Those Who Purchased Studsvik (STO:SVIK) Shares Three Years Ago Have A 54% Loss To Show For It

If you love investing in stocks you're bound to buy some losers. But the last three years have been particularly tough on longer term Studsvik AB (publ) (STO:SVIK) shareholders. Sadly for them, the share price is down 54% in that time. And over the last year the share price fell 33%, so we doubt many shareholders are delighted. Shareholders have had an even rougher run lately, with the share price down 12% in the last 90 days.

See our latest analysis for Studsvik

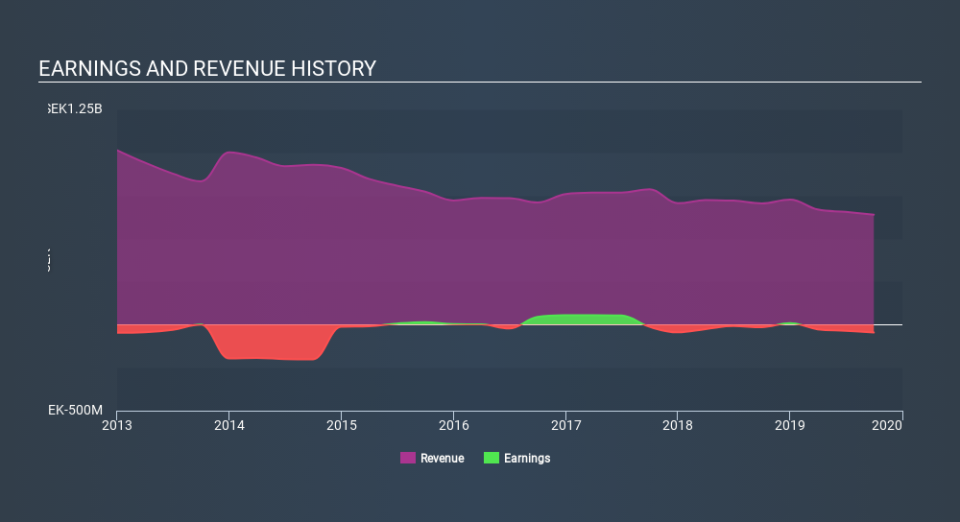

Given that Studsvik didn't make a profit in the last twelve months, we'll focus on revenue growth to form a quick view of its business development. Generally speaking, companies without profits are expected to grow revenue every year, and at a good clip. Some companies are willing to postpone profitability to grow revenue faster, but in that case one does expect good top-line growth.

Over the last three years, Studsvik's revenue dropped 4.9% per year. That is not a good result. With revenue in decline, and profit but a dream, we can understand why the share price has been declining at 23% per year. Having said that, if growth is coming in the future, now may be the low ebb for the company. We don't generally like to own companies that lose money and can't grow revenues. But any company is worth looking at when it makes a maiden profit.

The company's revenue and earnings (over time) are depicted in the image below (click to see the exact numbers).

If you are thinking of buying or selling Studsvik stock, you should check out this FREE detailed report on its balance sheet.

A Different Perspective

Investors in Studsvik had a tough year, with a total loss of 33%, against a market gain of about 28%. However, keep in mind that even the best stocks will sometimes underperform the market over a twelve month period. Unfortunately, last year's performance may indicate unresolved challenges, given that it was worse than the annualised loss of 6.4% over the last half decade. We realise that Buffett has said investors should 'buy when there is blood on the streets', but we caution that investors should first be sure they are buying a high quality businesses. Before spending more time on Studsvik it might be wise to click here to see if insiders have been buying or selling shares.

But note: Studsvik may not be the best stock to buy. So take a peek at this free list of interesting companies with past earnings growth (and further growth forecast).

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on SE exchanges.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned.

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Thank you for reading.