We Think Shareholders May Consider Being More Generous With M Winkworth PLC's (LON:WINK) CEO Compensation Package

The decent performance at M Winkworth PLC (LON:WINK) recently will please most shareholders as they go into the AGM coming up on 11 May 2021. The focus will probably be on the future strategic initiatives that the board and management will put in place to improve the business rather than executive remuneration when they cast their votes on company resolutions. Here is our take on why we think CEO compensation is fair and may even warrant a raise.

View our latest analysis for M Winkworth

How Does Total Compensation For Dominic Charles Agace Compare With Other Companies In The Industry?

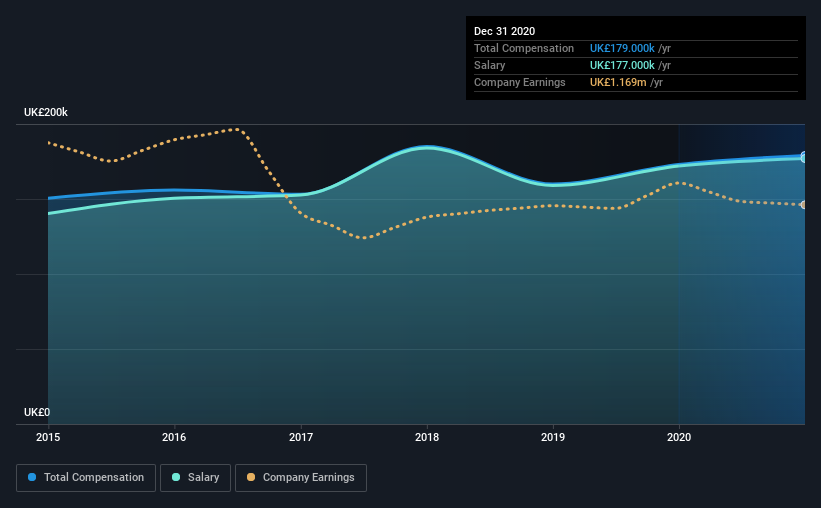

At the time of writing, our data shows that M Winkworth PLC has a market capitalization of UK£22m, and reported total annual CEO compensation of UK£179k for the year to December 2020. That's a fairly small increase of 3.5% over the previous year. In particular, the salary of UK£177.0k, makes up a huge portion of the total compensation being paid to the CEO.

On comparing similar-sized companies in the industry with market capitalizations below UK£145m, we found that the median total CEO compensation was UK£354k. In other words, M Winkworth pays its CEO lower than the industry median. Moreover, Dominic Charles Agace also holds UK£1.3m worth of M Winkworth stock directly under their own name, which reveals to us that they have a significant personal stake in the company.

Component | 2020 | 2019 | Proportion (2020) |

Salary | UK£177k | UK£172k | 99% |

Other | UK£2.0k | UK£1.0k | 1% |

Total Compensation | UK£179k | UK£173k | 100% |

Talking in terms of the industry, salary represented approximately 55% of total compensation out of all the companies we analyzed, while other remuneration made up 45% of the pie. M Winkworth has gone down a largely traditional route, paying Dominic Charles Agace a high salary, giving it preference over non-salary benefits. If salary is the major component in total compensation, it suggests that the CEO receives a higher fixed proportion of the total compensation, regardless of performance.

M Winkworth PLC's Growth

M Winkworth PLC has seen its earnings per share (EPS) increase by 2.0% a year over the past three years. Revenue was pretty flat on last year.

We would prefer it if there was revenue growth, but the modest EPS growth gives us some relief. It's hard to reach a conclusion about business performance right now. This may be one to watch. Moving away from current form for a second, it could be important to check this free visual depiction of what analysts expect for the future.

Has M Winkworth PLC Been A Good Investment?

We think that the total shareholder return of 87%, over three years, would leave most M Winkworth PLC shareholders smiling. So they may not be at all concerned if the CEO were to be paid more than is normal for companies around the same size.

To Conclude...

Dominic Charles receives almost all of their compensation through a salary. While the company seems to be headed in the right direction performance-wise, there's always room for improvement. Assuming the business continues to grow at a good clip, few shareholders would raise any objections to the CEO's remuneration. Instead, investors might be more interested in discussions that would help manage their longer-term growth expectations such as company business strategies and future growth potential.

CEO compensation can have a massive impact on performance, but it's just one element. That's why we did some digging and identified 2 warning signs for M Winkworth that investors should think about before committing capital to this stock.

Arguably, business quality is much more important than CEO compensation levels. So check out this free list of interesting companies that have HIGH return on equity and low debt.

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.