Those Who Purchased Topps Tiles (LON:TPT) Shares Five Years Ago Have A 38% Loss To Show For It

Ideally, your overall portfolio should beat the market average. But the main game is to find enough winners to more than offset the losers So we wouldn't blame long term Topps Tiles Plc (LON:TPT) shareholders for doubting their decision to hold, with the stock down 38% over a half decade. The silver lining is that the stock is up 1.6% in about a week.

View our latest analysis for Topps Tiles

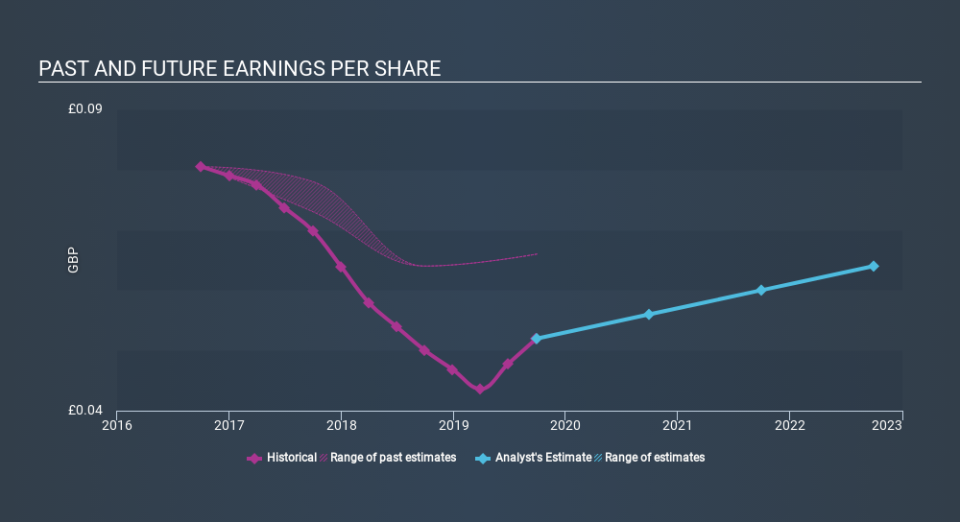

In his essay The Superinvestors of Graham-and-Doddsville Warren Buffett described how share prices do not always rationally reflect the value of a business. One flawed but reasonable way to assess how sentiment around a company has changed is to compare the earnings per share (EPS) with the share price.

During the five years over which the share price declined, Topps Tiles's earnings per share (EPS) dropped by 4.3% each year. Readers should note that the share price has fallen faster than the EPS, at a rate of 9.2% per year, over the period. This implies that the market was previously too optimistic about the stock.

The company's earnings per share (over time) is depicted in the image below (click to see the exact numbers).

It might be well worthwhile taking a look at our free report on Topps Tiles's earnings, revenue and cash flow.

What About Dividends?

As well as measuring the share price return, investors should also consider the total shareholder return (TSR). The TSR is a return calculation that accounts for the value of cash dividends (assuming that any dividend received was reinvested) and the calculated value of any discounted capital raisings and spin-offs. So for companies that pay a generous dividend, the TSR is often a lot higher than the share price return. We note that for Topps Tiles the TSR over the last 5 years was -25%, which is better than the share price return mentioned above. And there's no prize for guessing that the dividend payments largely explain the divergence!

A Different Perspective

It's good to see that Topps Tiles has rewarded shareholders with a total shareholder return of 23% in the last twelve months. And that does include the dividend. There's no doubt those recent returns are much better than the TSR loss of 5.6% per year over five years. This makes us a little wary, but the business might have turned around its fortunes. It's always interesting to track share price performance over the longer term. But to understand Topps Tiles better, we need to consider many other factors. Be aware that Topps Tiles is showing 3 warning signs in our investment analysis , you should know about...

For those who like to find winning investments this free list of growing companies with recent insider purchasing, could be just the ticket.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on GB exchanges.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned.

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Thank you for reading.