We Think Sunway International Holdings (HKG:58) Has A Fair Chunk Of Debt

Warren Buffett famously said, 'Volatility is far from synonymous with risk.' It's only natural to consider a company's balance sheet when you examine how risky it is, since debt is often involved when a business collapses. As with many other companies Sunway International Holdings Limited (HKG:58) makes use of debt. But the real question is whether this debt is making the company risky.

When Is Debt A Problem?

Debt assists a business until the business has trouble paying it off, either with new capital or with free cash flow. Ultimately, if the company can't fulfill its legal obligations to repay debt, shareholders could walk away with nothing. However, a more usual (but still expensive) situation is where a company must dilute shareholders at a cheap share price simply to get debt under control. Of course, plenty of companies use debt to fund growth, without any negative consequences. The first thing to do when considering how much debt a business uses is to look at its cash and debt together.

See our latest analysis for Sunway International Holdings

What Is Sunway International Holdings's Debt?

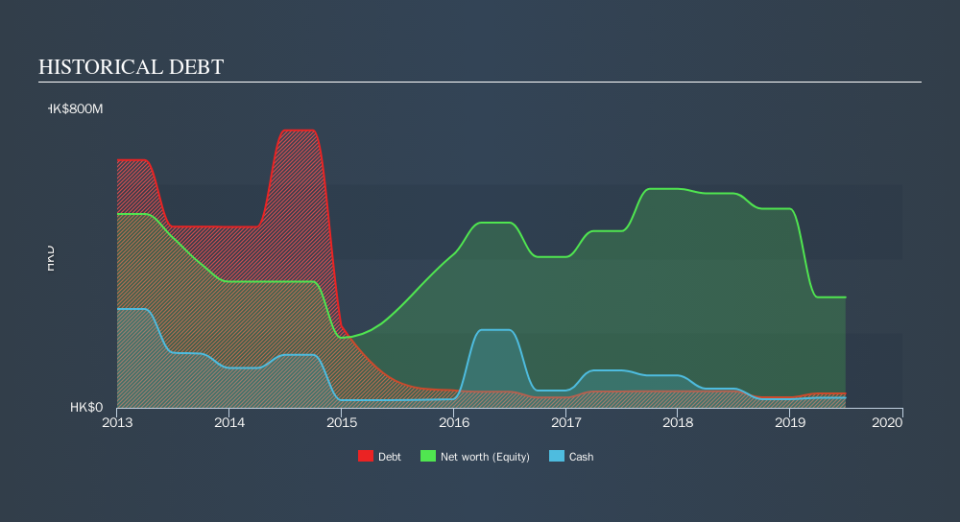

You can click the graphic below for the historical numbers, but it shows that Sunway International Holdings had HK$38.4m of debt in June 2019, down from HK$44.1m, one year before. However, because it has a cash reserve of HK$27.1m, its net debt is less, at about HK$11.3m.

How Strong Is Sunway International Holdings's Balance Sheet?

The latest balance sheet data shows that Sunway International Holdings had liabilities of HK$121.0m due within a year, and liabilities of HK$12.4m falling due after that. Offsetting these obligations, it had cash of HK$27.1m as well as receivables valued at HK$98.6m due within 12 months. So it has liabilities totalling HK$7.76m more than its cash and near-term receivables, combined.

Given Sunway International Holdings has a market capitalization of HK$71.1m, it's hard to believe these liabilities pose much threat. But there are sufficient liabilities that we would certainly recommend shareholders continue to monitor the balance sheet, going forward. When analysing debt levels, the balance sheet is the obvious place to start. But it is Sunway International Holdings's earnings that will influence how the balance sheet holds up in the future. So if you're keen to discover more about its earnings, it might be worth checking out this graph of its long term earnings trend.

It seems likely shareholders hope that Sunway International Holdings can significantly advance the business plan before too long, because it doesn't have any significant revenue at the moment.

Caveat Emptor

Over the last twelve months Sunway International Holdings produced an earnings before interest and tax (EBIT) loss. Its EBIT loss was a whopping HK$28m. When we look at that and recall the liabilities on its balance sheet, relative to cash, it seems unwise to us for the company to have any debt. Quite frankly we think the balance sheet is far from match-fit, although it could be improved with time. We would feel better if it turned its trailing twelve month loss of HK$289m into a profit. In the meantime, we consider the stock very risky. When I consider a company to be a bit risky, I think it is responsible to check out whether insiders have been reporting any share sales. Luckily, you can click here ito see our graphic depicting Sunway International Holdings insider transactions.

If you're interested in investing in businesses that can grow profits without the burden of debt, then check out this free list of growing businesses that have net cash on the balance sheet.

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned. Thank you for reading.