Three Things You Should Check Before Buying Adval Tech Holding AG (VTX:ADVN) For Its Dividend

Want to participate in a short research study? Help shape the future of investing tools and you could win a $250 gift card!

Could Adval Tech Holding AG (VTX:ADVN) be an attractive dividend share to own for the long haul? Investors are often drawn to strong companies with the idea of reinvesting the dividends. On the other hand, investors have been known to buy a stock because of its yield, and then lose money if the company's dividend doesn't live up to expectations.

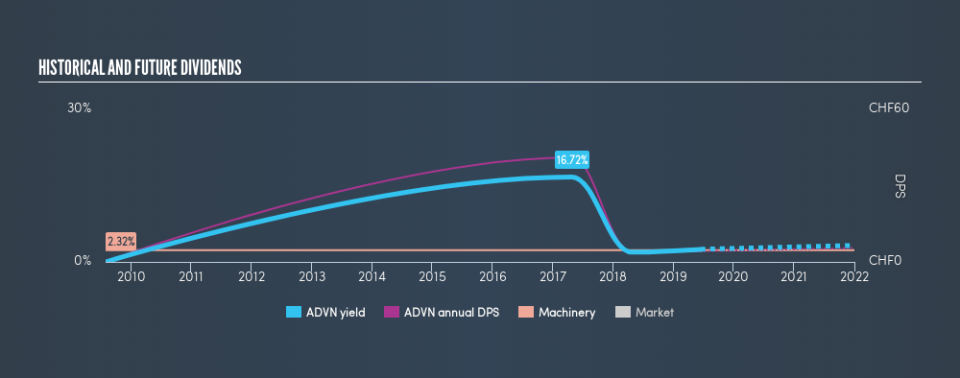

Some readers mightn't know much about Adval Tech Holding's 2.5% dividend, as it has only been paying distributions for the last two years. While it may not look like much, if earnings are growing it could become quite interesting. Some simple analysis can reduce the risk of holding Adval Tech Holding for its dividend, and we'll focus on the most important aspects below.

Click the interactive chart for our full dividend analysis

Payout ratios

Companies (usually) pay dividends out of their earnings. If a company is paying more than it earns, the dividend might have to be cut. Comparing dividend payments to a company's net profit after tax is a simple way of reality-checking whether a dividend is sustainable. Looking at the data, we can see that 35% of Adval Tech Holding's profits were paid out as dividends in the last 12 months. This is a middling range that strikes a nice balance between paying dividends to shareholders, and retaining enough earnings to invest in future growth. One of the risks is that management reinvests the retained capital poorly instead of paying a higher dividend.

Another important check we do is to see if the free cash flow generated is sufficient to pay the dividend. Adval Tech Holding paid out 91% of its free cash last year. Cash flows can be lumpy, but this dividend was not well covered by cash flow. Adval Tech Holding paid out less in dividends than it reported in profits, but unfortunately it didn't generate enough free cash flow to cover the dividend. Were it to repeatedly pay dividends that were not well covered by cash flow, this could be a risk to Adval Tech Holding's ability to maintain its dividend.

Consider getting our latest analysis on Adval Tech Holding's financial position here.

Dividend Volatility

Before buying a stock for its income, we want to see if the dividends have been stable in the past, and if the company has a track record of maintaining its dividend. This company's dividend has been unstable, and with a relatively short history, we think it's a little soon to draw strong conclusions about its long term dividend potential. During the past two-year period, the first annual payment was CHF41.00 in 2017, compared to CHF4.20 last year. As we can see, dividend payments have fallen heavily from where they were two years ago.

A shrinking dividend over a two-year period is not ideal, and we'd be concerned about investing in a dividend stock that lacks a solid record of growing dividends per share.

Dividend Growth Potential

With a relatively unstable dividend, and a poor history of shrinking dividends, it's even more important to see if EPS are growing. Strong earnings per share (EPS) growth might encourage our interest in the company despite fluctuating dividends, which is why it's great to see Adval Tech Holding has grown its earnings per share at 55% per annum over the past five years. With high earnings per share growth in recent times and a modest payout ratio, we think this is an attractive combination if earnings can be reinvested to generate further growth.

Conclusion

Dividend investors should always want to know if a) a company's dividends are affordable, b) if there is a track record of consistent payments, and c) if the dividend is capable of growing. Firstly, the company has a conservative payout ratio, although we'd note that its cashflow in the past year was substantially lower than its reported profit. Next, earnings growth has been good, but unfortunately the dividend has been cut at least once in the past. While we're not hugely bearish on it, overall we think there are potentially better dividend stocks than Adval Tech Holding out there.

You can also discover whether shareholders are aligned with insider interests by checking our visualisation of insider shareholdings and trades in Adval Tech Holding stock.

We have also put together a list of global stocks with a market capitalisation above $1bn and yielding more 3%.

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned. Thank you for reading.