Those Who Purchased Endomines (STO:ENDO) Shares Five Years Ago Have A 88% Loss To Show For It

Endomines AB (publ) (STO:ENDO) shareholders should be happy to see the share price up 16% in the last month. But that is little comfort to those holding over the last half decade, sitting on a big loss. In fact, the share price has declined rather badly, down some 88% in that time. So we're not so sure if the recent bounce should be celebrated. Of course, this could be the start of a turnaround.

We really feel for shareholders in this scenario. It's a good reminder of the importance of diversification, and it's worth keeping in mind there's more to life than money, anyway.

Check out our latest analysis for Endomines

With just kr13,024,000 worth of revenue in twelve months, we don't think the market considers Endomines to have proven its business plan. You have to wonder why venture capitalists aren't funding it. So it seems that the investors focused more on what could be, than paying attention to the current revenues (or lack thereof). For example, investors may be hoping that Endomines finds some valuable resources, before it runs out of money.

We think companies that have neither significant revenues nor profits are pretty high risk. There is almost always a chance they will need to raise more capital, and their progress - and share price - will dictate how dilutive that is to current holders. While some companies like this go on to deliver on their plan, making good money for shareholders, many end in painful losses and eventual de-listing. Some Endomines investors have already had a taste of the bitterness stocks like this can leave in the mouth.

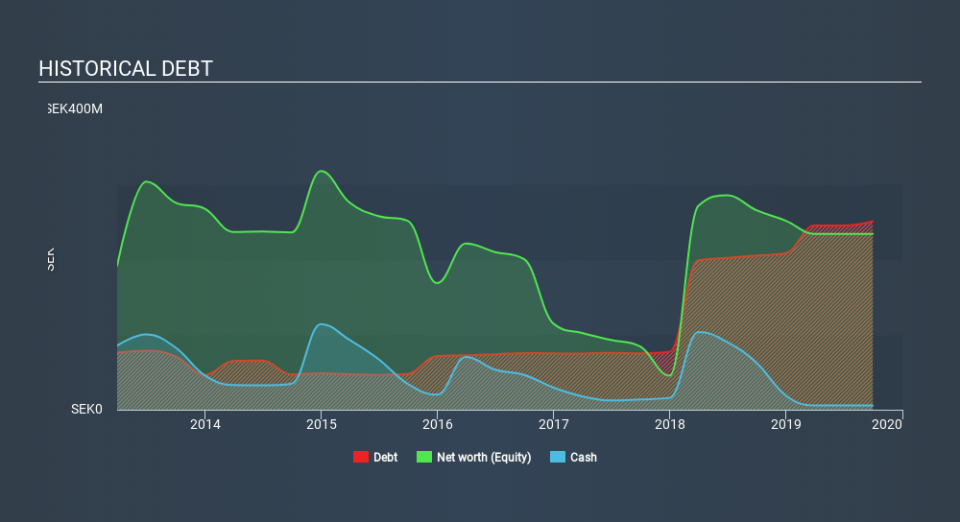

Our data indicates that Endomines had kr303m more in total liabilities than it had cash, when it last reported in September 2019. That puts it in the highest risk category, according to our analysis. But with the share price diving 35% per year, over 5 years , it's probably fair to say that some shareholders no longer believe the company will succeed. You can click on the image below to see (in greater detail) how Endomines's cash levels have changed over time. You can click on the image below to see (in greater detail) how Endomines's cash levels have changed over time.

It can be extremely risky to invest in a company that doesn't even have revenue. There's no way to know its value easily. Given that situation, would you be concerned if it turned out insiders were relentlessly selling stock? It would bother me, that's for sure. You can click here to see if there are insiders selling.

What about the Total Shareholder Return (TSR)?

Investors should note that there's a difference between Endomines's total shareholder return (TSR) and its share price change, which we've covered above. Arguably the TSR is a more complete return calculation because it accounts for the value of dividends (as if they were reinvested), along with the hypothetical value of any discounted capital that have been offered to shareholders. We note that Endomines's TSR, at -55% is higher than its share price return of -88%. When you consider it hasn't been paying a dividend, this data suggests shareholders have benefitted from a spin-off, or had the opportunity to acquire attractively priced shares in a discounted capital raising.

A Different Perspective

Investors in Endomines had a tough year, with a total loss of 4.3%, against a market gain of about 29%. Even the share prices of good stocks drop sometimes, but we want to see improvements in the fundamental metrics of a business, before getting too interested. However, the loss over the last year isn't as bad as the 15% per annum loss investors have suffered over the last half decade. We would want clear information suggesting the company will grow, before taking the view that the share price will stabilize. While it is well worth considering the different impacts that market conditions can have on the share price, there are other factors that are even more important. To that end, you should learn about the 4 warning signs we've spotted with Endomines (including 1 which is can't be ignored) .

We will like Endomines better if we see some big insider buys. While we wait, check out this free list of growing companies with considerable, recent, insider buying.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on SE exchanges.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned.

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Thank you for reading.