Thousands of Vermonters will lose Medicaid with end of Covid funding

Andy Lindquist is grateful for his Medicaid coverage.

The 28-year-old bookseller and barista lives in Norwich and works at a small business in Hanover, New Hampshire, that doesn't provide health care insurance, and so Lindquist relies on Medicaid for doctor visits and more.

"I've been really lucky, really grateful to have coverage these past few years, especially during the pandemic," Lindquist said. "It's great to get my yearly physical instead of waiting around and stressing, hoping that everything is fine."

There are about 200,000 Vermonters enrolled in Medicaid, representing about one-third of the roughly 600,000 Vermonters who have health insurance, according to Adaline Strumolo, deputy commissioner of the Department of Vermont Health Access. That number is up from about 165,000 Vermonters relying on Medicaid before the pandemic, when the federal government suspended eligibility requirements for the program in 2020 to ensure people had health care coverage throughout the Covid-19 crisis.

Now those eligibility requirements are being reinstated, beginning in April. Over the next 12 to 14 months, about 29,000 Vermonters are expected to lose their Medicaid coverage because they are no longer eligible, according to a December 2022 report from the Urban Institute.

"During the pandemic we had to keep people on Medicaid even if they were no longer eligible," Strumolo said. "This winter the federal government changed its policy. States have to restart eligibility checks. This is returning to normal operations, the same as before the pandemic."

Not taking it lightly

Medicaid is a health insurance program for low-income Americans funded by states along with a federal match, and is administered by the states. Every state program is unique. Eligibility is complicated, but is tied into federal poverty guidelines, as well as factors such as age and disabilities.

The Department of Vermont Health Access will do what it can to renew people using available data, Strumolo said, but if necessary, will contact Medicaid members to gather the data required to check on their eligibility.

"It's not a change about who can be on Medicaid, it's just that we're going back to the processes that were suspended," she said.

Some Vermonters on Medicaid have never had their eligibility re-checked because they were enrolled at the start of the pandemic.

"We don't take that lightly," Strumolo said. " We have no interest in (the resumption of checking eligibility) resulting in coverage losses. It's really important to us to maintain Vermont's high insured rate."

A report issued by the Vermont Department of Health last March showed 97% of Vermonters are covered by health insurance.

Doesn't have a lot of money lying around

Lindquist was able to get gender reaffirming surgery through Medicaid in December 2021, "something that's not available under a lot of others states' Medicaid," they said.

"There's only two or three surgeons who are covered through Vermont (Medicaid)," they said. "They're really good. I didn't have to pay anything for the care itself, which is a huge relief. I just graduated from school. I don't have a lot of money lying around."

If Lindquist does lose Medicaid coverage, their options will be limited to finding a new job that provides health insurance or buying their own policy on Vermont Health Connect, the state's health insurance marketplace.

"A lot of people get critical of Medicaid − you're not working hard enough, you should just get a job where you're covered by your employer," Lindquist said. "It's not that simple. I work really hard. I think I add a lot to my community. I feel like I do everything right and I don't think anybody should feel like they have to (change jobs) to deserve health care. That's not how it should work."

High deductibles, low level of care

If Lindquist does have to change jobs, they may find themselves in a position similar to Anders Aughey, who also works for an employer, in Johnson, who is unable to provide health care. Aughey, 32, was on Medicaid for most of his adult life, up until a few years ago, when he became ineligible.

"I would be eligible, then ineligible, then eligible again," Aughey said. "It was an ordeal giving the right documents, providing the right income verification. I was hovering around the income limit."

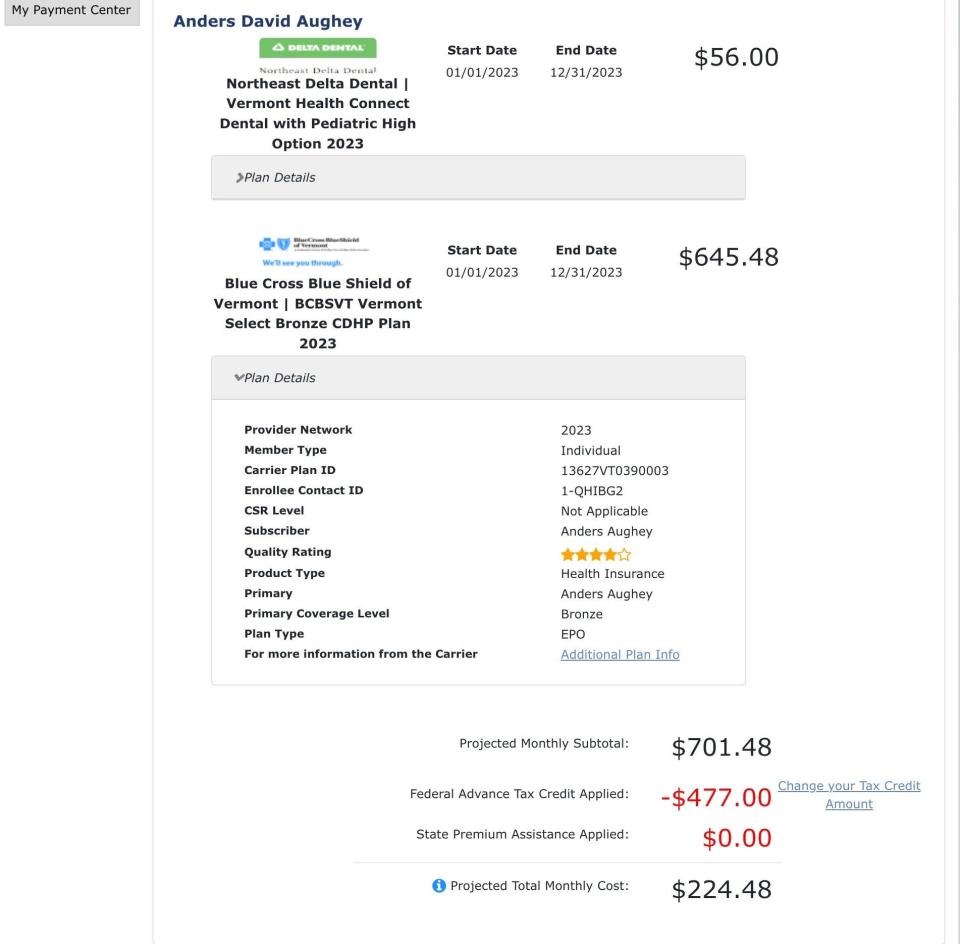

Aughey finally decided not to try for Medicaid any longer and just get a plan on Vermont Health Connect. The result has been less than satisfactory, according to Aughey.

"My experience is I'm paying a lot of premiums for coverage I can't use because the deductible is so high," Aughey said.

Aughey's deductible on his bronze-level plan with Blue Cross Blue Shield of Vermont is $7,150. His premium is $645.48 per month. Dental coverage with Northeast Delta Dental adds $56 per month for a total monthly premium of $701.48. Aughey receives a federal advance tax credit of $477 per month, reducing his monthly premium to $224. 48.

"I feel like I'm not insured because I don't want to go to the doctor or get a prescription and pay hundreds of dollars out of pocket in addition to my premium," Aughey said. "I can't afford that. I keep having health insurance in case of the worst case scenario − I get cancer or get in a car accident − but it's not really working for me."

'We were really scared'

Strumolo said there are federal subsidies to reduce the premiums on Vermont Health Connect insurance plans. Those subsidies are currently set to expire in 2026. Originally the subsidies were slated to end this year, which would have coincided with the restart of eligibility renewals for Medicaid − a one-two punch for low-income Vermonters.

"We were really scared," Strumolo said. "We were really pleased the (premium subsidies) were extended through 2025."

Aughey said he misses having Medicaid coverage.

"My health care was better when I was on Medicaid, and I spent less time navigating my options and having to wonder what things would cost," he said.

Aughey believes expanded Medicaid would save Vermont health care dollars in the long run, "because people like me would be able to access preventative care and end up costing less down the road."

"With Medicaid I went to the doctor all the time," Aughey said. "I feel like I had good access to health services and good care, and I just stopped going (without Medicaid). As I age I'm starting to notice more health needs."

Aughey has asthma and said it has gotten a lot worse in the last two years. He said he paid $89 for a "two-minute conversation" on telehealth, asking for a prescription for an inhaler. He paid another $64 for medication.

"It would have been $3 with Medicaid," Aughey said.

Contact Dan D’Ambrosio at 660-1841 or ddambrosio@freepressmedia.com. Follow him on Twitter @DanDambrosioVT. This coverage is only possible with support from our readers.

This article originally appeared on Burlington Free Press: Many Vermonters will lose Medicaid coverage as Covid funding dries up