Those Who Purchased Alelion Energy Systems (STO:ALELIO) Shares Three Years Ago Have A 94% Loss To Show For It

Every investor on earth makes bad calls sometimes. But really big losses can really drag down an overall portfolio. So take a moment to sympathize with the long term shareholders of Alelion Energy Systems AB (publ) (STO:ALELIO), who have seen the share price tank a massive 94% over a three year period. That would certainly shake our confidence in the decision to own the stock. And more recent buyers are having a tough time too, with a drop of 91% in the last year. Shareholders have had an even rougher run lately, with the share price down 46% in the last 90 days.

We really feel for shareholders in this scenario. It's a good reminder of the importance of diversification, and it's worth keeping in mind there's more to life than money, anyway.

View our latest analysis for Alelion Energy Systems

Because Alelion Energy Systems is loss-making, we think the market is probably more focussed on revenue and revenue growth, at least for now. When a company doesn't make profits, we'd generally expect to see good revenue growth. Some companies are willing to postpone profitability to grow revenue faster, but in that case one does expect good top-line growth.

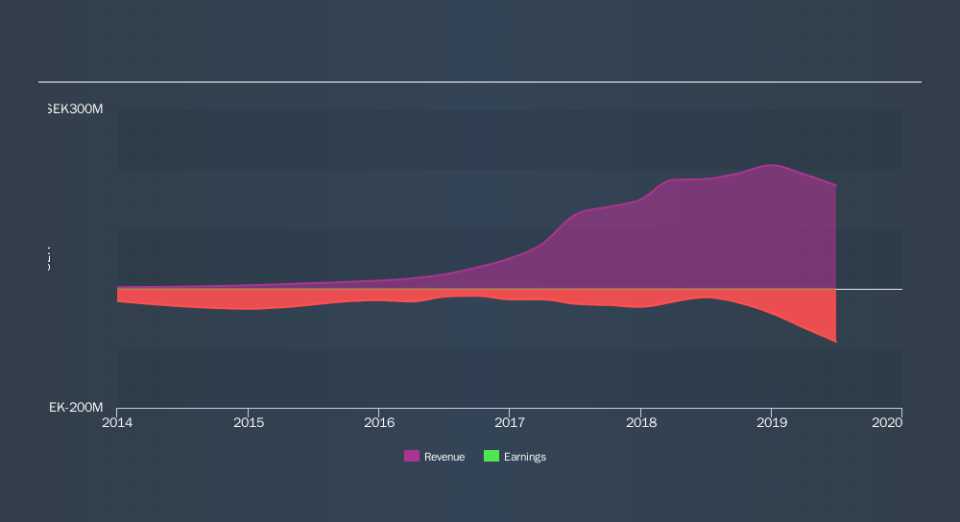

In the last three years, Alelion Energy Systems saw its revenue grow by 47% per year, compound. That's well above most other pre-profit companies. So why has the share priced crashed 60% per year, in the same time? The share price makes us wonder if there is an issue with profitability. Ultimately, revenue growth doesn't amount to much if the business can't scale well. If the company is low on cash, it may have to raise capital soon.

You can see how earnings and revenue have changed over time in the image below (click on the chart to see the exact values).

Take a more thorough look at Alelion Energy Systems's financial health with this free report on its balance sheet.

What about the Total Shareholder Return (TSR)?

We'd be remiss not to mention the difference between Alelion Energy Systems's total shareholder return (TSR) and its share price return. The TSR attempts to capture the value of dividends (as if they were reinvested) as well as any spin-offs or discounted capital raisings offered to shareholders. Alelion Energy Systems hasn't been paying dividends, but its TSR of -90% exceeds its share price return of -94%, implying it has either spun-off a business, or raised capital at a discount; thereby providing additional value to shareholders.

A Different Perspective

Alelion Energy Systems shareholders are down 86% for the year, but the broader market is up 24%. However, keep in mind that even the best stocks will sometimes underperform the market over a twelve month period. Shareholders have lost 53% per year over the last three years, so the share price drop has become steeper, over the last year; a potential symptom of as yet unsolved challenges. Although Warren Buffett famously said he likes to 'buy when there is blood on the streets', he also focusses on high quality stocks with solid prospects. Most investors take the time to check the data on insider transactions. You can click here to see if insiders have been buying or selling.

If you would prefer to check out another company -- one with potentially superior financials -- then do not miss this free list of companies that have proven they can grow earnings.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on SE exchanges.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned.

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Thank you for reading.