We Think Security and Intelligence Services (India) (NSE:SIS) Can Stay On Top Of Its Debt

Some say volatility, rather than debt, is the best way to think about risk as an investor, but Warren Buffett famously said that 'Volatility is far from synonymous with risk.' So it might be obvious that you need to consider debt, when you think about how risky any given stock is, because too much debt can sink a company. We can see that Security and Intelligence Services (India) Limited (NSE:SIS) does use debt in its business. But should shareholders be worried about its use of debt?

When Is Debt Dangerous?

Debt and other liabilities become risky for a business when it cannot easily fulfill those obligations, either with free cash flow or by raising capital at an attractive price. In the worst case scenario, a company can go bankrupt if it cannot pay its creditors. While that is not too common, we often do see indebted companies permanently diluting shareholders because lenders force them to raise capital at a distressed price. By replacing dilution, though, debt can be an extremely good tool for businesses that need capital to invest in growth at high rates of return. When we examine debt levels, we first consider both cash and debt levels, together.

View our latest analysis for Security and Intelligence Services (India)

What Is Security and Intelligence Services (India)'s Debt?

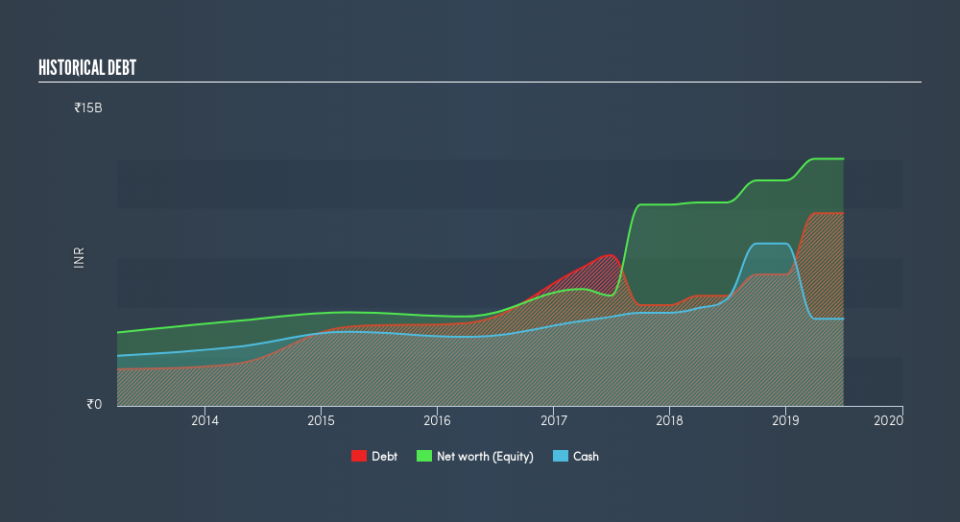

You can click the graphic below for the historical numbers, but it shows that as of March 2019 Security and Intelligence Services (India) had ₹9.75b of debt, an increase on ₹5.57b, over one year. However, because it has a cash reserve of ₹4.40b, its net debt is less, at about ₹5.34b.

How Strong Is Security and Intelligence Services (India)'s Balance Sheet?

According to the last reported balance sheet, Security and Intelligence Services (India) had liabilities of ₹14.3b due within 12 months, and liabilities of ₹15.4b due beyond 12 months. Offsetting this, it had ₹4.40b in cash and ₹14.2b in receivables that were due within 12 months. So its liabilities outweigh the sum of its cash and (near-term) receivables by ₹11.2b.

Of course, Security and Intelligence Services (India) has a market capitalization of ₹56.0b, so these liabilities are probably manageable. But there are sufficient liabilities that we would certainly recommend shareholders continue to monitor the balance sheet, going forward.

We measure a company's debt load relative to its earnings power by looking at its net debt divided by its earnings before interest, tax, depreciation, and amortization (EBITDA) and by calculating how easily its earnings before interest and tax (EBIT) cover its interest expense (interest cover). This way, we consider both the absolute quantum of the debt, as well as the interest rates paid on it.

While Security and Intelligence Services (India)'s low debt to EBITDA ratio of 1.3 suggests only modest use of debt, the fact that EBIT only covered the interest expense by 3.7 last year does give us pause. But the interest payments are certainly sufficient to have us thinking about how affordable its debt is. We note that Security and Intelligence Services (India) grew its EBIT by 28% in the last year, and that should make it easier to pay down debt, going forward. When analysing debt levels, the balance sheet is the obvious place to start. But ultimately the future profitability of the business will decide if Security and Intelligence Services (India) can strengthen its balance sheet over time. So if you're focused on the future you can check out this free report showing analyst profit forecasts.

Finally, a business needs free cash flow to pay off debt; accounting profits just don't cut it. So we always check how much of that EBIT is translated into free cash flow. In the last three years, Security and Intelligence Services (India)'s free cash flow amounted to 42% of its EBIT, less than we'd expect. That's not great, when it comes to paying down debt.

Our View

Happily, Security and Intelligence Services (India)'s impressive EBIT growth rate implies it has the upper hand on its debt. But, on a more sombre note, we are a little concerned by its interest cover. Looking at all the aforementioned factors together, it strikes us that Security and Intelligence Services (India) can handle its debt fairly comfortably. Of course, while this leverage can enhance returns on equity, it does bring more risk, so it's worth keeping an eye on this one. Of course, we wouldn't say no to the extra confidence that we'd gain if we knew that Security and Intelligence Services (India) insiders have been buying shares: if you're on the same wavelength, you can find out if insiders are buying by clicking this link.

If you're interested in investing in businesses that can grow profits without the burden of debt, then check out this free list of growing businesses that have net cash on the balance sheet.

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned. Thank you for reading.