Thurston school districts are asking voters to OK levies Feb. 13. Here’s what’s at stake

Ballots should be arriving in the mail for the Feb. 13 special election, and every school district in Thurston County is asking voters to approve school property tax levies.

North Thurston, Olympia and Tumwater school districts, plus the six smaller districts in the county, all have measures on the ballot to renew their expiring Educational Programs and Operations levy. Even with the state’s reworking of school financing a few years ago, those levies still provide a substantial part of districts’ operating budgets that fund staff and educational programs.

The levies are not a new tax, but would replace expiring four-year levies that voters approved in 2020. The estimated minimum tax rate would be $2.50 per $1,000 of assessed property value, but the final amount varies by district.

North Thurston Public Schools

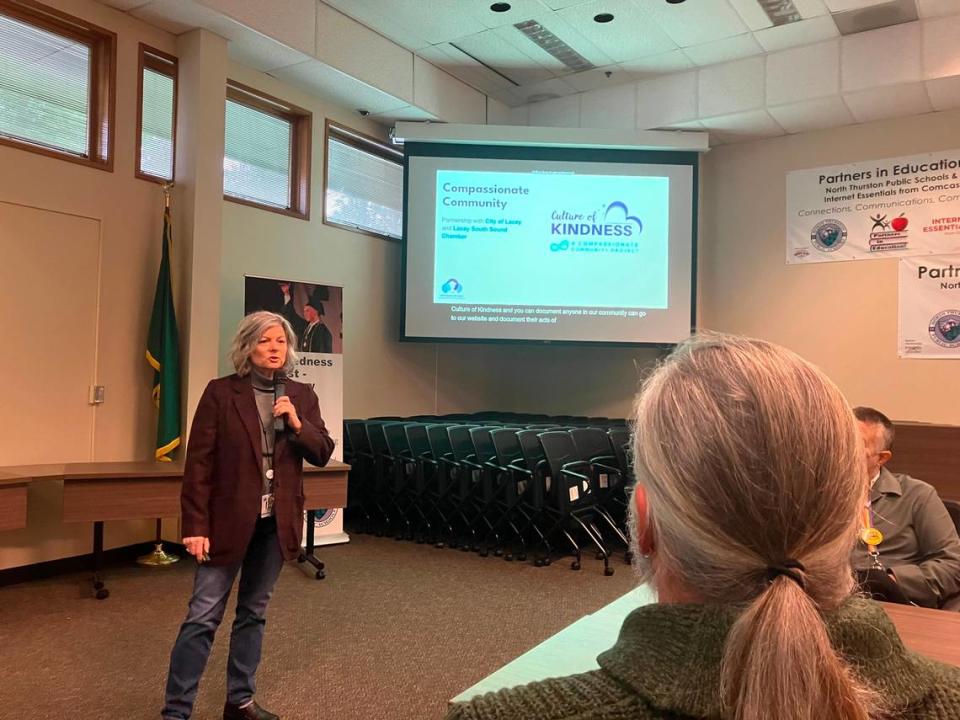

Not only are the North Thurston Public Schools asking residents to approve a four-year replacement levy, but also to support a new four-year capital levy to fund safety, technology and facility improvements throughout the district, said Superintendent Debra Clemens, who addressed a community gathering earlier this month at the district office in Lacey.

The EP&O replacement levy funds the shortfall between the cost of services for students and what the state provides in funding, she said. If approved by voters, the levy would raise around $50 million a year for special education, arts and athletic programs, mental health and nutrition services, transportation and school nurses.

North Thurston, the largest district in the county, serves almost 10,000 meals a day, Clemens said.

The new capital levy, which would collect an additional 77 cents per $1,000 of assessed property value, is projected to raise $18.1 million a year that would be used to improve parent drop-off and pick-up sites at Mountain View, Seven Oaks, Lydia Hawk and Woodland elementary schools, and replace roofs, including at South Sound Stadium, and sewer systems at some schools, plus expand pre-school programs and replace kitchen equipment.

The capital levy also would be used to upgrade security video systems and cameras, and improve WiFi at some schools that have internet “dead spots,” said Heather Larson, the district’s executive director of financial services.

But what if the levies don’t pass?

The district has a balanced budget for the 2023-24 school year, including what the district calls a “fiscally responsible reserve balance.”

However, if the EP&O levy does not pass, the district “would need to identify cuts to educational programs and services,” district spokeswoman Amy Blondin said.

About 60% of the EP&O levy dollars go toward basic education enhancements, such as teachers, mental health support staff and supplies. About 20% goes toward special education, according to district data.

And if the capital levy doesn’t pass, none of the aforementioned investments will happen, Blondin said.

“We would not be able to invest in a new district-wide security system, could not make repairs and upgrades at many schools around the district, such as new sewer systems and student dropoff/pickup improvements, and could not expand high-quality preschool opportunities to meet community need,” she said.

Schools get the lion’s share of property taxes collected by the county. If voters approve both levies Feb. 13, the total cost to a property owner in the district will be $5.12 per $1,000 of assessed property value, or just under $1,800 a year for a home with a median value of $350,900, according to district information. That amount includes a previously approved bond issue.

Isn’t that home value low? Larson says it’s the median value within district boundaries, which includes Lacey and parts of the county, she said. The countywide home price median is higher, she said.

Check your mailbox: The district has released a mailer about the upcoming election, and the Thurston County Auditor’s Office announced Friday that voters’ pamphlets are in the mail. Ballots were to be mailed Wednesday, Jan. 24.

Olympia School District

In Olympia, the replacement levy would collect an estimated $177.3 million over four years. It’s broken down as $39.4 million in 2025, $42.5 million in 2026, $45.9 million in 2027 and $49.5 million in 2028.

The Olympia School District uses the levy funds for the same reasons North Thurston does, and more. The funds would be used to help pay for middle and high school athletics and activities, transportation outside the basic school day, special education, visual and performing arts programs, staff professional development and other maintenance and operations.

In an interview, Olympia Superintendent Patrick Murphy broke down the reason district’s need local levies to fund basic education needs. He said it goes back to the decision made in the 2012 lawsuit McCleary v. Washington.

In short, the lawsuit was filed on behalf of two families against the state of Washington for failing to meet its constitutional obligation to amply fund basic education. A King County Superior Court judge sided with the families, and it was upheld by the state Supreme Court. In 2013, the state Legislature raised school funding 11.4% to $15.2 billion to comply with the court order.

However, the state also put new limits on local school district levies and raised state taxes to pay for the McCleary decision. This change had wide and varying impacts, negatively affecting many districts that had higher levies, including Olympia and Tumwater.

With an operating budget of $175 million, Murphy said the local levy historically provided the Olympia district with nearly 25% of the total. With the shift in funding from the state, local jurisdictions had to lower the amount of property taxes they were able to collect from residents. Now Olympia can collect only around 13% of its total budget from residents.

Murphy said the state also removed staff experience from the calculations for how much state funding a district would receive. The state now bases funding off a statewide average. He said if you’re a district that has predominantly newer teachers, you benefited. But if your district has veteran teachers, like Olympia, the district lost money.

“Olympia is a school district where, if you’ve ever gone around and met our schools, we have like 600 teachers in the school district, a lot of them went to school here,” he said. “They went to university and came back and worked here. And once they get a job here, they stay here. And the fact of the matter is, a 25-year veteran teacher costs a lot more than a first- or second-year teacher, just because of the experience that they have.”

The state’s teacher salary schedule takes into account years of service and education attained.

Murphy said there’s more work to be done at the legislative level to fully fund special education services as well. He said it’s federally required that states provide full funding for special education services, and groups in Washington have argued the state isn’t doing its duty, leaving individual school districts to fill the funding gap.

He said many believed a lawsuit over special education funding would be filed before the McCleary lawsuit, but it never came. Murphy said the state claimed the McCleary decision solved the problem, but potential for a lawsuit still lingered. Then the COVID-19 pandemic happened and federal funding put everything out of order.

As a result, Olympia must subsidize state special education funding with the local levy. Murphy said $10 million a year, or about 29% of the levy funds, go toward special education.

“(The replacement levies) are not enhancements. It’s not extra frills,” Murphy said. “It’s the basic needs that I think our community and our staff need and students expect in our schools.”

Murphy said the amount the district can collect from residents is limited to $2.50 per $1,000 of assessed value, or $2,500 per pupil. He said the property tax rates for the levy were estimated to be $1.93 per $1,000 of assessed value in 2023, and if the measure is approved next month, it could go back up to the full $2.50.

OSD spokesperson Susan Gifford said the district uses the county’s median home value of $500,000 to calculate how much taxes will be collected. She said with that median home value, taxes payable will go from $965 to $1,250 per year, an increase of $285 annually.

Tumwater School District

In Tumwater, the levy would collect $109 million over four years. The Tumwater levy would help the school district pay for staffing, school health and safety, special education, STEM programs, enrichment activities and athletics.

According to the district’s website, the state provides funds for the district to employ 270 teachers, but Tumwater has 342. The state provides funding for 11 general education paraprofessionals, but the district has more than 100 for general and special education programs. Those additional positions are at risk if the levy doesn’t pass.

Combined with Tumwater’s current bonds and the Capital Facilities Levy, Tumwater residents should expect to pay $4 per $1,000 of assessed value in 2025 and 2026. The rate will drop to under $3.50 per $1,000 of assessed value in 2027 and 2028.

Spokesperson Laurie Wiedenmeyer said the average assessed value for a single-family home in Tumwater in 2023 was $391,147. The replacement EP&O levy would allow the city to collect up to $2.50 per $1,000 of assessed value, which would be about $977.87 a year from 2025 to 2028. That being said, with the levy lid that is in place, Tumwater is currently collecting $2.13 per $1,000 and does not expect that lid will change. If the lid remains, collection would be $833.14 a year.

Need more information?

North Thurston has one last community meeting planned to explain and field questions about the special election. Community meetings were not planned for the Olympia and Tumwater school districts.

The last North Thurston meeting is from 5:30-6:30 p.m. Tuesday, Jan. 30, in the Timberline High School library, 6120 Mullen Road SE.