Top 1st-Quarter Buys of Steven Cohen's Firm

Steven Cohen (Trades, Portfolio)'s Point72 Asset Management recently disclosed its portfolio updates for the first quarter of 2020, which ended on March 31.

Point72 is a hedge fund that was formed in 2014 when SAC Capital Advisors converted its investment operations into a family office. In 2018, the firm reopened to external investors. With approximately $16.2 billion in assets under management, Point72 invests via a wide range of asset classes and strategies worldwide. Its core investing strategy is based on bottom-up research with a focus on fundamentals and macroeconomic conditions.Cohen serves as the president, CEO and chairman of the firm.

During the quarter, the firm established 293 new common stock positions, sold out of over 400 common stock positions and added to or reduced several other holdings for a turnover rate of 47%. Its top buys for the quarter were Micron Technology Inc. (NASDAQ:MU), Take-Two Interactive Software Inc. (NASDAQ:TTWO), AbbVie Inc. (NYSE:ABBV), CSX Corp. (NASDAQ:CSX) and Las Vegas Sands Corp. (NYSE:LVS).

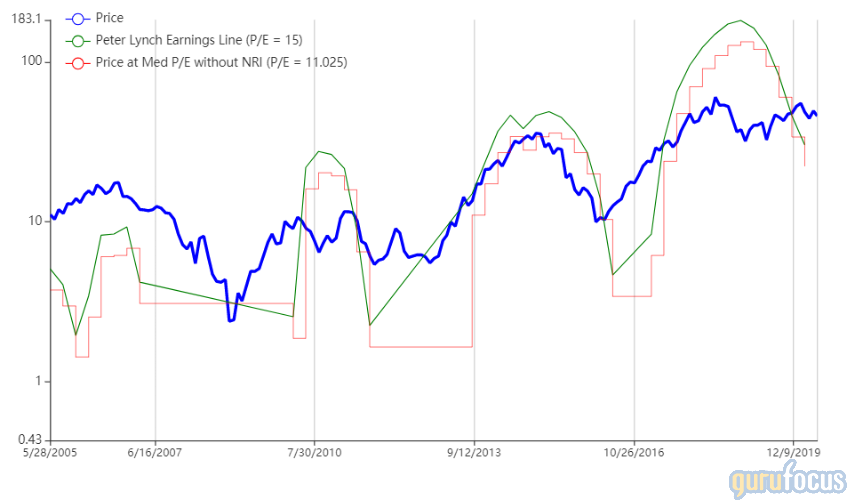

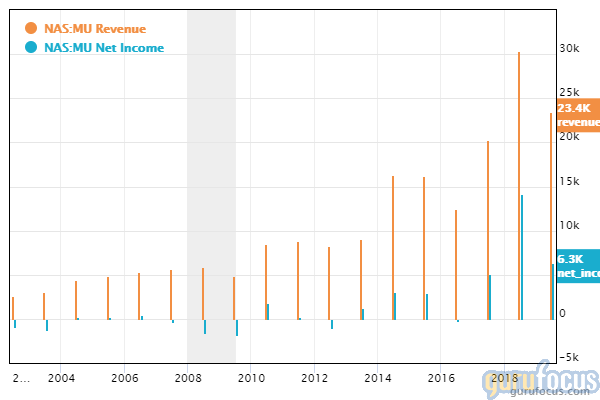

Micron Technology

The firm added 4,325,179 shares to its investment in Micron Technology, increasing the stake by 229.91% for a total of 6,206,425 shares. The trade had a 1.48% impact on the equity portfolio. During the quarter, shares traded for an average price of $52.21.

Micron is a semiconductor company based in Boise, Idaho. It primarily produces computer memory and data storage products, including DRAM and flash memory. The company's products are geared toward applications in 5G, industrial IoT, automotive, networking and servers.

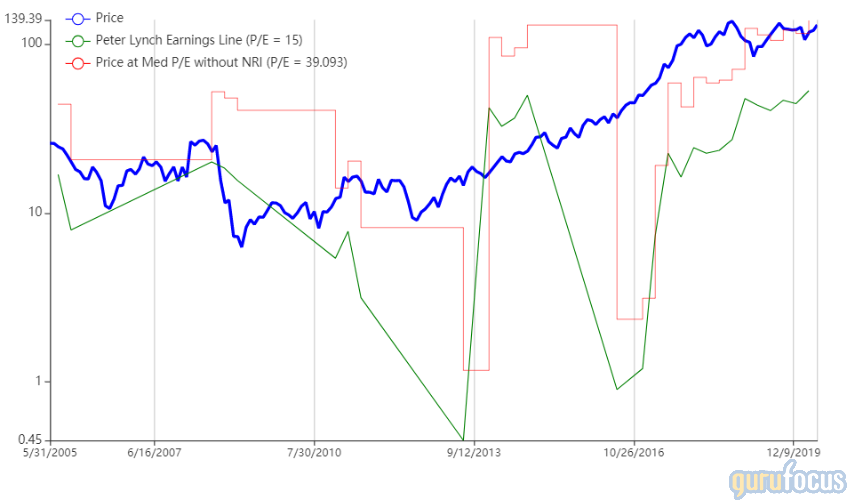

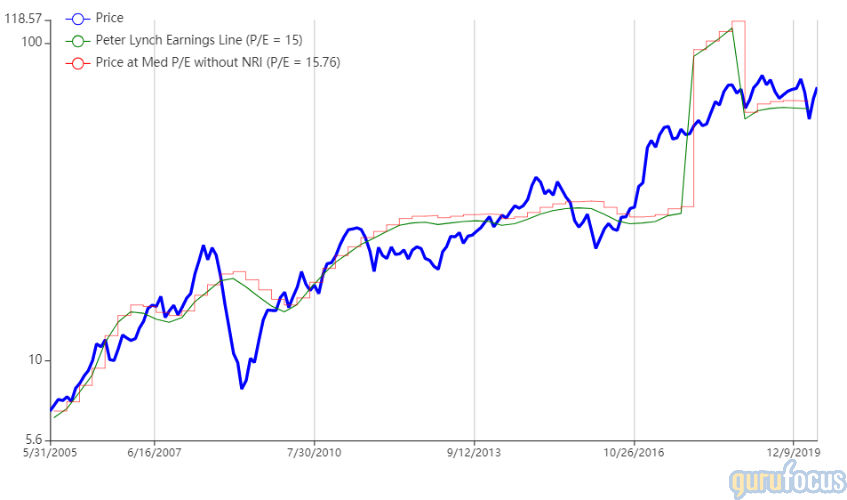

On May 27, shares of Micron traded around $49.09 for a market cap of $53.72 billion and a price-earnings ratio of 24.32. According to the Peter Lynch chart, the stock is trading slightly above what recent earnings were worth.

GuruFocus gives the company a financial strength rating of 7 out of 10 and a profitability rating of 9 out of 10. The cash-debt ratio of 1.25 is average for the industry, while the Altman Z-Score of 4.12 indicates that the company is not in danger of bankruptcy. With an operating margin of 13.46%, the company has grown its revenue and net income overall in the past few years, though the last fiscal year saw a dropoff.

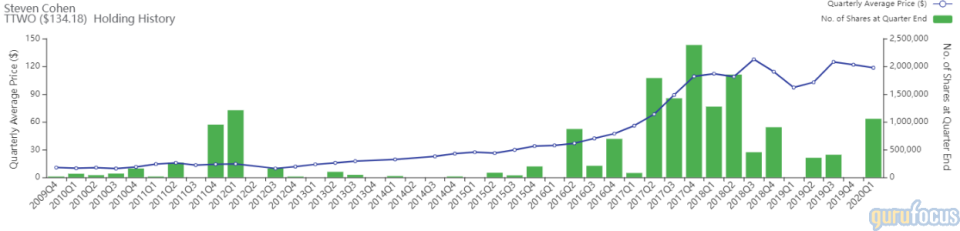

Take-Two Interactive Software

Point72 established a new holding of 1,054,856 shares in Take-Two Interactive Software after selling out of its previous investment in the company in the fourth quarter of 2019. The trade impacted the equity portfolio by 1.02%. Shares traded for an average price of $118.38 during the quarter.

New York-based Take-Two Interactive is a video game holding company that publishes mainly under the Rockstar Games and 2K labels. Some of the company's famous titles include "Borderlands," "Grand Theft Auto," "Bioshock" and the NBA video games.

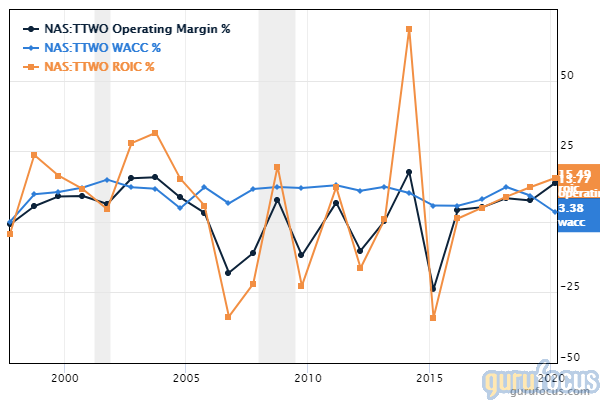

On May 27, shares of Take-Two Interactive traded around $133.98 for a market cap of $15.04 billion and a price-earnings ratio of 37.91. According to the Peter Lynch chart, the stock is trading above its intrinsic value but in line with its historical median valuation.

GuruFocus gives the company a financial strength rating of 7 out of 10 and a profitability rating of 6 out of 10. The cash-debt ratio of 11.29 indicates plenty of liquidity, and the Altman Z-Score of 5.34 confirms that the company is unlikely to go bankrupt. The operating margin of 13.77% is higher than 69.46% of competitors. The return on invested capital is higher than the weighted average cost of capital, indicating profitability.

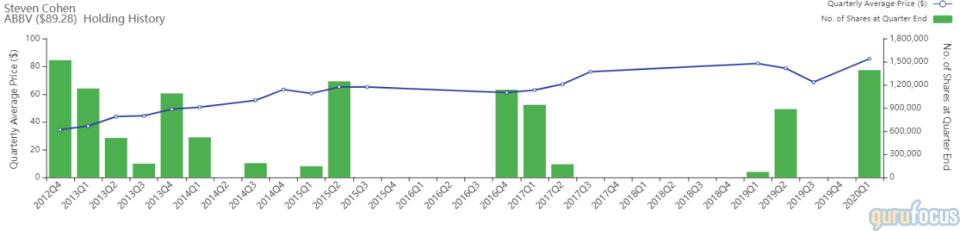

AbbVie

Cohen's firm also bought 1,390,906 shares of AbbVie after selling out of its previous investment in the company in the third quarter of 2019. The trade impacted the equity portfolio by 0.86%. During the quarter, shares traded for an average price of $85.41.

AbbVie is a biopharmaceutical company based in North Chicago, Illinois. It was formed as a spinoff from Abbott Laboratories (ABT) in 2013. The company focuses on developing treatments in the fields of oncology, immunology, neuroscience, virology and general medicine.

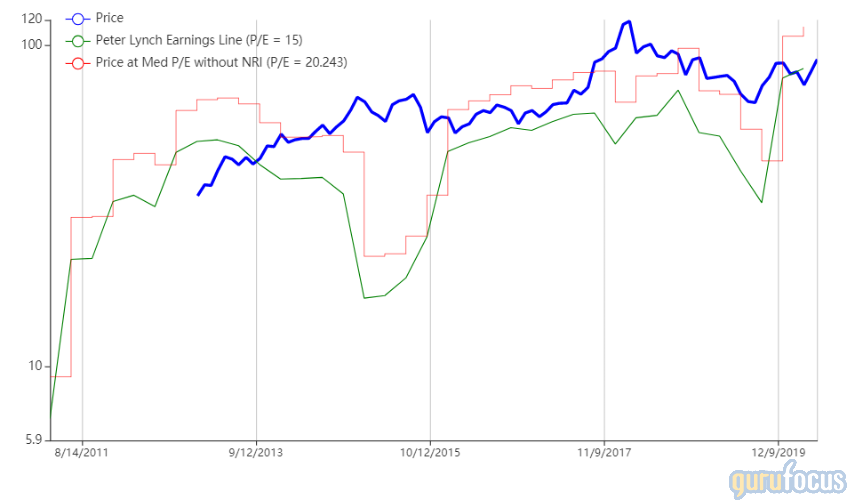

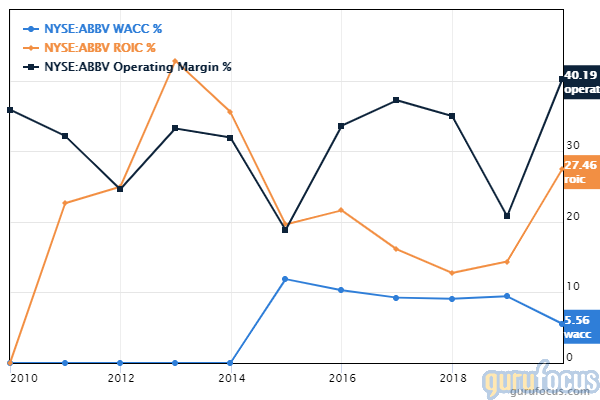

On May 27, shares of AbbVie traded around $89.20 for a market cap of $156.8 billion and a price-earnings ratio of 15.79. The Peter Lynch chart indicates that the stock is trading near its intrinsic value.

GuruFocus gives the company a financial strength rating of 4 out of 10 and a profitability rating of 9 out of 10. The interest coverage ratio of 7.04 is lower than 64.58% of competitors, but the Alman Z-Score of 2.3 suggests that the company is most likely safe from bankruptcy. The operating margin of 40.54% is higher than 97.90% of competitors and the ROIC is more than five times the WACC, indicating high profitability.

CSX

The firm added shares, or 1682.42%, to its investment in CSX, bringing the total number of shares owned to 1,927,831. The trade had a 0.85% impact on the equity portfolio. During the quarter, shares traded for an average price of $70.33.

CSX is holding company that mainly owns rail transportation and real estate. Headquartered in Jacksonville, Florida, it is a leading supplier of rail-based freight transportation in North America.

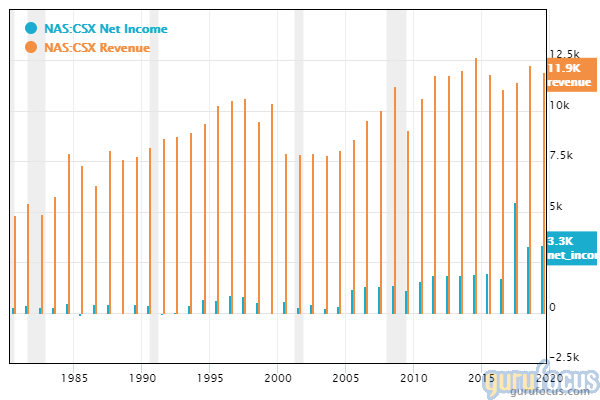

On May 27, shares of CSX traded around $73.25 for a market cap of $56.25 billion and a price-earnings ratio of 13.63. The Peter Lynch chart shows that the stock is trading slightly above its intrinsic value.

GuruFocus gives the company a financial strength rating of 4 out of 10 and a profitability rating of 7 out of 10. While the cash-debt ratio of 0.14 is on the low end of the spectrum, the Alman Z-Score of 2.42 and current ratio of 1.73 indicate little risk of bankruptcy. With a high operating margin of 41.19%, the company's revenue and net income have both shown strong upwards trends over the past few decades.

Las Vegas Sands

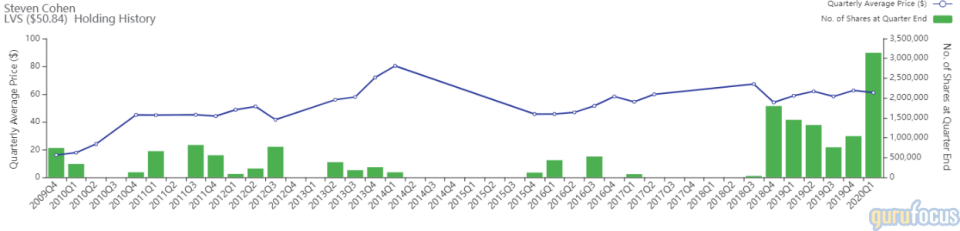

The firm also upped its stake in Las Vegas Sands by 2,101,883 shares, increasing the position by 202.23% for a total holding of 3,141,220 shares. The trade had a 0.72% impact on the equity portfolio. Shares traded for an average price of $61 during the quarter.

Based in Paradise, Nevada, Las Vegas Sands is a casino and resort company that combines accommodations with a variety of entertainment, retail and dining options. The company owns nine properties located around the world.

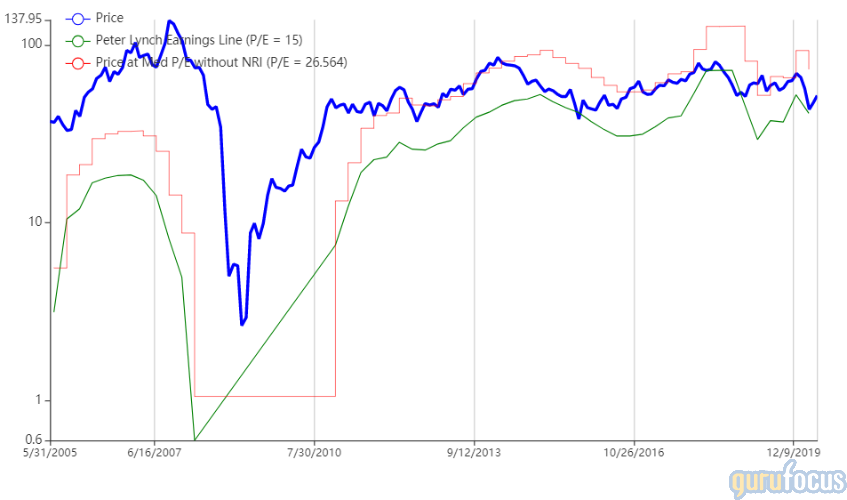

On May 27, shares of Las Vegas Sands traded around $50.93 for a market cap of $38.83 billion and a price-earnings ratio of 18.5. As the Peter Lynch chart shows, the stock is trading near its intrinsic value.

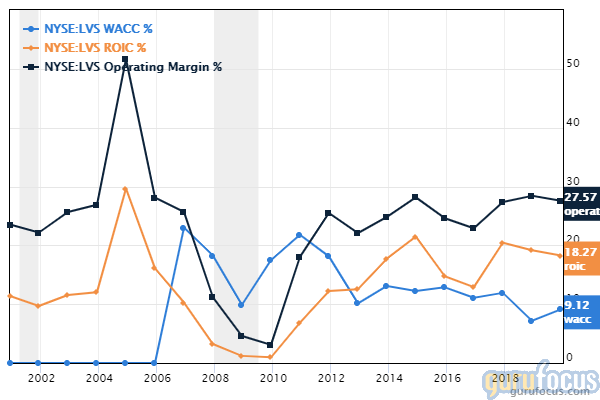

GuruFocus gives the company a financial strength rating of 4 out of 10 and a profitability rating of 7 out of 10. Though the cash-debt ratio of 0.21 is lower than 64.13% of competitors, the Altman Z-Score of 2.78 indicates the company is not likely to go bankrupt. The operating margin of 24.17% is higher than 89.36% of competitors and the ROIC is double the WACC, indicating overall profitability.

Portfolio overview

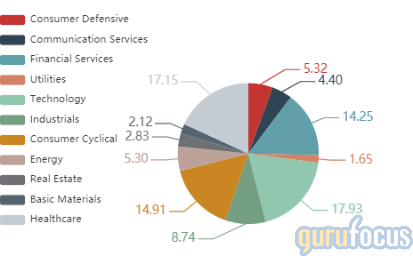

As of the quarter's end, the firm had common stock holdings in 746 companies for an equity portfolio valued at $12.31 billion. The top holdings were Amazon.com Inc. (AMZN) with a 2.82% portfolio weight, Micron Technology with 2.12% and JD.com Inc. (JD) with 1.82%.

In terms of sector weighting, the firm was most invested in technology, health care and consumer cyclical.

Disclosure: Author owns no shares in any of the stocks mentioned. The mention of stocks in this article does not at any point constitute an investment recommendation. Portfolio updates reflect only common stock positions as per the regulatory filings for the quarter in question and may not include changes made after the quarter ended.

Read more here:

Julian Robertson's Top 1st-Quarter Trades

Philippe Laffont's Firm Buys JD, Sells Mastercard

Top 1st-Quarter Buys of the Bill & Melinda Gates Foundation Trust

Not a Premium Member of GuruFocus? Sign up for a free 7-day trial here.

This article first appeared on GuruFocus.