We Think Shareholders Are Less Likely To Approve A Large Pay Rise For Conifex Timber Inc.'s (TSE:CFF) CEO For Now

The underwhelming share price performance of Conifex Timber Inc. (TSE:CFF) in the past three years would have disappointed many shareholders. In addition, the company's per-share earnings growth is not looking good, despite growing revenues. The AGM coming up on 22 June 2021 will be an opportunity for shareholders to have their concerns addressed by the board and for them to exercise their influence on management through voting on resolutions such as executive remuneration. Here's our take on why we think shareholders might be hesitant about approving a raise at the moment.

Check out our latest analysis for Conifex Timber

How Does Total Compensation For Ken Shields Compare With Other Companies In The Industry?

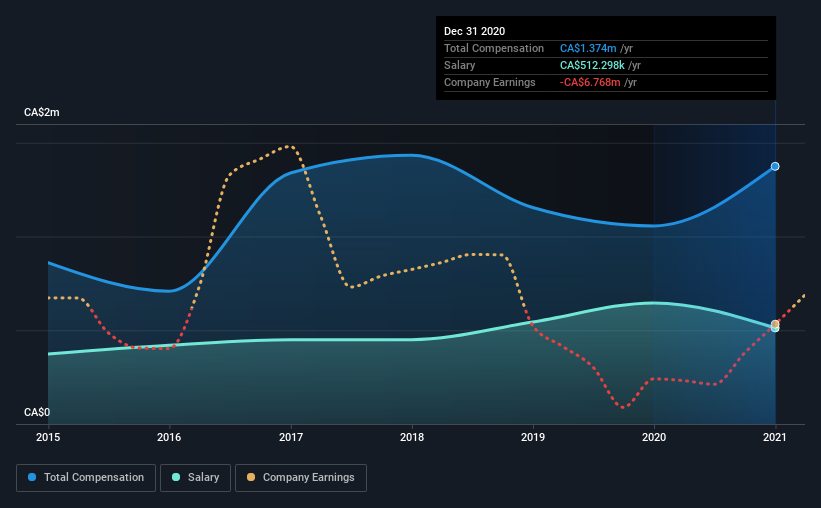

Our data indicates that Conifex Timber Inc. has a market capitalization of CA$96m, and total annual CEO compensation was reported as CA$1.4m for the year to December 2020. That's a notable increase of 30% on last year. While this analysis focuses on total compensation, it's worth acknowledging that the salary portion is lower, valued at CA$512k.

For comparison, other companies in the industry with market capitalizations below CA$244m, reported a median total CEO compensation of CA$347k. Hence, we can conclude that Ken Shields is remunerated higher than the industry median. What's more, Ken Shields holds CA$2.4m worth of shares in the company in their own name, indicating that they have a lot of skin in the game.

Component | 2020 | 2019 | Proportion (2020) |

Salary | CA$512k | CA$646k | 37% |

Other | CA$862k | CA$411k | 63% |

Total Compensation | CA$1.4m | CA$1.1m | 100% |

Speaking on an industry level, nearly 37% of total compensation represents salary, while the remainder of 63% is other remuneration. Although there is a difference in how total compensation is set, Conifex Timber more or less reflects the market in terms of setting the salary. If non-salary compensation dominates total pay, it's an indicator that the executive's salary is tied to company performance.

Conifex Timber Inc.'s Growth

Over the last three years, Conifex Timber Inc. has shrunk its earnings per share by 45% per year. It achieved revenue growth of 19% over the last year.

The decrease in EPS could be a concern for some investors. But in contrast the revenue growth is strong, suggesting future potential for EPS growth. These two metrics are moving in different directions, so while it's hard to be confident judging performance, we think the stock is worth watching. Historical performance can sometimes be a good indicator on what's coming up next but if you want to peer into the company's future you might be interested in this free visualization of analyst forecasts.

Has Conifex Timber Inc. Been A Good Investment?

Few Conifex Timber Inc. shareholders would feel satisfied with the return of -64% over three years. So shareholders would probably want the company to be less generous with CEO compensation.

In Summary...

The loss to shareholders over the past three years is certainly concerning and possibly has something to do with the fact that the company's earnings haven't grown. In the upcoming AGM, shareholders will get the opportunity to discuss any issues with the board, including those related to CEO remuneration and assess if the board's plan is in line with their expectations.

CEO pay is simply one of the many factors that need to be considered while examining business performance. We identified 4 warning signs for Conifex Timber (2 make us uncomfortable!) that you should be aware of before investing here.

Of course, you might find a fantastic investment by looking at a different set of stocks. So take a peek at this free list of interesting companies.

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.