Three things to know about taxes in Oklahoma as Gov. Stitt calls special session

- Oops!Something went wrong.Please try again later.

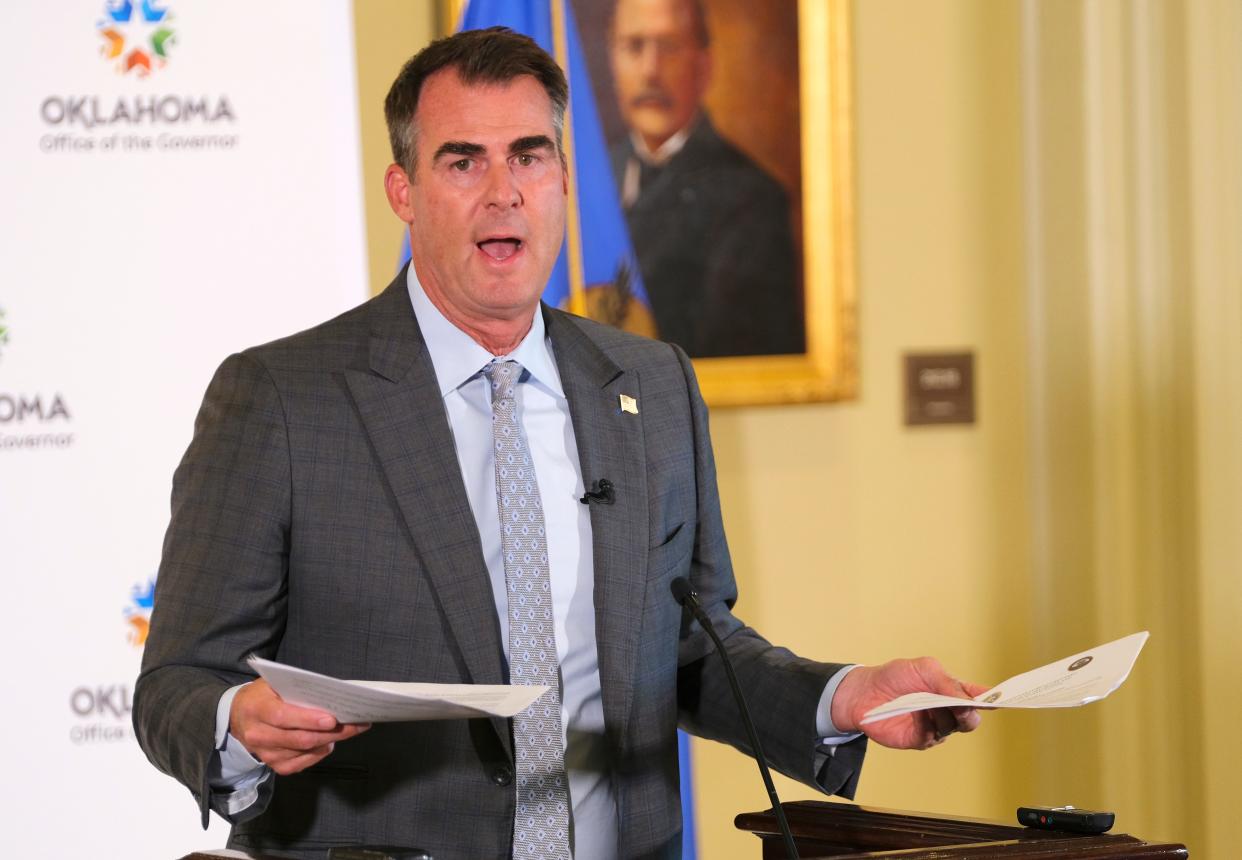

Governor Kevin Stitt’s call on Tuesday to bring the state Legislature into special session in October addressed several areas – the biggest, however, was taxes.

In his executive order, Stitt called on state lawmakers to “deliver Oklahomans a personal state income tax cut – one that puts the state on a pathway to zero personal state income taxes.”

Here are some key facts related to the governor's request.

How much do Oklahomans pay in income taxes? How much revenue does it bring in?

An Oklahoman making $70,000 per year paid about $10,055 in state and federal taxes in 2022, according to an analysis by Forbes Magazine. That means about $2,787 in state tax and $8,168 in federal tax.

The income tax generated $5,777,865,116 for the state for the 2021-2022 tax year, the Oklahoma Tax commission said. Of that amount, $808,332,385.45 was refunded, leaving the state with a net income tax revenue of $4,969,523,730.69

Oklahoma has a graduated personal income tax rate which ranges from 0.25 percent to 4.75 percent. The state’s corporate income tax rate is 4% and the state sales tax rate is 4.57%. The Tax Foundation, a Washington D.C. think tank, ranked Oklahoma's tax burden at 10th in the country for 2022.

Can Oklahoma afford to cut taxes?

Maybe. But it appears that the state’s economy is showing signs of slowing down.

Last week, State Treasurer Todd Russ released the August revenue report showing gross state tax receipts for August 2023 declined by $121.8 million – almost 9 percent – from August 2022.

More: Gov. Kevin Stitt calls special legislative session in October to address three proposals

In addition, personal income tax revenue declined by $96 million to $745.7 million in revenue from August 2022 to this year.

If income taxes are cut, would property taxes and other taxes go up?

The answer is mixed. In Oklahoma, as in many states, property taxes are set at the local level, not by the state legislature. Unlike other states, Oklahoma's constitution requires tax increases to be approved either by a 75% majority of the legislature or by a vote of the people -- a high bar to overcome. It is exactly for this reason that some legislators have expressed a reluctance to cut taxes if future revenues are uncertain.

This article originally appeared on Oklahoman: What happens if Oklahoma income tax is reduced as Gov. Stitt proposed?