The Ticking Debt Clock

- Oops!Something went wrong.Please try again later.

- Oops!Something went wrong.Please try again later.

- Oops!Something went wrong.Please try again later.

- Oops!Something went wrong.Please try again later.

- Oops!Something went wrong.Please try again later.

- Oops!Something went wrong.Please try again later.

- Oops!Something went wrong.Please try again later.

- Oops!Something went wrong.Please try again later.

From the The Morning Dispatch on The Dispatch

Happy Wednesday! Are you financially stable and looking for love this Valentine’s Day? Score, a new dating app open only to those with excellent credit ratings, will help you find a partner worth investing in!

And just in case you’re looking for a last-minute gift idea because there are no flowers left at your local CVS … we think we have a suggestion worth investing in, too.

Quick Hits: Today’s Top Stories

A coalition government in Pakistan was formed on Tuesday, after elections last week failed to give one party a ruling majority. The parties that received the second- and third-most votes—the Pakistan Muslim League (PMLN) and Pakistan Peoples Party (PPP), respectively—will support consensus choice Shehbaz Sharif, the brother of PMLN candidate and three-time former Prime Minister Nawaz Sharif. “Forget and forgive; forgive and forget—come let’s join hands for the betterment of the country,” Shehbaz Sharif said yesterday, hoping to move Pakistan beyond protests that erupted over the weekend over charges of a rigged election. The coalition will not include representation from independent candidates aligned with jailed former Prime Minister Imran Khan’s Pakistan Tehreek-e-Insaf (PTI) party, which won the most seats in the election. Khan said yesterday that PTI-aligned members will not sit with either party.

In the chamber’s second attempt to do so in recent days, the House of Representatives voted 214-213 on Tuesday evening to impeach Secretary of Homeland Security Alejandro Mayorkas, marking the first time a Cabinet secretary has been impeached since 1876. Three Republicans—Rep. Ken Buck of Colorado, Rep. Mike Gallagher of Wisconsin, and Rep. Tom McClintock of California—once again joined with all Democrats to vote against impeachment, but Majority Leader Steve Scalise returned from cancer treatment Tuesday morning to cast the deciding vote. “There are two primary grounds justifying this historic act by Congress. First, Mr. Mayorkas willfully refused to comply with the law, blatantly disregarding numerous provisions of the Immigration and Nationality Act,” Rep. Mark Green, chairman of the House Homeland Security Committee, wrote in an op-ed published in the Wall Street Journal last night. “Second, Mr. Mayorkas breached the public trust, both by violating his statutory duty to control the border and by knowingly making false statements to Congress.” The articles of impeachment will next be delivered to the Senate, where Mayorkas will stand trial and is unlikely to be convicted by a Democratic majority. “History will not look kindly on House Republicans for their blatant act of unconstitutional partisanship that has targeted an honorable public servant in order to play petty political games,” President Joe Biden said in a statement released last night.

The Supreme Court on Tuesday gave special counsel Jack Smith one week to respond to former President Donald Trump’s emergency request to pause the case regarding his attempts to overturn the 2020 election while his legal team appeals the claim that he is immune from criminal charges. A three-judge panel on the D.C. Circuit Court of Appeals last week unanimously rejected Trump’s argument that he cannot be charged in relation to his actions on January 6, 2021, because of his presidential immunity.

The Consumer Price Index rose 0.3 percent month-over-month and 3.1 percent annually in January, the Bureau of Labor Statistics reported Tuesday, up from 0.2 percent and down from 3.4 percent in December, respectively—and slightly above economists’ expectations. High housing costs were one of the largest factors in the report, and stocks tumbled yesterday as the data seemed to increase the odds that the Federal Reserve will hold interest rates steady at its meeting next month rather than beginning to lower them.

Defense Secretary Lloyd Austin was released from Walter Reed Military Medical Center on Tuesday, resuming duties remotely as he recovers at home. Austin entered the hospital on February 11 after experiencing “discomfort and concern from a bladder issue related to his December 2023 prostate cancer surgery,” according to a statement released by his doctors, who noted that the bladder issue should have “no effect on his excellent cancer prognosis.”

Former Democratic Rep. Tom Suozzi was projected to win a special election in New York on Tuesday night, defeating Republican Mazi Pilip by approximately 8 percentage points to flip the seat of former GOP Rep. George Santos following his expulsion. The victory will further narrow Republicans’ slim majority in the House for the remainder of the year. In another special election last night, Pennsylvania Democrats were able to maintain their slim majority in the state House after winning an open seat in the 140th state House District, which includes the northern Philadelphia suburbs of Bucks County.

Where Have All the Deficit Hawks Gone?

“We just heard, about an hour ago, that our government eclipsed the $16 trillion amount in our national debt,” then-vice presidential candidate Paul Ryan told supporters at an Iowa campaign stop in September 2012. “This is a serious threat to our economy.” Ryan’s running mate, Mitt Romney, made federal spending and debt one of his campaign’s central issues—even delivering stump speeches with a running national debt clock on stage behind him while he spoke.

Looking back, 2012 may have been the high-water mark for political interest in addressing America’s debt. A dozen years later, that $16 trillion has ballooned to more than $34 trillion, and there appears to be little appetite in either party to slow that trend, let alone reverse it. But economists warn that the current fiscal trajectory—made painfully clear in last week’s Congressional Budget Office (CBO) 10-year budget and economic outlook—could soon begin imposing the economic costs that the deficit hawks of yesteryear warned of.

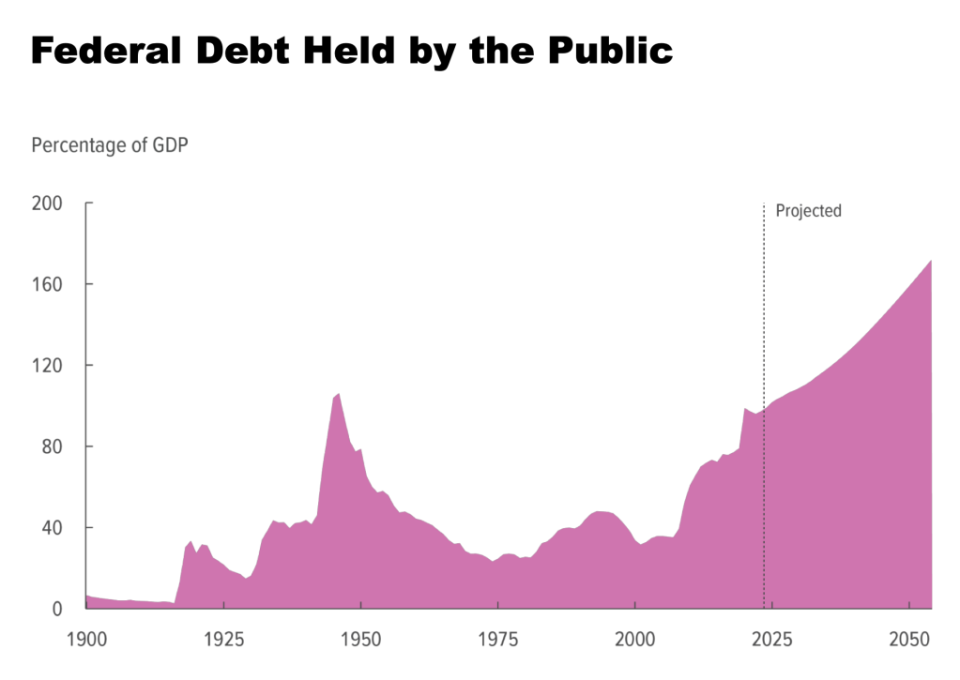

Though $34 trillion is quite a sum, the more relevant number is publicly held debt—the portion of the debt excluding intragovernmental debt, or the money the government owes itself—which stands at $27 trillion. The CBO projects that between 2024 and 2034, public debt will balloon to $48 trillion and the annual budget deficit will grow from $1.6 trillion to $2.6 trillion. (In fiscal year 2019, the deficit was $984 billion.) According to the report, the deficit as a percentage of gross domestic product (GDP) will grow to 6.1 percent in 2025—a figure that, since the Great Depression, has only been exceeded during times of crisis: “during and shortly after World War II, the 2007–2009 financial crisis, and the coronavirus pandemic.” By 2034, public debt will reflect a larger portion of the economy, 116 percent of GDP, than at any point in American history, leapfrogging the record high of 106 percent during World War II. Extending the projections out an additional 20 years shows that the debt-to-GDP ratio would be 172 percent in 2054.

Rising interest rates have contributed to the sharp increase in the deficit and the cost of servicing the debt. “Net interest costs are a major contributor to the deficit, and their growth is equal to about three-quarters of the increase in the deficit from 2024 to 2034,” CBO Director Phillip Swagel said in a statement last week. This fiscal year, interest costs will be higher than discretionary defense spending, and in 2025, interest costs are expected to exceed what the government will spend on total non-defense discretionary spending.

There was some less-gloomy news in the report. The spending agreement negotiated between President Joe Biden and former House Speaker Kevin McCarthy last spring, the Fiscal Responsibility Act, along with the continued reduced discretionary spending from last year’s continuing resolutions, decreased the CBO’s 10-year deficit projections by a cumulative $1.4 trillion (about 7 percent). Still, the non-partisan agency’s report is likely painting a rosier picture than reality, as the agency is legally required to make projections based on current law. Parts of the Tax Cuts and Jobs Act, passed by former President Donald Trump in 2017, are set to expire at the end of this year. “Everybody assumes that some share of [those cuts] are going to be made permanent, probably without offset,” Ben Ritz, director of the Center for Funding America’s Future at the Progressive Policy Institute, told TMD. “That means the reality is likely to be worse than CBO’s projections.” The beefed-up Affordable Care Act subsidies extended through the Inflation Reduction Act are also technically set to expire at the end of the year but, if made permanent, would further worsen the deficit.

“I don’t think it’s a stretch to say that CBO’s numbers are probably more of a best-case than a worst-case scenario,” Ritz added.

A change in interest rates could also significantly alter the projections, for better or worse. “We have a pretty moderate path of interest rates,” Swagel told CNBC last week. “It could go in either direction, but higher interest rates, given the mounting debt, would mean a much larger deficit in the near term.” CBO projects that the average interest rate on public debt will rise to 3.5 percent over the next decade, but because of the size of the debt, even small changes to the rate could have a huge effect on the interest costs.

“Every percentage point that interest rates go higher adds $2.8 trillion over the decade and $30 trillion over 30 years in interest costs,” said Brian Riedl, a Dispatch contributor, Manhattan Institute senior fellow, and erstwhile chief economist to former Republican Sen. Rob Portman of Ohio. “That’s the equivalent of adding an additional Defense Department. That’s just for one point. If interest rates go up to five-and-a-half [percent] instead of three-and-a-half, you get $5.6 trillion over the decade and $60 trillion over 30 years.”

What are the actual consequences of such increases to the debt and deficit? The long-term risk is a fiscal crisis in which the deficit becomes so large that investors lose confidence in the government as a borrower and are no longer willing to lend it money—or require much higher interest rates to compensate for the riskier investment. Either outcome could lead to the U.S. defaulting on its debt obligations—a scenario viewed by most economists as catastrophic for the global economy. No one knows what deficit level would trigger such a crisis. “It has the potential to materialize suddenly, without warning, or at least, at [a] point we wouldn’t be able to really do anything about it,” Ritz said.

Observers argue that, while a fiscal crisis isn’t necessarily imminent, the U.S. is approaching a point where, if nothing is done, a crisis could become inevitable. “The next 10 years are critical not because a debt crisis is guaranteed in the next 10 years, but [because] any plausible way to avoid a debt crisis really needs to get started in the next 10 years,” Riedl told TMD. The University of Pennsylvania Wharton School budget model estimated in the fall that “financial markets cannot sustain more than the next 20 years of accumulated deficits.”

The medium-term consequences of rising deficits, though not catastrophic, will be painful. “In the best-case scenario, you continue on this path, you’re wasting resources on debt service, you’re crowding out resources for the government and the broader private economy, and you’re slowing growth over the long run,” Ritz told TMD. More government borrowing puts upward pressure on inflation, often leading to higher interest rates, making private access to credit and capital more costly, which in turn can slow growth. Today’s (relatively) high interest rates are largely due to the Federal Reserve’s response to inflation, driven in part by government spending.

These medium-term risks have prompted a marked about-face among many left-leaning economists and analysts who have long favored deficit spending and argued it was relatively risk free. “We had 15 years of low interest rates,” Marc Goldwein, the senior policy director for the Committee for a Responsible Federal Budget, told TMD. “That got a lot of people looking at this and saying, ‘Well, maybe we have been worried for nothing.’” While a small contingent of progressive economists still maintain that the deficit is a construct and lawmakers shouldn’t be worried, some liberal economists are more concerned than they’ve been for years. “I spent a large part of the past 15 years inveighing against the deficit scolds,” economist Paul Krugman wrote in his New York Times column in October. “Serious deficit reduction, a bad idea a decade ago, is a good idea now.” Bloomberg columnist Matt Yglesias argued this fall that a decade ago, “there was no urgent reason to have a debate about ways to reduce federal borrowing,” but “now the situation is transformed in every respect.” This summer, Annie Lowrey, an economics writer for The Atlantic, published a piece that summed up the awakening: “It Turns Out That the Debt Matters After All.”

But the shift in conversation comes as leaders in both parties seem committed to not addressing the biggest debt drivers—namely, entitlement spending and tax cuts. “I’m not optimistic that Congress is going to do much of anything in the next decade to address these programs until we have a fiscal crisis,” Riedl argued. “The political will just is not there.” There has been some recent movement on a congressional fiscal commission: The House Budget Committee advanced legislation last month to create a bipartisan panel made up of an equal number of senators and representatives from both parties and tasked with developing legislative recommendations to reduce debt and deficits.

“I’m very excited about the possibility there’s going to be another fiscal commission,” Goldwein, who worked on the Simpson-Bowles commission in 2010, told TMD. “Those aren’t guaranteed success, but they increase your odds a pretty good amount.”

But Riedl, a veteran of the 2011 congressional “super committee” on deficit reduction, believes the chances of success for a commission are low absent unified buy-in from the White House and both parties’ leadership. “Even if Congress can cobble together the votes to create a fiscal commission,” he said, “I do not see the bipartisan commitment to actually negotiating a painful compromise for both sides and pushing it through. I hope I’m wrong.”

Worth Your Time

In an interview with Politico Magazine, John Bolton—who served as national security adviser to former President Donald Trump—explained why he takes Trump’s anti-NATO rhetoric gravely seriously, and why he believes voters should, too. “If they want to secure a country, having alliances that help reinforce our power around the world is critical,” he told Politico’s Kelly Garrity. “You know, the world doesn’t have a natural order. And what order there is, is basically supplied by the United States and its alliances. We’re not doing that out of charity. We’re doing it because it’s in our national interest, to have trade and investment and everything that goes with the world that’s not threatened by hostile, belligerent, aggressive nations. It’s true that probably most allies are free-riding to an extent on U.S. power—and they should pay more. But the answer when they don’t is not to cut off your nose to spite your face.”

Presented Without Comment

NBC News: ‘Antisemitic Writings’ Found in Search of Joel Osteen Megachurch Shooter’s Items

Also Presented Without Comment

CBS News: Nikki Haley Says President Can’t Be Someone Who “Mocks Our Men and Women Who Are Trying to Protect America”

Toeing the Company Line

What should we make of the efforts to reshape the Republican National Committee and Tucker Carlson’s visit to Moscow? How did your Dispatchers react to the breaking news that Homeland Security Secretary Alejandro Mayorkas was impeached? Mike was joined by John, David, Alex, Grayson, and Mary to discuss all that and more on last night’s Dispatch Live (🔒). Members who missed the conversation can catch a rerun, either video or audio-only, by clicking here.

In the newsletters: Nick weighed (🔒) the price of acquittal for the GOP three years after Republican senators voted against convicting former President Donald Trump in his second impeachment trial.

On the podcasts: On the latest episode of The Remnant, Jonah interviewed scholars Hyrum and Verlan Lewis about their book, The Myth of Left and Right, which argues those generalized political labels are undermining sophisticated political discourse. And on The Skiff (🔒), associate editor Luis Parrales kicked off a debate series by moderating a conversation between Kevin Corinth of the American Enterprise Institute and Patrick T. Brown of the Ethics and Public Policy Center on the merits of a proposal to expand the Child Tax Credit.

On the site today: Kevin compares Tucker Carlson’s recent jaunt to Russia to Walter Duranty, Kristie De Peña explains how much President Joe Biden can actually do on immigration without congressional action, and Alexandra Hudson pens a Valentine’s Day essay arguing politics shouldn’t play nearly as big a role in romance as it does.

Let Us Know

What do you think it will take for policymakers to get serious about the national debt—if they ever will?