Top 4th-Quarter Buys of Ken Heebner's CGM

Ken Heebner (Trades, Portfolio)'s Capital Growth Management recently disclosed its portfolio updates for the fourth quarter of 2019. As of the quarter's end, the $1.24 billion equity portfolio consisted of positions in 48 stocks, 28 of which are new.

Boston-based Capital Growth Management specializes in swift and bold sector calls, typically establishing large short-term positions in companies that it expects will see strong growth in the near future. Heebner is the co-founder of the firm and believes that placing large bets on his convictions is the way to investing success.

Based on the above criteria, CGM's biggest buys for the fourth quarter were in Thor Industries Inc. (NYSE:THO), M.D.C. Holdings Inc. (NYSE:MDC), Skyworks Solutions Inc. (NASDAQ:SWKS), Signet Jewelers Ltd (NYSE:SIG) and Micron Technology Inc. (NASDAQ:MU).

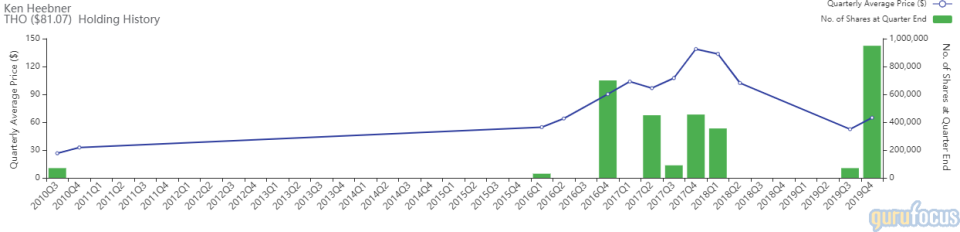

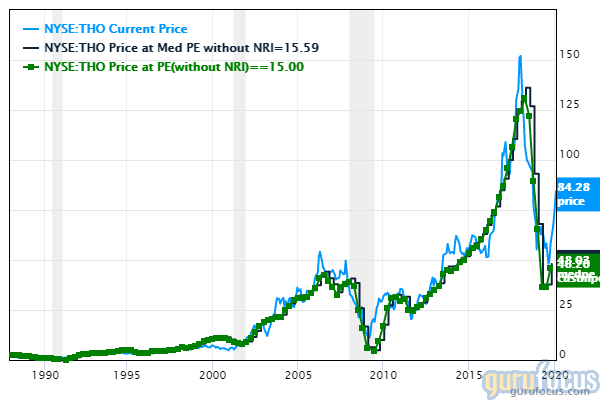

Thor Industries

The firm increased its stake in Thor Industries by 879,000 shares, or 1,255.71%, impacting the equity portfolio by 5.28% and making it the second-largest holding. Shares traded at an average price of $64.80 apiece during the quarter.

Thor Industries is one of the world's leading manufacturers and sellers of motorized and towable recreation vehicles (RVs). The Elkhart, Indiana-based company sells its products through its subsidiary brands, which include Heartland, Jayco, Livin Lite and Airstream.

As of Feb. 25, shares of Thor Industries traded around $81.30 for a market cap of $4.48 billion and a price-earnings ratio of 26.38. According to the Peter Lynch chart, the stock may be trading above its intrinsic value.

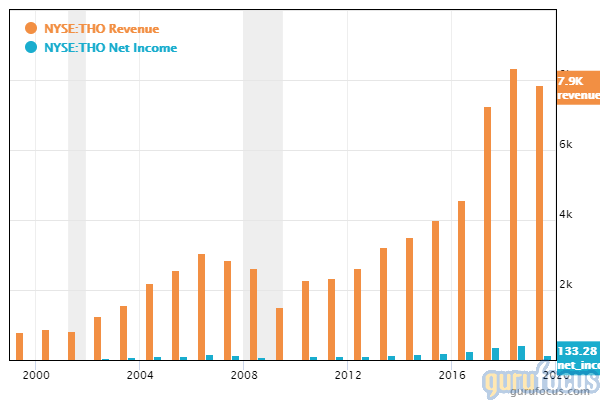

GuruFocus has assigned the company a financial strength rating of 5 out of 10 and a profitability rating of 9 out of 10. The low cash-debt ratio of 0.13 is balanced out by the Altman Z-score of 3.07, which indicates that the company is not in financial distress. The company has seen strong growth in revenue and net income in recent years, though its profits fell in 2019 due to an industry-wide downturn.

M.D.C. Holdings

CGM made a new investment in 1,592,000 shares of M.D.C. Holdings, impacting the equity portfolio by 4.91% and making it the third-largest holding. During the quarter, shares traded at an average price of $40.57 each.

Based in Denver, M.D.C. Holdings is one of the largest home builders in the U.S. It operates through its subsidiaries, who build homes under the name "Richmond American Homes."

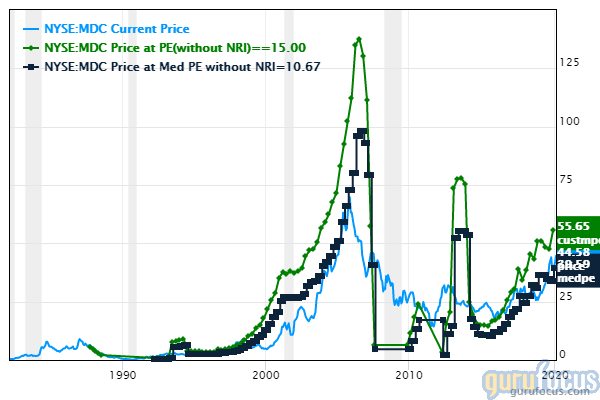

On Feb. 25, shares of M.D.C. traded around $44.24 apiece for a market cap of $2.78 billion and a price-earnings ratio of 11.87. The Peter Lynch chart indicates that the stock is trading near or slightly below its intrinsic value.

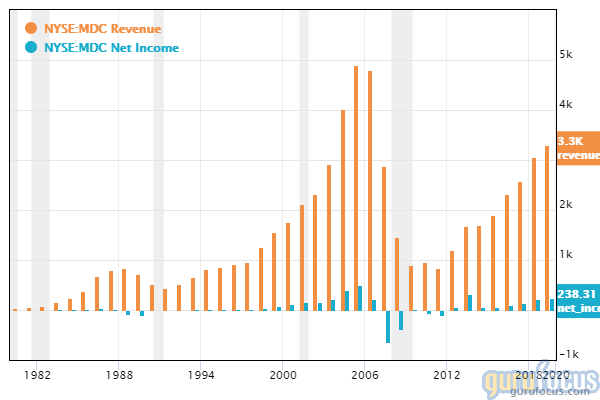

M.D.C. has a GuruFocus financial strength score of 5 out of 10 and a profitability score of 7 out of 10. The cash-debt rate of 0.45 is average for the industry, while the Altman Z-score of 3.53 indicates financial stability. Both revenue and net income have been growing steadily since the mortgage crisis shrank the demand for new houses in 2008.

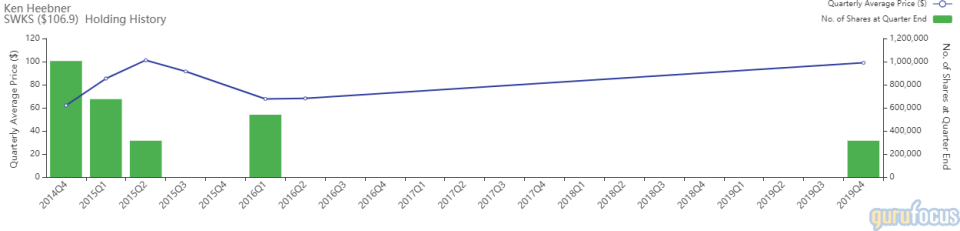

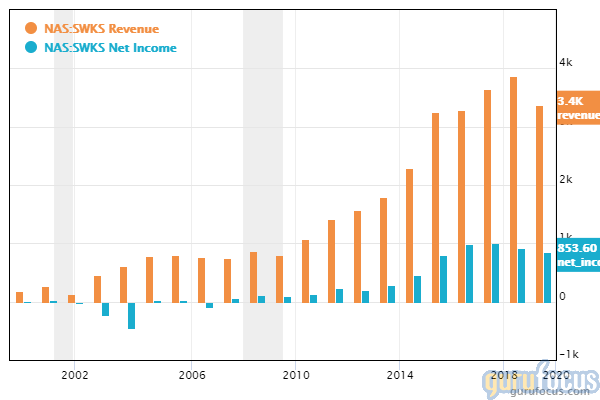

Skyworks Solutions

After exiting a previous holding in Skyworks Solutions in the second quarter of 2016, CGM established a new position in the company of 315,000 shares. The trade impacted the equity portfolio by 3.08%. Shares traded around an average of $98.94 for the quarter.

Skyworks Solutions is a semiconductor company based in Woburn, Massachusetts. It primarily manufactures semiconductor modules for radio frequency, memory and mobile communications systems.

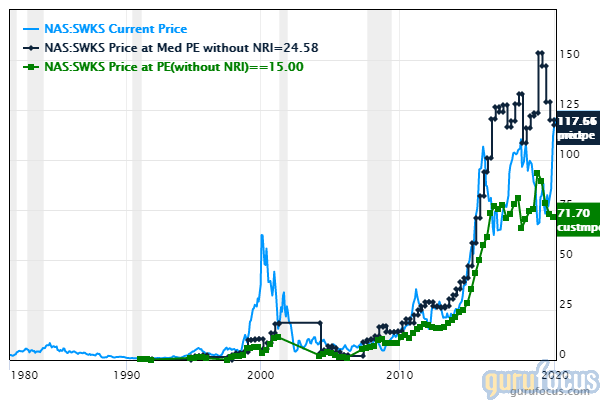

On Feb. 25, Skyworks shares traded around $107.56 for a market cap of $18.39 billion and a price-earnings ratio of 22.34. According to the Peter Lynch chart, shares are trading slightly above their fair value.

GuruFocus has given Skyworks a financial strength rating of 8 out of 10 and a profitability rating of 9 out of 10. The company has no debt and an Altman Z-score of 16.75, indicating it will not be in financial danger even if it faces serious setbacks. Revenue and net income shrank in 2019 after years of growth, but the company's profits are expected to grow again as 5G technology rolls out.

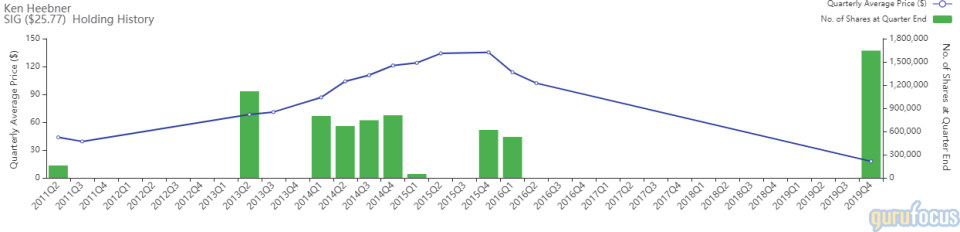

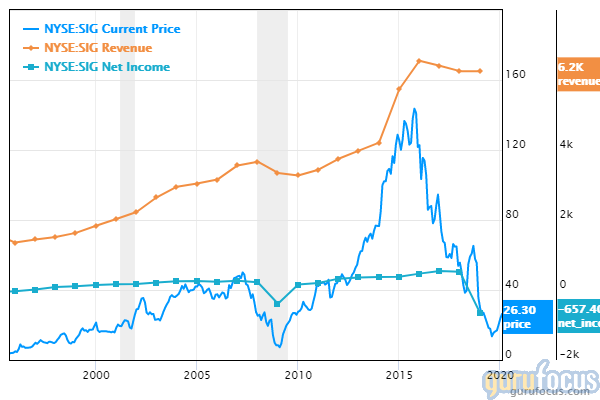

Signet Jewelers

Having sold out of its previous investment in Signet Jewelers in the second quarter of 2016, the firm made a new 1,645,000-share investment in the company, impacting the equity portfolio by 2.89%. During the quarter, shares traded at an average price of $17.81.

Akron, Ohio-based Signet Jewelers is the largest retailer of diamond jewelry in the world. It operates more than 3,300 stores under its brand names, which include Zales, Kay, Jared and JamesAllen.com.

On Feb. 25, shares of Signet traded around $25.74 for a market cap of $1.36 billion. The company has a GuruFocus financial strength rating of 4 out of 10 and a profitability rating of 7 out of 10.

The cash-debt ratio of 0.07 and Altman Z-score of 1.91 are lower than 84.73% of industry competitors. However, the interest coverage of 6.48% and current ratio of 2.12 indicate that the company can meet its short-term debt obligations.

Signet has seen its shares drop since 2015 despite increasing revenue and net income. This was largely due to a combination of higher credit costs, intensified competition and lower traffic in brick-and-mortar stores. The company was able to hold on to growth through investments and issuing new debt. Now that the company has reached a point where it can work toward decreasing debt rather than increasing it, we may see a turnaround.

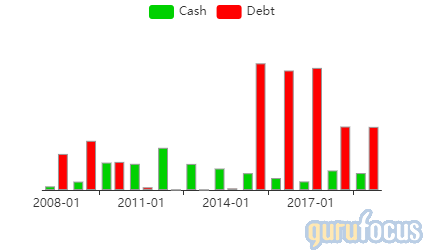

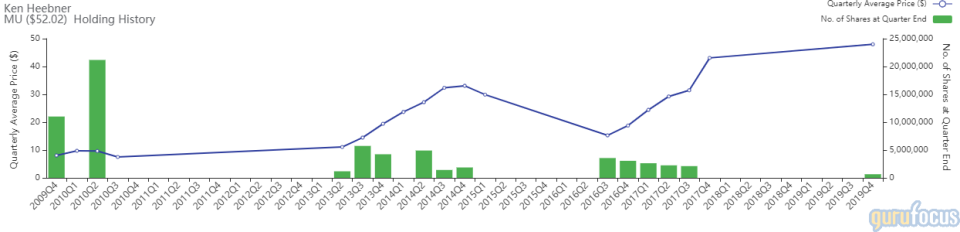

Micron Technology

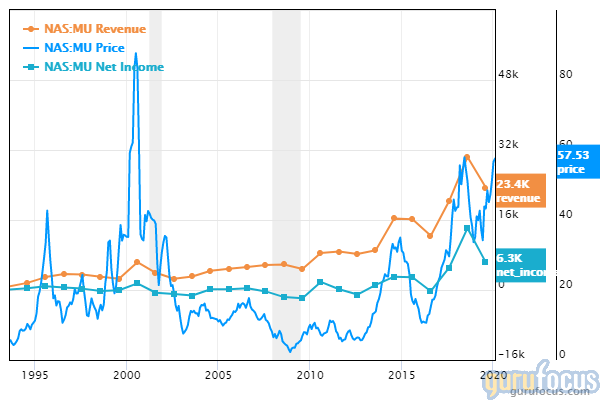

CGM also established a new 650,000-share position in Micron Technology, impacting the equity portfolio by 2.83%. The firm sold out of its previous holding in the company in the fourth quarter of 2017. For the 2019 fourth quarter, shares of Micron traded at an average price of $47.96 apiece.

Micron is a semiconductor company based in Boise, Idaho. It primarily produces computer memory and data storage products, including dynamic random-access memory and flash memory.

On Feb. 25, Micron shares traded around $52.02 for a market cap of $57.79 billion and a price-earnings ratio of 16.89. GuruFocus has assigned the company a financial strength rating of 8 out of 10 and a profitability rating of 9 out of 10.

Micron's cash-debt ratio of 1.36 and Altman Z-score of 4.59 indicate high financial stability. In recent years, the company has maintained more cash on hand than debt obligations.

The operating margin of 20.33% is outperforming 20.33% of industry competitors. Over the past three years, the company has achieved revenue and net income growth, though profits plunged in 2019 due to an industry-wide decline in the memory market. The memory market is expected to rebound in 2020 alongside increasing rollout of 5G and internet of things (IoT) technology.

Portfolio overview

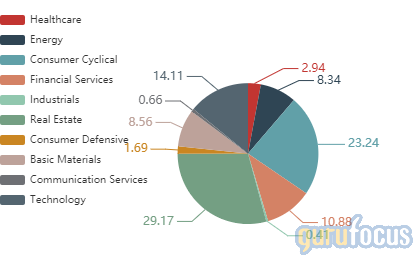

At the end of the quarter, CGM's top five holdings were Petroleo Brasileiro SA Petrobras (PBR) with 8.34% of the equity portfolio, Thor Industries with 5.7%, M.D.C. Holdings with 4.91%, American Tower Corp. (AMT) with 3.25% and Bank Bradesco SA (BBD) with 3.22%.

In terms of sector weighting, the fund was most invested in real estate, consumer cyclical and technology.

Disclosure: Author owns no shares in any of the stocks mentioned. The mention of stocks in this article does not at any point constitute an investment recommendation. Investors should always conduct their own careful research or consult registered investment advisors before taking action in the stock market.

Read more here:

American Tower Posts 4th-Quarter Earnings Beat

The Most Popular Guru Stocks of the 4th Quarter

Third Avenue Management Buys 2, Sells 2 in Fourth Quarter

Not a Premium Member of GuruFocus? Sign up for a free 7-day trial here

This article first appeared on GuruFocus.