The TIE Kinetix (AMS:TIE) Share Price Is Down 18% So Some Shareholders Are Getting Worried

This week we saw the TIE Kinetix N.V. (AMS:TIE) share price climb by 15%. But that doesn't change the fact that the returns over the last three years have been less than pleasing. After all, the share price is down 18% in the last three years, significantly under-performing the market.

View our latest analysis for TIE Kinetix

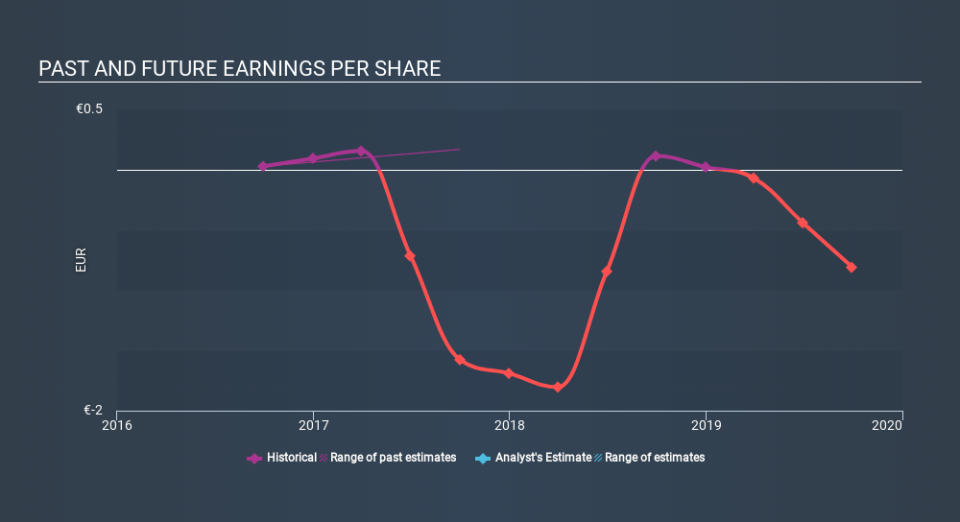

To quote Buffett, 'Ships will sail around the world but the Flat Earth Society will flourish. There will continue to be wide discrepancies between price and value in the marketplace...' By comparing earnings per share (EPS) and share price changes over time, we can get a feel for how investor attitudes to a company have morphed over time.

Over the three years that the share price declined, TIE Kinetix's earnings per share (EPS) dropped significantly, falling to a loss. Since the company has fallen to a loss making position, it's hard to compare the change in EPS with the share price change. However, we can say we'd expect to see a falling share price in this scenario.

The image below shows how EPS has tracked over time (if you click on the image you can see greater detail).

It might be well worthwhile taking a look at our free report on TIE Kinetix's earnings, revenue and cash flow.

A Different Perspective

TIE Kinetix provided a TSR of 11% over the last twelve months. Unfortunately this falls short of the market return. On the bright side, that's still a gain, and it's actually better than the average return of 3.3% over half a decade This could indicate that the company is winning over new investors, as it pursues its strategy. It's always interesting to track share price performance over the longer term. But to understand TIE Kinetix better, we need to consider many other factors. Be aware that TIE Kinetix is showing 3 warning signs in our investment analysis , and 1 of those can't be ignored...

If you would prefer to check out another company -- one with potentially superior financials -- then do not miss this free list of companies that have proven they can grow earnings.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on NL exchanges.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned.

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Thank you for reading.