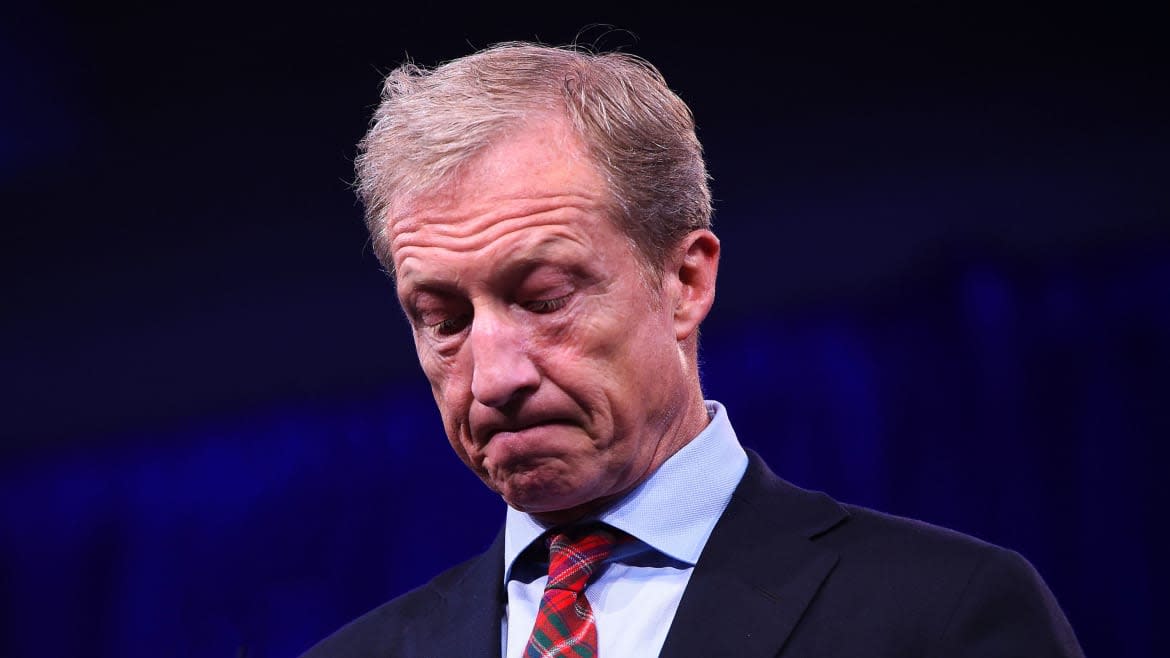

Tom Steyer Says He Can’t Disclose Hundreds of Millions in Financial Assets

Democratic presidential candidate Tom Steyer has insisted publicly that he is divested from his once-extensive fossil fuel interests. But he also has hundreds of millions of dollars tied up in assets that he will not or cannot disclose.

The California billionaire filed a new personal financial accounting last week giving a broad view of his extensive assets and sources of income. But he declined to go into detail about significant segments of his investment portfolio, citing confidentiality agreements that bar him from publicly disclosing the underlying assets in which he is invested.

Those assets are worth between $370 million and $742 million, according to a Daily Beast review of the filing, which only discloses the values in ranges. The total could actually be higher than that, as four of the assets, holdings in two hedge funds and two private equity funds, are valued at more than $50 million, without an upper range (The Daily Beast pegged their values at $50 million precisely for the purposes of this analysis).

Tom Steyer Attacks Senate Dems for Ducking Trump Impeachment

Steyer declined to fully detail his holdings in 43 different investment vehicles, including hedge funds managed by Farallon Capital Management, the firm Steyer founded more than 30 years ago.

“Underlying assets are not disclosed due to a preexisting confidentiality agreement,” Steyer repeatedly told the Office of Government Ethics in his financial disclosure filing. For all 43 line items, Steyer pledged that he “will divest this asset if elected.”

Steyer’s arrangement appears kosher legally. Federal law allows political candidates to shield such specifics from public view if the asset at issue “is considered confidential as a result of a privileged [legal] relationship.”

Steyer stressed compliance in a statement to the Daily Beast. "His public release is consistent with Office of Government Ethics guidance with respect to not disclosing underlying assets of investment funds and general IRS guidance on requirements for entities that have to file public returns," his campaign said.

But his report will still likely draw additional scrutiny from federal ethics officials due to that lack of disclosure, according to Alex Baumgart, a researcher at the Center for Responsive Politics, which first obtained a copy of Steyer’s financial disclosure filing.

“OGE is generally pretty stringent when it comes to this so we'll see what happens, I'd expect a bit of a back and forth at least before OGE certifies,” Baumgart said in an email.

“I think it's going to depend a lot on how the agency officials react to this and if they see it as valid,” he added. “The question that Steyer and the agency officials have to answer is ‘would disclosure actually violate his confidentiality agreements?’—which it may for these types of investments.”

His withholding of those details from his financial disclosure nevertheless obscures from public view significant information about his vast personal wealth, including information that would verify his claims that he has purged his portfolio of assets that conflict with his image as a strident environmentalist.

“I divested from all of that stuff,” Steyer said of his once-extensive fossil fuel holdings in an ABC interview in July. Steyer has made the same claim since 2014, when he says he instructed Farallon, which still manages much of his assets, to allocate them away from the firm’s oil and coal holdings.

In a statement issued Tuesday night, Steyer’s campaign continued to stress that he was abiding by is pledge that he has divested from fossil fuel holdings, not just through his Farallon holdings but in every other investment fund in which he has a stake.

"Tom has divested from Farallon's fossil fuel holdings and has provided all investment funds with a copy of his investment policy so that they can be screened clear of fossil fuel holdings," the campaign said. "If any investments don't meet Tom's screening, the proceeds from those investments are donated to charity."

But while Farallon and similar companies must disclose what assets they have under management, they do not have to disclose which funds actually hold which assets, and certainly not how those assets are distributed among their clients. That makes it virtually impossible to independently verify Steyer’s public statements about his holdings.

Get our top stories in your inbox every day. Sign up now!

Daily Beast Membership: Beast Inside goes deeper on the stories that matter to you. Learn more.