Top 5 4th-Quarter Buys of George Soros' Firm

Soros Fund Management, the firm founded by legendary guru George Soros (Trades, Portfolio), disclosed last week that its top five buys for the fourth quarter of 2019 were in Activision Blizzard Inc. (NASDAQ:ATVI), Tiffany & Co. (NYSE:TIF), Campbell Soup Co. (NYSE:CPB), Pioneer Natural Resources Co. (NYSE:PXD) and WellCare Health Plans Inc. (NYSE:WCG).

Soros' theory of reflexivity is based on the premise that individual investor biases affect the economy and market transactions. The guru's firm seeks investing opportunities through the study of value and market prices of assets, stocks, bonds and other securities.

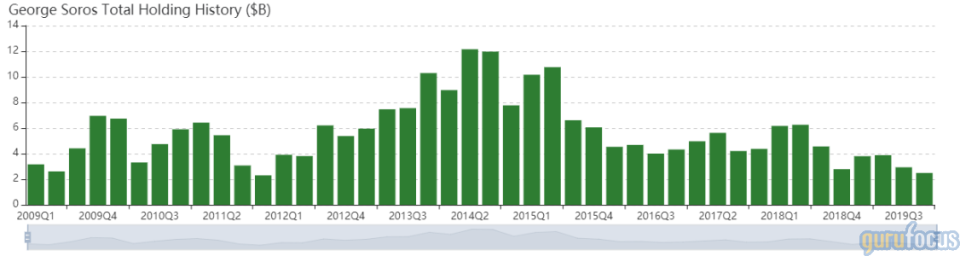

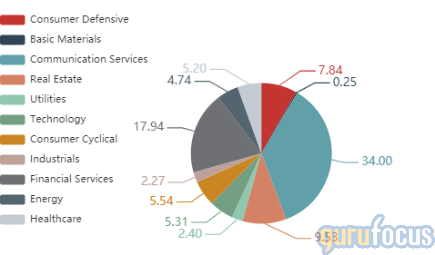

Soros converted his firm into a family office in 2011. As of December 2019, the $2.49 billion equity portfolio contains 140 stocks, with 32 new holdings and a turnover ratio of 15%. The top three sectors in terms of weight are communication services, financial services and real estate, with weights of 34%, 17.94% and 9.53%.

Activision Blizzard

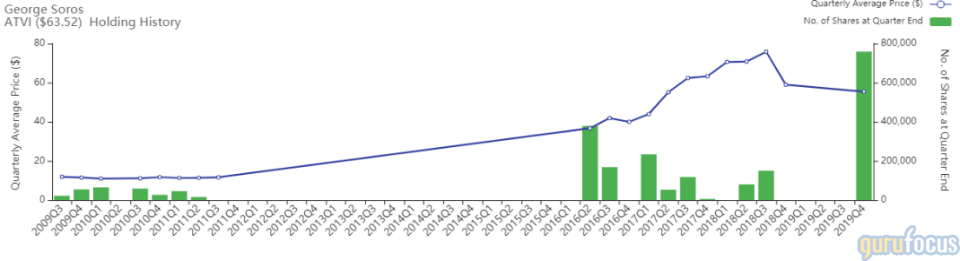

Soros Fund Management purchased 758,500 shares of Activision Blizzard, giving the position 1.81% weight in the equity portfolio. Shares averaged $55.44 during the quarter.

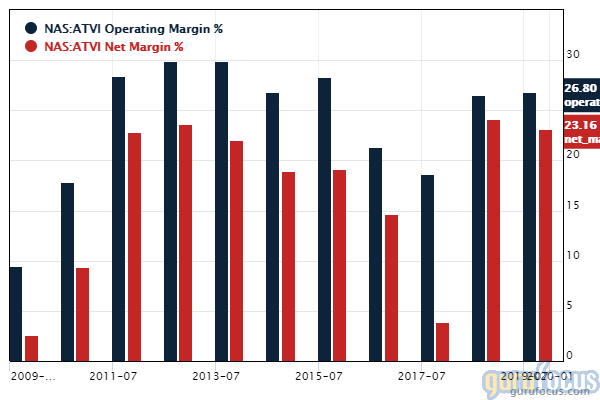

The Santa Monica, California-based company publishes video games like "World of Warcraft" and "Call of Duty." GuruFocus ranks Activision Blizzard's profitability 9 out of 10 on several positive investing signs, which include profit margins that are outperforming over 85% of global competitors.

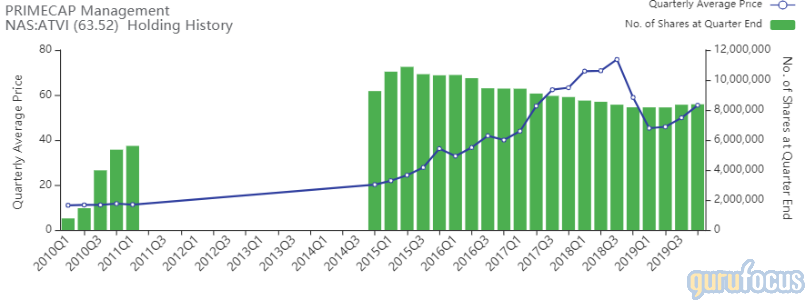

Gurus with large holdings in Activision Blizzard include PRIMECAP Management (Trades, Portfolio) and Philippe Laffont (Trades, Portfolio).

Tiffany

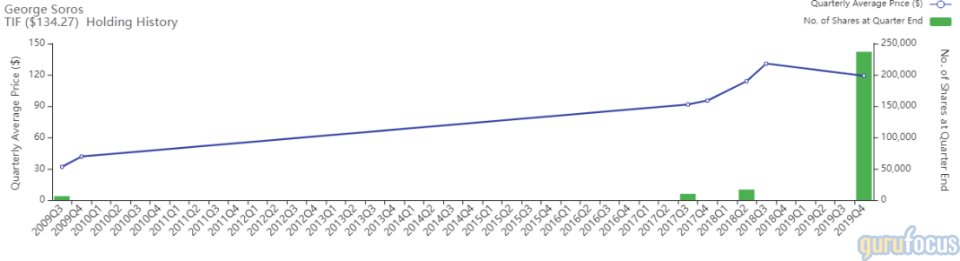

Soros Fund Management purchased 236,750 shares of Tiffany, giving the holding 1.27% weight in the equity portfolio. Shares averaged $119.09 during the quarter.

Bound to a merger with LVMH Moet Hennessy Louis Vuitton SE (MIL:LVMH), New York-based Tiffany produces luxury jewelry using polished diamonds. GuruFocus ranks Tiffany's profitability 8 out of 10: Even though the three-year revenue growth rate outperforms just 56.89% of global competitors, the company's profit margins and returns are outperforming over 85% of global companies producing luxury goods.

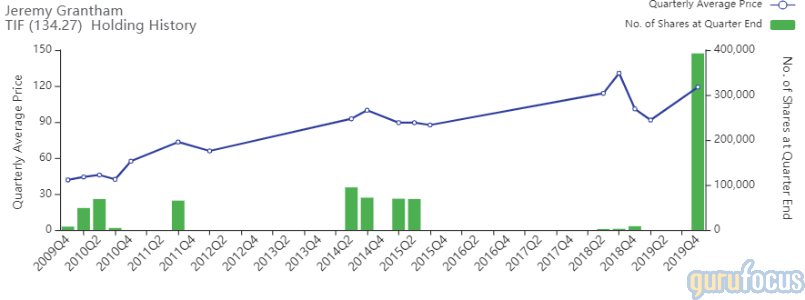

Jeremy Grantham (Trades, Portfolio)'s GMO also purchased shares of Tiffany during the quarter.

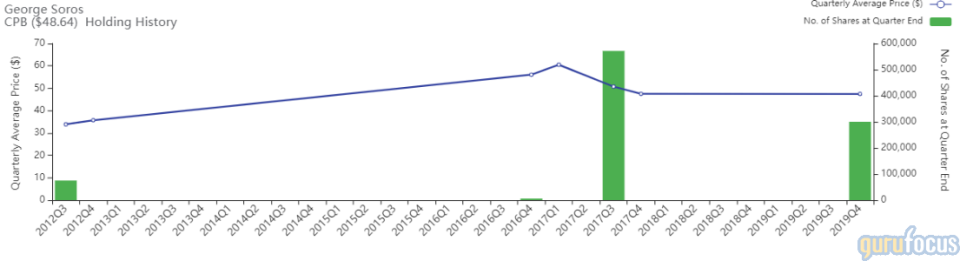

Campbell Soup

Soros Fund Management purchased 300,000 shares of Campbell Soup, giving the position 0.59% weight in the equity portfolio. Shares averaged $47.45 during the quarter.

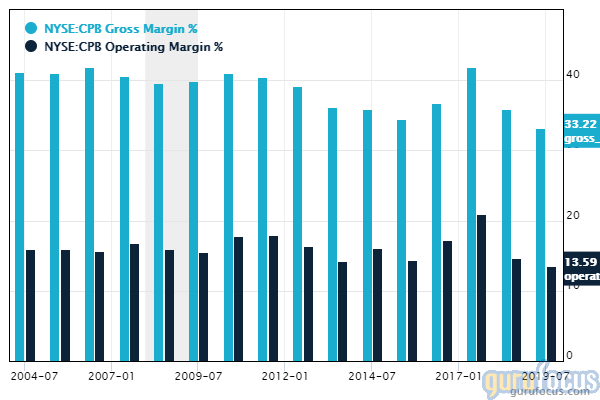

The Camden, New Jersey-based company produces a wide range of convenience food products, with brands including Campbell's, Pace, Prego, Swanson, V8 and Pepperidge Farm. GuruFocus ranks the company's profitability 7 out of 10: The operating margin and return on equity outperform over 76% of global competitors despite gross profit margins contracting approximately 0.4% per year on average over the past five years.

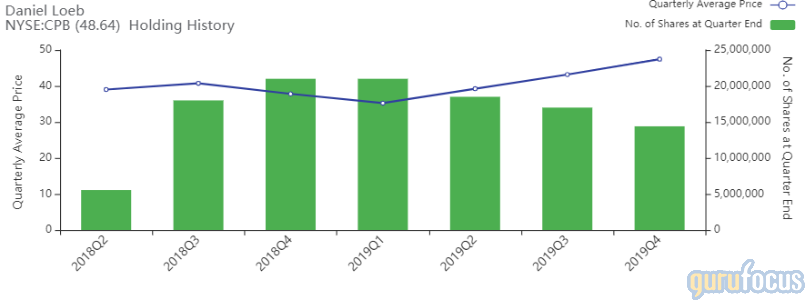

Third Point investor Daniel Loeb (Trades, Portfolio) owns 14.4 million shares of Campbell Soup as of fourth-quarter 2019, down 15.29% from his holding as of third-quarter 2019.

Pioneer Natural Resources

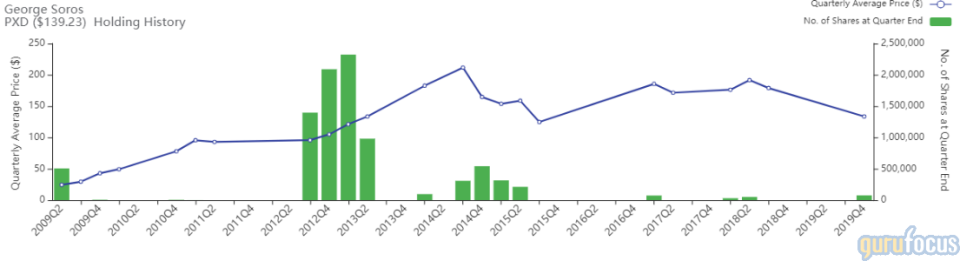

Soros Fund Management purchased 75,000 shares of Pioneer Natural Resources, giving the holding 0.46% weight in the equity portfolio. Shares averaged $133.56 during the quarter.

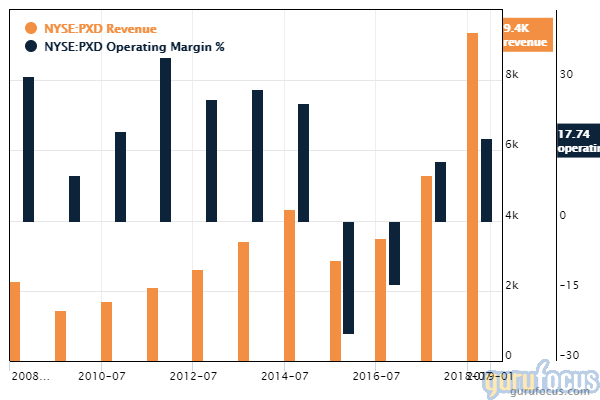

The Irving, Texas-based company explores for and produces oil and natural gas primarily in the southern and central parts of the U.S., including the Permian Basin and Eagle Ford Shale. GuruFocus ranks the company's profitability 7 out of 10 on several positive investing signs, which include an operating margin that outperforms 68.44% of global competitors and a three-year revenue growth rate that outperforms 90.87% of global energy exploration and production companies.

WellCare Health Plans

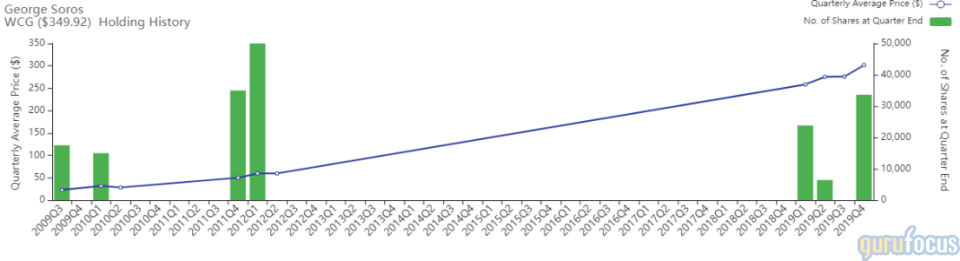

Soros Fund Management purchased 33,624 shares of WellCare Health Plans, giving the position 0.45% weight in the equity portfolio. Shares averaged $301.65 during the quarter.

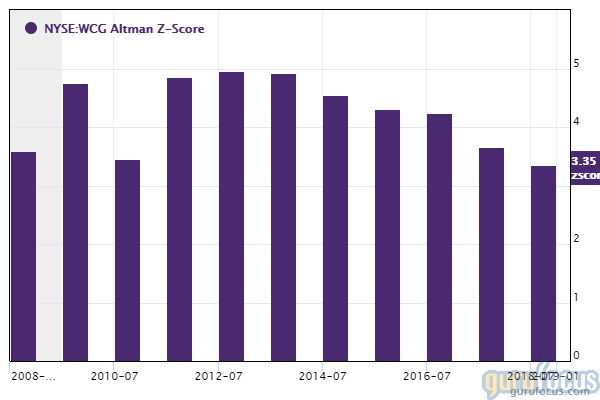

The Tampa, Florida-based company provides government-sponsored managed care services like Medicare and Medicaid. GuruFocus ranks the company's financial strength 6 out of 10: Although it has a strong Altman Z-score of 3.72, WellCare's interest coverage of 7.8 underperforms 57.14% of global competitors.

Disclosure: No positions.

Read more here:

David Tepper's Top 5 Buys in the 4th Quarter

Top 5 4th-Quarter Buys of Chase Coleman's Tiger Global

Andreas Halvorsen's Top 5 Buys in the 4th Quarter

Not a Premium Member of GuruFocus? Sign up for a free 7-day trial here.

This article first appeared on GuruFocus.