Those Who Purchased Pfenex (NYSEMKT:PFNX) Shares Three Years Ago Have A 23% Loss To Show For It

Want to participate in a short research study? Help shape the future of investing tools and you could win a $250 gift card!

As an investor its worth striving to ensure your overall portfolio beats the market average. But the risk of stock picking is that you will likely buy under-performing companies. We regret to report that long term Pfenex Inc. (NYSEMKT:PFNX) shareholders have had that experience, with the share price dropping 23% in three years, versus a market return of about 46%. On top of that, the share price has dropped a further 14% in a month.

View our latest analysis for Pfenex

Pfenex isn't currently profitable, so most analysts would look to revenue growth to get an idea of how fast the underlying business is growing. Shareholders of unprofitable companies usually expect strong revenue growth. That's because it's hard to be confident a company will be sustainable if revenue growth is negligible, and it never makes a profit.

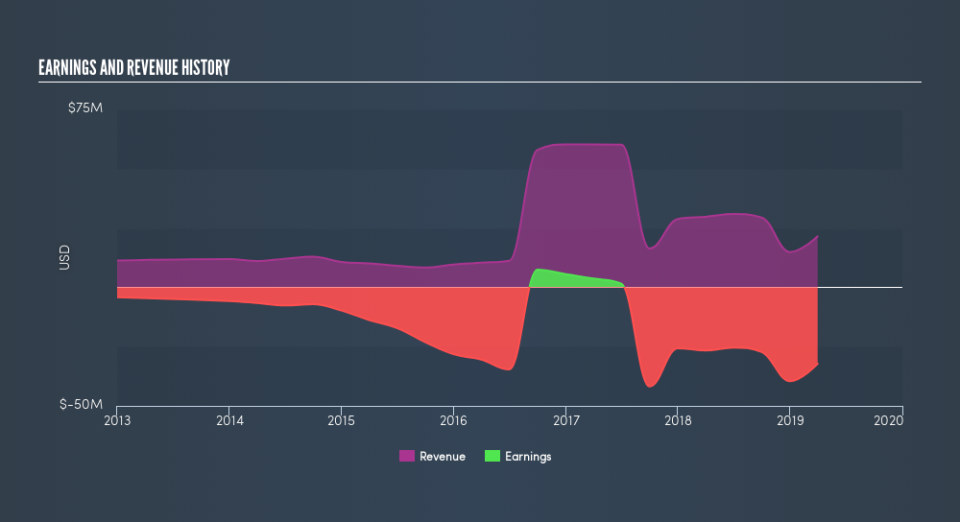

In the last three years Pfenex saw its revenue shrink by 14% per year. That is not a good result. The annual decline of 8.4% per year in that period has clearly disappointed holders. And with no profits, and weak revenue, are you surprised? However, in this kind of situation you can sometimes find opportunity, where sentiment is negative but the company is actually making good progress.

The image below shows how earnings and revenue have tracked over time (if you click on the image you can see greater detail).

We consider it positive that insiders have made significant purchases in the last year. Having said that, most people consider earnings and revenue growth trends to be a more meaningful guide to the business. You can see what analysts are predicting for Pfenex in this interactive graph of future profit estimates.

A Different Perspective

Pfenex provided a TSR of 5.9% over the year. That's fairly close to the broader market return. Most would be happy with a gain, and it helps that the year's return is actually better than the average return over five years, which was 0.6%. Even if the share price growth slows down from here, there's a good chance that this is business worth watching in the long term. Investors who like to make money usually check up on insider purchases, such as the price paid, and total amount bought. You can find out about the insider purchases of Pfenex by clicking this link.

If you like to buy stocks alongside management, then you might just love this free list of companies. (Hint: insiders have been buying them).

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on US exchanges.

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned. Thank you for reading.