This week in Trumponomics: Forget everything but impeachment

There’s now a good chance the House of Representatives will impeach President Trump. The Senate will probably decline to convict him. Trump will remain in office, and a year from now, it might seem like not much has changed.

But a lot will change, with the House now committed to a formal inquiry likely to end with impeachment. Trump’s economic agenda will remain in place, but all available resources will now go toward fighting impeachment rather than landing trade deals, lowering drug prices or designing an infrastructure plan. Trump himself already seems consumed with impeachment, talking and tweeting about little else.

There’s modern precedent for what Trump is about to go through: the 1998 impeachment of Bill Clinton. “Impeachment sucked all the air out of the room,” says William Reinsch of the Center for Strategic and International Studies, who was a top official at the Commerce Department under Clinton. “You'd bring an issue to the White House and they'd tell you we can't deal with that right now – make it go away.” Trump’s White House is understaffed compared with other presidents, further narrowing its resources.

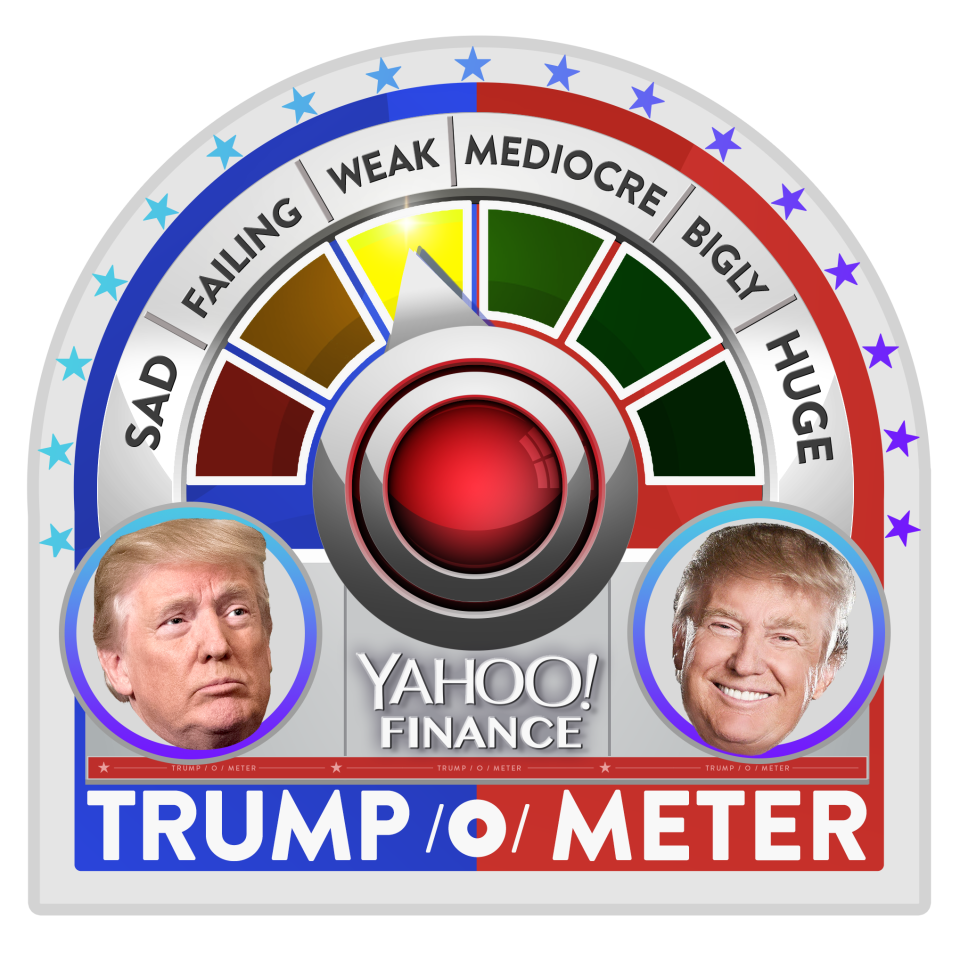

In some ways, a less-interventionist White House might be good for markets and the economy. Investors would love to see Trump wrap up his trade war with China, for instance, Trump might now feel he needs to do that, to get something going his way. Impeachment is obviously an ominous development, but the Trump-o-meter grades economics, not politics. So instead of a SAD rating—the worst – the Trump-o-meter this week reads WEAK, our third-lowest score.

Analysts have been studying every possible impeachment scenario and trying to deduce the implications. A new level of warfare between Democrats and Republicans might mean there’s no chance Congress will ratify the revamped trade deal with Canada and Mexico, or extend key spending measures that will expire in November. Or, the two parties might be desperate to show voters they’re capable of doing something productive and pass all needed measures more easily than usual.

The China trade war concerns markets more than other geopolitical issues, and an uncertain situation has become even murkier. Maybe impeachment will compel Trump to agree to some “skinny” deal he can claim as a victory. Or maybe he’ll become more resolute than ever and give in on nothing. China has a say, too. They might conclude Trump is damaged goods, and hold out till next year’s election, hoping he loses. Or they might think it’s a good time to hit Trump up for relief from tariffs and other measures.

There’s also a second-order effect on the Democratic presidential race. Since the impeachment hubbub revolves around Trump’s effort to dig up dirt on Joe Biden’s son Hunter, when he sat on the board of a Ukrainian energy company, it drags Biden in a direction he’d rather not go. There’s no evidence Biden or his son did anything wrong, but Trump and his allies are sure trying to make it look like there is.

That could turn some voters against Biden, helping Sen. Elizabeth Warren, who is now the Democratic front-runner in some polls. There’d be a big difference between a Warren presidency and a Biden (or Trump) presidency, since Warren favors aggressive corporate reforms that would transform big parts of the economy. So impeaching Trump could dent Biden’s reputation and help Warren become president. Or something like that.

Rick Newman is the author of four books, including “Rebounders: How Winners Pivot from Setback to Success.” Follow him on Twitter: @rickjnewman. Confidential tip line: rickjnewman@yahoo.com. Encrypted communication available. Click here to get Rick’s stories by email.

Read more:

Markets would soar, not crash, if Trump got impeached

Trump’s trade war has killed 300,000 jobs

The Bernie Sanders billionaire-eradication plan

4 problems with Andrew Yang’s free money drop

Read the latest financial and business news from Yahoo Finance

Follow Yahoo Finance on Twitter, Facebook, Instagram, Flipboard, SmartNews, LinkedIn, YouTube, and reddit.