Is Tingyi (Cayman Islands) Holding Corp.’s (HKG:322) CEO Paid At A Competitive Rate?

Want to participate in a short research study? Help shape the future of investing tools and you could win a $250 gift card!

In 2015 James Wei was appointed CEO of Tingyi (Cayman Islands) Holding Corp. (HKG:322). First, this article will compare CEO compensation with compensation at similar sized companies. Then we’ll look at a snap shot of the business growth. Third, we’ll reflect on the total return to shareholders over three years, as a second measure of business performance. This process should give us an idea about how appropriately the CEO is paid.

Check out our latest analysis for Tingyi (Cayman Islands) Holding

How Does James Wei’s Compensation Compare With Similar Sized Companies?

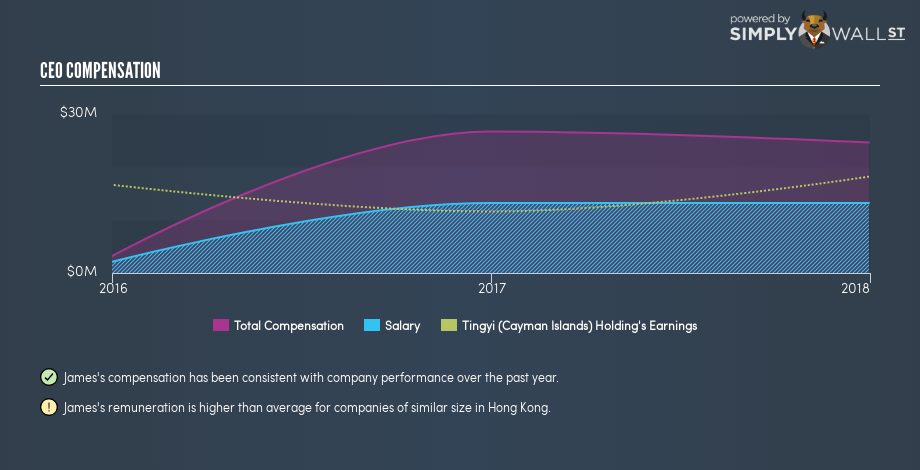

Our data indicates that Tingyi (Cayman Islands) Holding Corp. is worth HK$60b, and total annual CEO compensation is CN¥25m. (This is based on the year to 2017). While we always look at total compensation first, we note that the salary component is less, at CN¥13m. We looked at a group of companies with market capitalizations from CN¥27b to CN¥81b, and the median CEO compensation was CN¥3.7m.

Thus we can conclude that James Wei receives more in total compensation than the median of a group of companies in the same market, and of similar size to Tingyi (Cayman Islands) Holding Corp.. However, this doesn’t necessarily mean the pay is too high. We can get a better idea of how generous the pay is by looking at the performance of the underlying business.

You can see a visual representation of the CEO compensation at Tingyi (Cayman Islands) Holding, below.

Is Tingyi (Cayman Islands) Holding Corp. Growing?

On average over the last three years, Tingyi (Cayman Islands) Holding Corp. has grown earnings per share (EPS) by 20% each year (using a line of best fit). In the last year, its revenue is up 3.9%.

This shows that the company has improved itself over the last few years. Good news for shareholders. It’s good to see a bit of revenue growth, as this suggests the business is able to grow sustainably. You might want to check this free visual report on analyst forecasts for future earnings.

Has Tingyi (Cayman Islands) Holding Corp. Been A Good Investment?

Most shareholders would probably be pleased with Tingyi (Cayman Islands) Holding Corp. for providing a total return of 34% over three years. As a result, some may believe the CEO should be paid more than is normal for companies of similar size.

In Summary…

We compared the total CEO remuneration paid by Tingyi (Cayman Islands) Holding Corp., and compared it to remuneration at a group of similar sized companies. As discussed above, we discovered that the company pays more than the median of that group.

Importantly, though, the company has impressed with its earnings per share growth, over three years. Even better, returns to shareholders have been plentiful, over the same time period. As a result of this good performance, the CEO remuneration may well be quite reasonable. Whatever your view on compensation, you might want to check if insiders are buying or selling Tingyi (Cayman Islands) Holding shares (free trial).

Arguably, business quality is much more important than CEO compensation levels. So check out this free list of interesting companies, that have HIGH return on equity and low debt.

To help readers see past the short term volatility of the financial market, we aim to bring you a long-term focused research analysis purely driven by fundamental data. Note that our analysis does not factor in the latest price-sensitive company announcements.

The author is an independent contributor and at the time of publication had no position in the stocks mentioned. For errors that warrant correction please contact the editor at editorial-team@simplywallst.com.