We Think Torslanda Property Investment (STO:TORSAB) Can Stay On Top Of Its Debt

Howard Marks put it nicely when he said that, rather than worrying about share price volatility, 'The possibility of permanent loss is the risk I worry about... and every practical investor I know worries about. It's only natural to consider a company's balance sheet when you examine how risky it is, since debt is often involved when a business collapses. Importantly, Torslanda Property Investment AB (publ) (STO:TORSAB) does carry debt. But is this debt a concern to shareholders?

Why Does Debt Bring Risk?

Debt and other liabilities become risky for a business when it cannot easily fulfill those obligations, either with free cash flow or by raising capital at an attractive price. Ultimately, if the company can't fulfill its legal obligations to repay debt, shareholders could walk away with nothing. However, a more frequent (but still costly) occurrence is where a company must issue shares at bargain-basement prices, permanently diluting shareholders, just to shore up its balance sheet. By replacing dilution, though, debt can be an extremely good tool for businesses that need capital to invest in growth at high rates of return. The first thing to do when considering how much debt a business uses is to look at its cash and debt together.

See our latest analysis for Torslanda Property Investment

What Is Torslanda Property Investment's Debt?

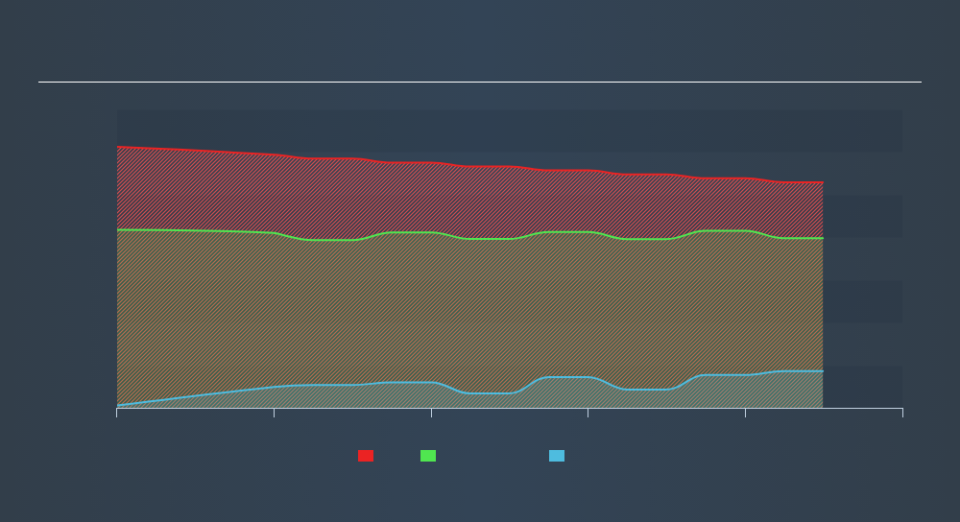

As you can see below, Torslanda Property Investment had kr264.6m of debt, at June 2019, which is about the same the year before. You can click the chart for greater detail. However, it also had kr43.1m in cash, and so its net debt is kr221.5m.

A Look At Torslanda Property Investment's Liabilities

The latest balance sheet data shows that Torslanda Property Investment had liabilities of kr47.1m due within a year, and liabilities of kr277.6m falling due after that. Offsetting these obligations, it had cash of kr43.1m as well as receivables valued at kr2.78m due within 12 months. So its liabilities total kr278.7m more than the combination of its cash and short-term receivables.

While this might seem like a lot, it is not so bad since Torslanda Property Investment has a market capitalization of kr1.11b, and so it could probably strengthen its balance sheet by raising capital if it needed to. But it's clear that we should definitely closely examine whether it can manage its debt without dilution.

In order to size up a company's debt relative to its earnings, we calculate its net debt divided by its earnings before interest, tax, depreciation, and amortization (EBITDA) and its earnings before interest and tax (EBIT) divided by its interest expense (its interest cover). Thus we consider debt relative to earnings both with and without depreciation and amortization expenses.

With a net debt to EBITDA ratio of 5.4, it's fair to say Torslanda Property Investment does have a significant amount of debt. But the good news is that it boasts fairly comforting interest cover of 4.2 times, suggesting it can responsibly service its obligations. Given the debt load, it's hardly ideal that Torslanda Property Investment's EBIT was pretty flat over the last twelve months. When analysing debt levels, the balance sheet is the obvious place to start. But it is Torslanda Property Investment's earnings that will influence how the balance sheet holds up in the future. So when considering debt, it's definitely worth looking at the earnings trend. Click here for an interactive snapshot.

Finally, while the tax-man may adore accounting profits, lenders only accept cold hard cash. So we clearly need to look at whether that EBIT is leading to corresponding free cash flow. Over the last three years, Torslanda Property Investment actually produced more free cash flow than EBIT. There's nothing better than incoming cash when it comes to staying in your lenders' good graces.

Our View

On our analysis Torslanda Property Investment's conversion of EBIT to free cash flow should signal that it won't have too much trouble with its debt. But the other factors we noted above weren't so encouraging. In particular, net debt to EBITDA gives us cold feet. Considering this range of data points, we think Torslanda Property Investment is in a good position to manage its debt levels. But a word of caution: we think debt levels are high enough to justify ongoing monitoring. Given Torslanda Property Investment has a strong balance sheet is profitable and pays a dividend, it would be good to know how fast its dividends are growing, if at all. You can find out instantly by clicking this link.

Of course, if you're the type of investor who prefers buying stocks without the burden of debt, then don't hesitate to discover our exclusive list of net cash growth stocks, today.

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned. Thank you for reading.