Those Who Purchased Amasse Capital Holdings (HKG:8168) Shares A Year Ago Have A 24% Loss To Show For It

You can invest in an index fund if you want to make sure your returns approximately match the overall market. In contrast individual stocks will provide a wide range of possible returns, and may fall short. That's what happened in the case of Amasse Capital Holdings Limited (HKG:8168): its share price dropped 24% while the market returned -20%. We wouldn't rush to judgement on Amasse Capital Holdings because we don't have a long term history to look at. The falls have accelerated recently, with the share price down 17% in the last three months. But this could be related to the weak market, which is down 17% in the same period.

See our latest analysis for Amasse Capital Holdings

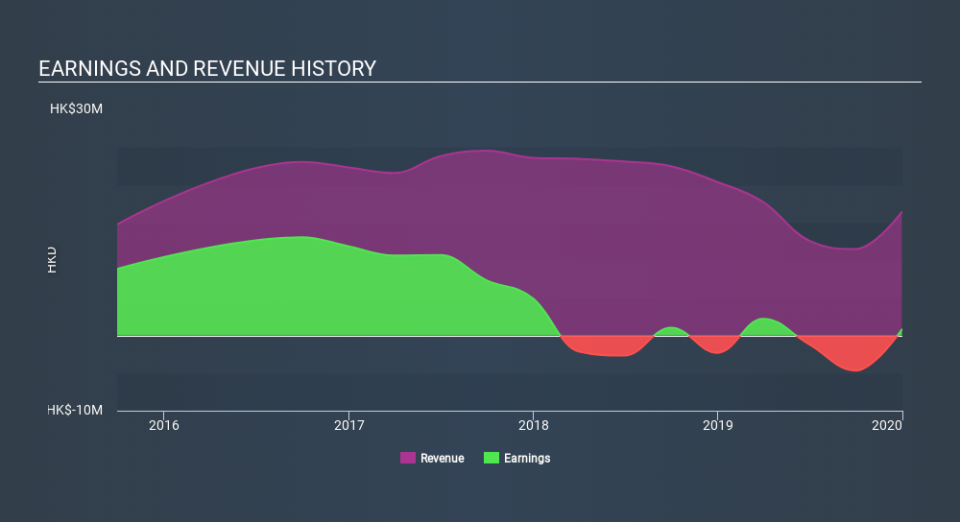

We don't think that Amasse Capital Holdings's modest trailing twelve month profit has the market's full attention at the moment. We think revenue is probably a better guide. As a general rule, we think this kind of company is more comparable to loss-making stocks, since the actual profit is so low. For shareholders to have confidence a company will grow profits significantly, it must grow revenue.

Amasse Capital Holdings's revenue didn't grow at all in the last year. In fact, it fell 20%. That looks pretty grim, at a glance. The stock price has languished lately, falling 24% in a year. That seems pretty reasonable given the lack of both profits and revenue growth. It's hard to escape the conclusion that buyers must envision either growth down the track, cost cutting, or both.

The image below shows how earnings and revenue have tracked over time (if you click on the image you can see greater detail).

You can see how its balance sheet has strengthened (or weakened) over time in this free interactive graphic.

What About Dividends?

As well as measuring the share price return, investors should also consider the total shareholder return (TSR). The TSR is a return calculation that accounts for the value of cash dividends (assuming that any dividend received was reinvested) and the calculated value of any discounted capital raisings and spin-offs. Arguably, the TSR gives a more comprehensive picture of the return generated by a stock. In the case of Amasse Capital Holdings, it has a TSR of -21% for the last year. That exceeds its share price return that we previously mentioned. The dividends paid by the company have thusly boosted the total shareholder return.

A Different Perspective

Having lost 21% over the year , including dividends , Amasse Capital Holdings has generated a return within the same ballpark as the broader market. Given that the share price has continued to slide (by 17%) in the last three months, it's hard to know when we might see the bottom. It's not uncommon to see companies without long term track records disappoint shareholders. It's always interesting to track share price performance over the longer term. But to understand Amasse Capital Holdings better, we need to consider many other factors. For example, we've discovered 5 warning signs for Amasse Capital Holdings (1 is a bit concerning!) that you should be aware of before investing here.

For those who like to find winning investments this free list of growing companies with recent insider purchasing, could be just the ticket.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on HK exchanges.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned.

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Thank you for reading.