Thinking of renovating a historic building? Here's what you should know

While historic designations are a means to preserve the history and integrity of buildings over a half a century old, renovating and maintaining them can be rewarding, and also quite a challenge.

Depending on the age of the building and its location, the term "historic" can mean many different things, according to Monroe's Chief Economic Developer Kelsea McCrary.

"In regards to the state tax credit, eligibility is determined by a rolling deadline of 50 years or older," McCrary said. "So, right now we are looking at buildings as recently built as 1972. However, what a community or individual thinks as of historic isn't something that can be regulated or designated unless it's in relation to a program or guideline, or grant."

Adams Street shotgun houses restored: Traditional shotgun houses renovated in downtown Monroe

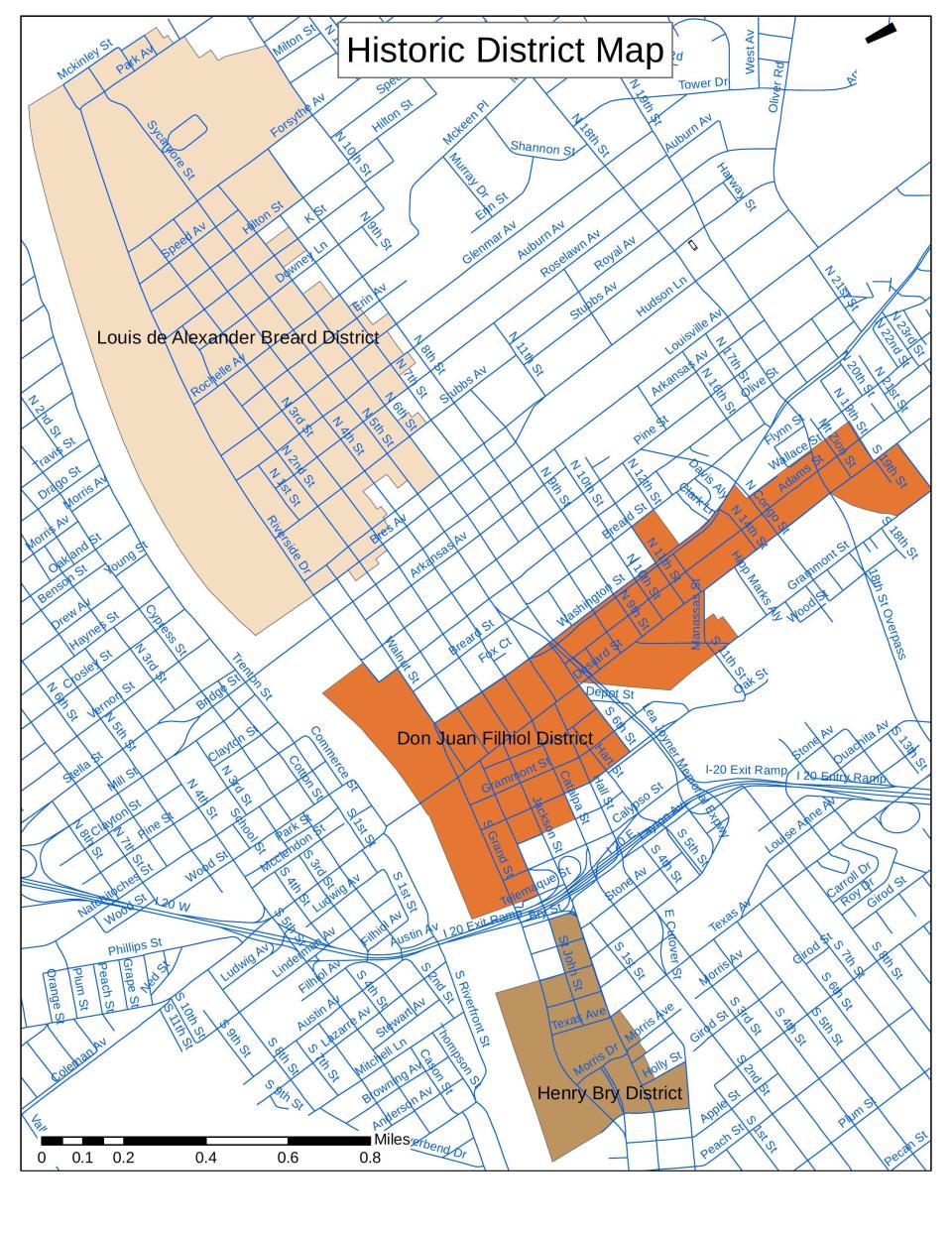

A historic district can be locally designed, overseen typically by a historic preservation commission, or it can be a larger designation such as a National Register District which is governed and regulated by different guidelines, McCrary said. There are four local historic districts in the Twin Cities and approximately 32 landmark properties.

The four local historic districts are:

Cotton Port Historic District, West Monroe

Louis de Alexander Breard District, Monroe

Don Juan Filhiol District, Monroe

Henry Bry District, Monroe

Downtown West Monroe is a National Register Historic District as well as Louisiana Cultural District.

"This two designations mean that historic buildings within those districts are eligible for historic tax credits up to 40% on renovation projects," Main Street Director Adrienne LaFrance-Wells said. "Properties must be income-producing in order to qualify and construction projects must meet the Secretary of the Interior's standards for historic buildings."

Tax credits available for renovating historic buildings

The federal historic tax credits program is an indirect federal subsidy to finance the rehabilitation of historic buildings with a 20% tax credit for qualified expenditures.

Tim Brandon of TBA Studio, a West Monroe-based architectural firm, said the historic tax credit process is the factor that determines if a historic property is able to be renovated or not.

"It provides the owner 20%, if the project is significant, determined by the state or the SHPO (Historic Preservation Officer), and if the project is in a national certified district, cultural district," Brandon said. "If it qualifies then the project can receive up to 20% of the cost of the project, 20% tax credits, state and federal."

For subscribers: 'A treasure of our community': Historic West Monroe property renovation goes viral

Brandon said a 20% state tax credit is considered to be good for a large renovation project. Brandon said the state tax credit can also be sold.

"Those tax credits can be brokered out through a tax credit broker company and they could be sold for .85 on the dollar," Brandon said. "20% of a large budget, and then you sell those credits, that money can go towards the development. The tax credits are a huge advantage for a building owner."

Why renovate a historic building?

It takes experience and know-how to determine whether a historic property is financially feasible to renovate, Brandon said.

"The structure needs to be solid, the exterior walls, the brick," Brandon said. "All of that needs to be structurally sound. If not you end up spending way too much money."

McCrary said benefits from having local historic designations can range from simply being connected to a group of folks with similar interests as a resource-sharing model to having access to guidelines for renovation which can be based on a commonly held set of rules that the commission sets and keeps for the neighborhood or district.

Historic Miller-Roy building: Chitlin' Circuit stop to get become affordable housing with $15M investment

"Historic renovation often be categorized as environmentally responsible since it encourages the reuse and adaptation instead of producing new materials and these buildings typically are more energy efficient," McCrary said. "Since they were built to take full advantage of the natural environment versus having the advantages of AC/central heat – so these districts and designations can support this mindset inside of its boundaries."

McCrary said, despite the unique obstacles involved, preserving historic buildings is vital.

"The historic built environment serves as the fingerprints of a community," she said "These structures are directly reflective of a community's identity and are incredible important to preserve, save, and activate again for the citizens and community around them."

Follow Ian Robinson on Twitter @_irobinson and on Facebook at https://bit.ly/3vln0w1.

Support local journalism by subscribing at https://cm.thenewsstar.com/specialoffer.

This article originally appeared on Monroe News-Star: Renovating a historic building in Monroe? What you should know