totalling UK£35.1m more than its cash and near-term receivables, combined.

This deficit isn't so bad because City Pub Group is worth UK£109.8m, and thus could probably raise enough capital to shore up its balance sheet, if the need arose. But it's clear that we should definitely closely examine whether it can manage its debt without dilution.

In order to size up a company's debt relative to its earnings, we calculate its net debt divided by its earnings before interest, tax, depreciation, and amortization (EBITDA) and its earnings before interest and tax (EBIT) divided by its interest expense (its interest cover). Thus we consider debt relative to earnings both with and without depreciation and amortization expenses.

City Pub Group's net debt is 3.4 times its EBITDA, which is a significant but still reasonable amount of leverage. However, its interest coverage of 47.8 is very high, suggesting that the interest expense may well rise in the future, even if there hasn't yet been a major cost attached to that debt. City Pub Group grew its EBIT by 6.4% in the last year. That's far from incredible but it is a good thing, when it comes to paying off debt. The balance sheet is clearly the area to focus on when you are analysing debt. But ultimately the future profitability of the business will decide if City Pub Group can strengthen its balance sheet over time. So if you're focused on the future you can check out this free report showing analyst profit forecasts.

Finally, a company can only pay off debt with cold hard cash, not accounting profits. So the logical step is to look at the proportion of that EBIT that is matched by actual free cash flow. During the last three years, City Pub Group burned a lot of cash. While that may be a result of expenditure for growth, it does make the debt far more risky.

Our View

City Pub Group's conversion of EBIT to free cash flow and net debt to EBITDA definitely weigh on it, in our esteem. But its interest cover tells a very different story, and suggests some resilience. We think that City Pub Group's debt does make it a bit risky, after considering the aforementioned data points together. That's not necessarily a bad thing, since leverage can boost returns on equity, but it is something to be aware of. Above most other metrics, we think its important to track how fast earnings per share is growing, if at all. If you've also come to that realization, you're in luck, because today you can view this interactive graph of City Pub Group's earnings per share history for free.

Of course, if you're the type of investor who prefers buying stocks without the burden of debt, then don't hesitate to discover our exclusive list of net cash growth stocks, today.

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned. Thank you for reading.