How you can get thousands back from the government for buying an EV

(KRON) — In California, the cost of a gallon of regular gas has gone from an average of $5.28 roughly one month ago to $5.97 per gallon, as of this week, according to AAA. As of Wednesday, the Bay Area’s cheapest average price for a gallon is in Santa Clara County at about $5.79 per gallon — the national average is $3.78.

Tired of rising gas prices?

Perhaps you may want to switch to an electric vehicle (EV). The federal government and the state of California are offering thousands of dollars in cash incentives for drivers to switch from a gasoline vehicle to an EV or fuel cell electric vehicle (FCV).

Overview of Government Incentives

The federal government, via the Internal Revenue Service (IRS), is offering up to $7,500 back in your federal tax return for purchasing a battery-powered car. The program is part of the Inflation Reduction Act of 2022, which is a 10-year plan. The maximum tax credit of $7,500 is “likely” to be reduced by Jan. 1, 2024, according to Tesla.

California, via the Clean Vehicle Rebate Project (CVRP), is offering between $1,000 and $7,500 cash rebates for qualified drivers. In addition, the state allocated millions of dollars to its Clean Cars 4 All project to incentivize low-income drivers to go green.

The program is also applicable for used clean-vehicle purchases (see end of the story). Here’s how you can qualify for each program:

How To Receive Federal Tax Credit on EV Purchase

For new EVs or FCVs purchased this year, qualified buyers can receive up to $7,500 back in their tax return that is filed in 2024. You will need to fill out Form 8936 to verify the EV purchase. You may need to know if the vehicle was placed in service before or after April 18, 2023 as tax credits may vary depending on that factor.

Another factor in whether or not you receive the maximum rebate is if the vehicle’s critical parts are domestically produced. For example, if the EV only meets the battery requirement but not the “critical minerals requirement,” the driver may only get $3,750 or half of the maximum rebate.

See which cars are eligible for which specific rebate amount by going to the U.S. Department of Energy’s website. If you’re browsing around in person or online, the link will help determine if that specific vehicle qualifies for the rebate.

Keep in mind, eligible cars cannot have a manufacturer’s suggested retail price (MSRP) exceeding $80,000 for vans, SUVs and pickup trucks. All other vehicles, including sedans, cannot have an MSRP of over $55,000.

“The credit is nonrefundable, so you can’t get back more on the credit than you owe in taxes. You can’t apply any excess credit to future tax years,” the IRS said.

North Bay gas prices shoot up 26 cents overnight

Who Qualifies

Conditions for the federal rebate are also determined by the annual gross income of the buyer of the EV.

For married couples filing jointly, their combined gross income cannot exceed $300,000. That number is $225,000 for heads of households, the IRS said. All other tax filers cannot have an income of over $150,000.

How To Receive Cash Rebate from CA on EV Purchase

California — led by Gov. Gavin Newsom who announced last year that his goal is for the state to have 100% zero-emission vehicles by 2035 — is sponsoring two clean vehicle projects in order to incentivize drivers to go green.

Clean Vehicle Rebate Project

Applicants who want the CVRP rebate should apply soon as funds are “nearly exhausted,” according to its website. The CVRP rebate is not guaranteed — in contrast to the IRS tax credit. A list of qualified vehicles for CVRP’s rebate can be viewed here. Those who lease their vehicles are also eligible to apply.

In addition to EVs, vehicles under CVRP’s program also include plug-in hybrids, hydrogen fuel cell cars and zero-emission motorcycles. Rebates range from $750 to $7,500, according to CVRP’s website.

As of Aug. 15, CVRP said rebate recipients will receive an additional $2,000 EV charging card on top of the $2,000 cash rebate.

For vehicles purchased on Feb. 24, 2022 and later, drivers with the following gross annual income do NOT qualify: $135,000+ for single filers, $175,000+ for head of household and $200,000+ for joint filers.

For information on CVRP’s eligibility and requirements, click here. You will need to provide a number of official documents for your application to be considered.

Clean Cars 4 All

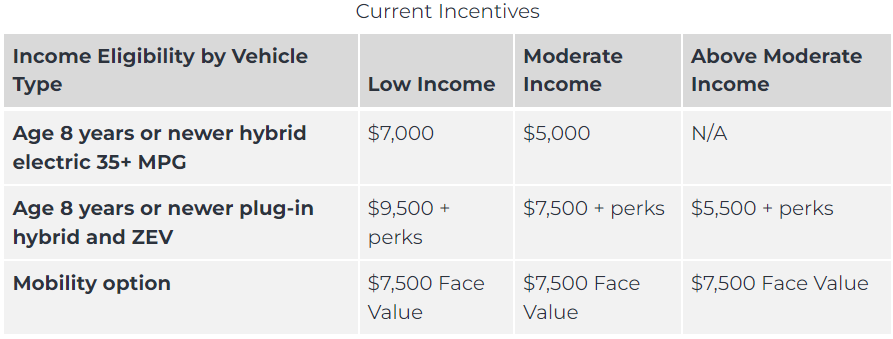

This program is primarily for low-income California residents “near or in disadvantaged communities” to switch to a clean vehicle, which includes EVs and hybrids. California said $436 million was allocated to this program.

To qualify, an individual must have a household income of less than or equal to 400% of the Federal Poverty Level. As defined by the federal government, the poverty guideline for a single person in a household (in 48 states except Hawaii and Alaska) is $13,590, which means 400% of that is equal to $54,360.

More information about the Clean Cars 4 All program can be viewed here.

California Climate Credits to shave some money off of electricity bills

Rebates For Used Vehicles

If you purchase a qualified used EV or FCV after Jan. 1, 2023, you can get a tax credit of up to $4,000. The pre-owned vehicle must cost $25,000 or less and be a model year two years earlier than the calendar year it was purchased. (For example, it must be a model year of 2021 or older if the vehicle was purchased in 2023.)

Just like for new EVs, the IRS tax credit is nonrefundable. The buyer of the vehicle cannot get more on the tax credit than they owe in taxes. Also, the credit cannot applied to future tax years.

“The credit is nonrefundable, so you can’t get back more on the credit than you owe in taxes. You can’t apply any excess credit to future tax years,” the IRS said.

According to the IRS, these are the individuals who qualify,

Be an individual who bought the vehicle for use and not for resale

Not be the original owner

Not be claimed as a dependent on another person’s tax return

Not have claimed another used clean vehicle credit in the 3 years before the purchase date

In addition, single tax filers cannot have an annual gross income exceeding $75,000. The limit for married filing jointly taxpayers is $150,000 and $112,500 for heads of households.

For more information about tax credits for used vehicles purchased in 2023, click here.

Editor’s Note: This article is primarily to inform drivers who are purchasing an EV in 2023. Information on IRS tax credits for new EVs purchased in 2022 or earlier can be viewed HERE.

For the latest news, weather, sports, and streaming video, head to FOX 5 San Diego.