Those Who Purchased Nine Dragons Paper (Holdings) (HKG:2689) Shares A Year Ago Have A 46% Loss To Show For It

The simplest way to benefit from a rising market is to buy an index fund. But if you buy individual stocks, you can do both better or worse than that. For example, the Nine Dragons Paper (Holdings) Limited (HKG:2689) share price is down 46% in the last year. That's disappointing when you consider the market returned -12%. Longer term investors have fared much better, since the share price is up 28% in three years. Shareholders have had an even rougher run lately, with the share price down 18% in the last 90 days.

Want to participate in a short research study? Help shape the future of investing tools and you could win a $250 gift card!

See our latest analysis for Nine Dragons Paper (Holdings)

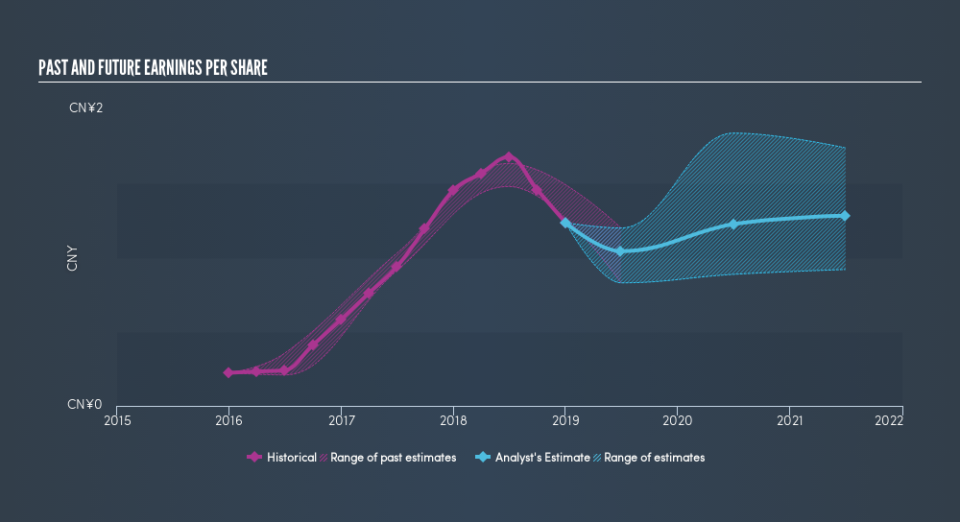

In his essay The Superinvestors of Graham-and-Doddsville Warren Buffett described how share prices do not always rationally reflect the value of a business. By comparing earnings per share (EPS) and share price changes over time, we can get a feel for how investor attitudes to a company have morphed over time.

Unhappily, Nine Dragons Paper (Holdings) had to report a 15% decline in EPS over the last year. This reduction in EPS is not as bad as the 46% share price fall. So it seems the market was too confident about the business, a year ago. The P/E ratio of 4.92 also points to the negative market sentiment.

The image below shows how EPS has tracked over time (if you click on the image you can see greater detail).

It is of course excellent to see how Nine Dragons Paper (Holdings) has grown profits over the years, but the future is more important for shareholders. Take a more thorough look at Nine Dragons Paper (Holdings)'s financial health with this free report on its balance sheet.

What About Dividends?

As well as measuring the share price return, investors should also consider the total shareholder return (TSR). Whereas the share price return only reflects the change in the share price, the TSR includes the value of dividends (assuming they were reinvested) and the benefit of any discounted capital raising or spin-off. So for companies that pay a generous dividend, the TSR is often a lot higher than the share price return. As it happens, Nine Dragons Paper (Holdings)'s TSR for the last year was -42%, which exceeds the share price return mentioned earlier. This is largely a result of its dividend payments!

A Different Perspective

We regret to report that Nine Dragons Paper (Holdings) shareholders are down 42% for the year (even including dividends). Unfortunately, that's worse than the broader market decline of 12%. Having said that, it's inevitable that some stocks will be oversold in a falling market. The key is to keep your eyes on the fundamental developments. Longer term investors wouldn't be so upset, since they would have made 8.8%, each year, over five years. It could be that the recent sell-off is an opportunity, so it may be worth checking the fundamental data for signs of a long term growth trend. Importantly, we haven't analysed Nine Dragons Paper (Holdings)'s dividend history. This free visual report on its dividends is a must-read if you're thinking of buying.

If you would prefer to check out another company -- one with potentially superior financials -- then do not miss this free list of companies that have proven they can grow earnings.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on HK exchanges.

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned. Thank you for reading.