Time To Worry? Analysts Are Downgrading Their TGS-NOPEC Geophysical Company ASA (OB:TGS) Outlook

The latest analyst coverage could presage a bad day for TGS-NOPEC Geophysical Company ASA (OB:TGS), with the analysts making across-the-board cuts to their statutory estimates that might leave shareholders a little shell-shocked. Both revenue and earnings per share (EPS) estimates were cut sharply as analysts factored in the latest outlook for the business, concluding that they were too optimistic previously. Investors however, have been notably more optimistic about TGS-NOPEC Geophysical recently, with the stock price up an impressive 12% to US$143 in the past week. It will be interesting to see if the downgrade has an impact on buying demand for the company's shares.

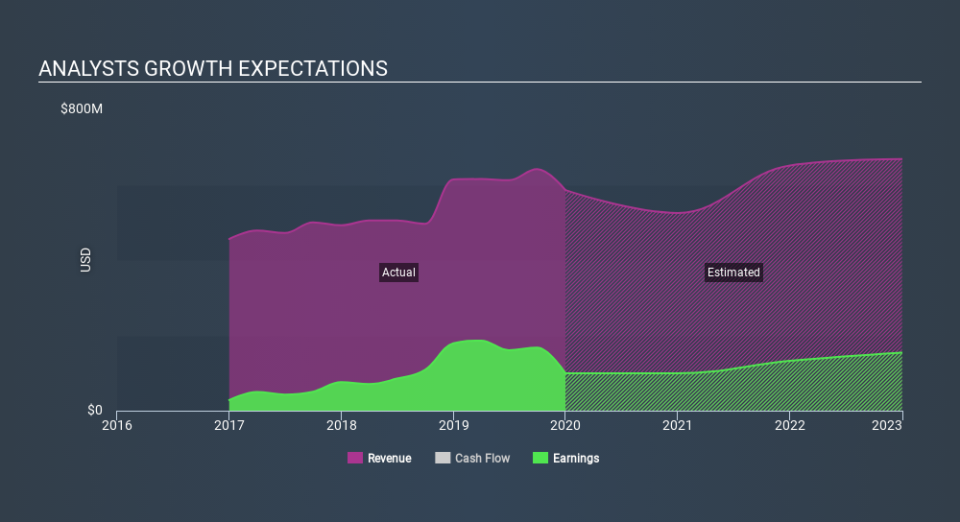

Following the downgrade, the consensus from seven analysts covering TGS-NOPEC Geophysical is for revenues of US$525m in 2020, implying a chunky 10% decline in sales compared to the last 12 months. Statutory earnings per share are anticipated to shrink 7.9% to US$0.85 in the same period. Previously, the analysts had been modelling revenues of US$787m and earnings per share (EPS) of US$1.29 in 2020. Indeed, we can see that the analysts are a lot more bearish about TGS-NOPEC Geophysical's prospects, administering a pretty serious reduction to revenue estimates and slashing their EPS estimates to boot.

See our latest analysis for TGS-NOPEC Geophysical

It'll come as no surprise then, to learn that the analysts have cut their price target 12% to US$18.96. The consensus price target is just an average of individual analyst targets, so - it could be handy to see how wide the range of underlying estimates is. Currently, the most bullish analyst values TGS-NOPEC Geophysical at US$32.12 per share, while the most bearish prices it at US$12.67. As you can see the range of estimates is wide, with the lowest valuation coming in at less than half the most bullish estimate, suggesting there are some strongly diverging views on how think this business will perform. With this in mind, we wouldn't rely too heavily on the consensus price target, as it is just an average and analysts clearly have some deeply divergent views on the business.

Taking a look at the bigger picture now, one of the ways we can understand these forecasts is to see how they compare to both past performance and industry growth estimates. One more thing stood out to us about these estimates, and it's the idea that TGS-NOPEC Geophysical'sdecline is expected to accelerate, with revenues forecast to fall 10% next year, topping off a historical decline of 6.6% a year over the past five years. Compare this against analyst estimates for companies in the wider industry, which suggest that revenues (in aggregate) are expected to grow 2.2% next year. So while a broad number of companies are forecast to decline, unfortunately TGS-NOPEC Geophysical is expected to see its sales affected worse than other companies in the industry.

The Bottom Line

The most important thing to take away is that analysts cut their earnings per share estimates, expecting a clear decline in business conditions. Unfortunately analysts also downgraded their revenue estimates, and industry data suggests that TGS-NOPEC Geophysical's revenues are expected to grow slower than the wider market. With a serious cut to this year's expectations and a falling price target, we wouldn't be surprised if investors were becoming wary of TGS-NOPEC Geophysical.

After a downgrade like this, it's pretty clear that previous forecasts were too optimistic. What's more, we've spotted several possible issues with TGS-NOPEC Geophysical's business, like dilutive stock issuance over the past year. Learn more, and discover the 4 other concerns we've identified, for free on our platform here.

Of course, seeing company management invest large sums of money in a stock can be just as useful as knowing whether analysts are downgrading their estimates. So you may also wish to search this free list of stocks that insiders are buying.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned.

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Thank you for reading.