The Top New Buys of Larry Robbins' Firm

- Oops!Something went wrong.Please try again later.

- By Margaret Moran

Glenview Capital Management recently disclosed its portfolio updates for the fourth quarter of 2020, which ended on Dec. 31.

Founded by Larry Robbins (Trades, Portfolio) in 2000, Glenview is a New York-based hedge fund that focuses on deep fundamental research and individual security selection. It operates via two funds: the Glenview Fund, which runs a long-short strategy, and the Glenview Opportunity Fund, a more concentrated and opportunistic vehicle. The firm primarily focuses on U.S. securities, though it also has some exposure to Western Europe. The majority of its investments are in the health care industry.

Based on its investing strategy, the firm's biggest new buys during the third quarter were Anthem Inc. (NYSE:ANTM), Norfolk Southern Corp. (NYSE:NSC) and DuPont de Nemours Inc. (NYSE:DD).

Anthem

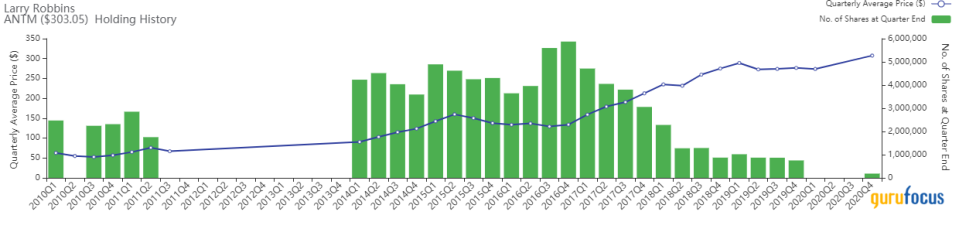

The firm established a new holding of 184,461 shares in Anthem Inc. (NYSE:ANTM) after selling out of its previous investment in the stock in the first quarter of 2020. The trade had a 1.36% impact on the equity portfolio. During the quarter, shares traded for an average price of $307.47.

Anthem is a health insurance provider based in Indianapolis. It is the largest for-profit managed care company in the Blue Cross Blue Shield Association with more than 40 million members.

On Feb. 26, shares of Anthem traded around $303.21 for a market cap of $74.34 billion. According to the GuruFocus Value chart, the stock is modestly undervalued.

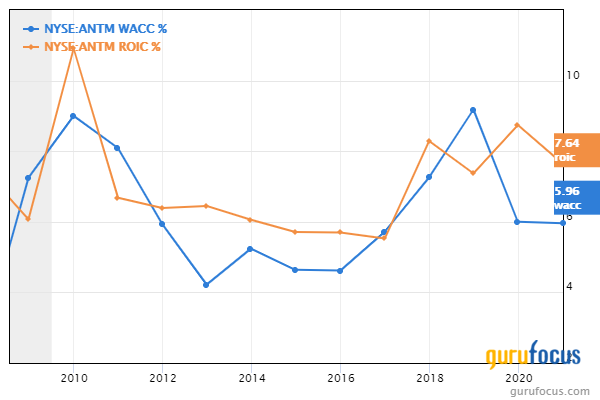

The company has a financial strength rating of 5 out of 10 and a profitability rating of 7 out of 10. While the cash-debt ratio of 0.29 is lower than 78% of industry peers, the Piotroski F-Score of 5 out of 9 indicates stable financial conditions. The return on invested capital typically surpasses the weighted average cost of capital, indicating that operations are profitable.

Norfolk Southern Corp

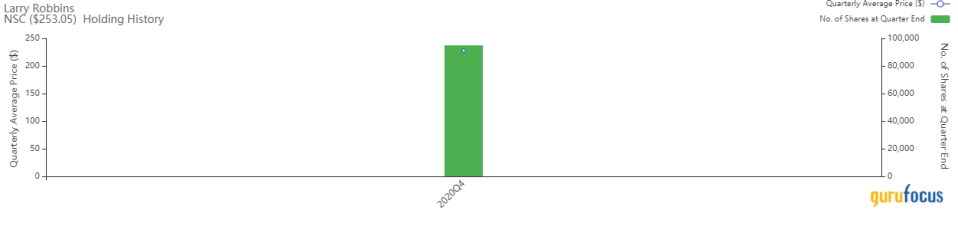

The firm took a 94,933-share position in Norfolk Southern Corp. (NYSE:NSC), impacting the equity portfolio by 0.52%. Shares traded for an average price of $227.77 during the quarter.

Norfolk Southern is a transportation company based in Norfolk, Virginia. It is primarily involved in the railway transportation of raw materials, intermediate products and finished goods in 22 states of the U.S. through its Norfolk Southern Railway Co. subsidiary.

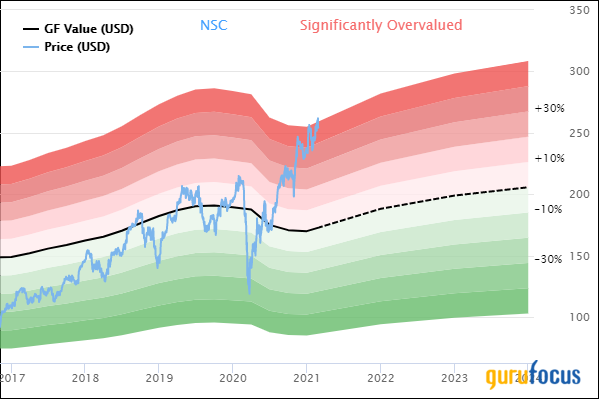

On Feb. 26, shares of Norfolk Southern traded around $252.60 for a market cap of $63.87 billion. According to the GF Value chart, the stock is significantly overvalued.

The company has a financial strength rating of 4 out of 10 and a profitability rating of 8 out of 10. The interest coverage ratio of 5.71 is average for the industry, and the Altman Z-Score of 2.67 indicates the company is unlikely to be in financial distress. The operating margin of 36.43% is beating 94% of industry peers, while the net margin of 20.56% beats 90% of peers despite declining in recent years.

DuPont de Nemours

After selling out of its previous stake in DuPont de Nemours Inc. (NYSE:DD) in the first quarter of 2019, the firm made a new investment of 258,003 shares in the company, impacting the equity portfolio by 0.42%. During the quarter, shares traded for an average price of $62.69.

DuPont de Nemours is an American chemicals company that was formed from the 2017 merger of Dow Chemical and Dupont and the subsequent spinoffs of Dow Inc. (DOW) and Corteva Inc. (CTVA). The company makes a variety of chemicals, pharmaceuticals, synthetic fibers, petroleum-based fuels, building materials, cosmetic chemicals, packaging and agricultural chemicals.

On Feb. 26, shares of DuPont traded around $70.24 for a market cap of $37.77 billion. According to the GF Value chart, the stock is modestly overvalued.

The company has a financial strength rating of 4 out of 10 and a profitability rating of 5 out of 10. The interest coverage ratio of 2.17 and Altman Z-Score of 0.77 indicate the company could be at risk of bankruptcy. The ROIC has been below the WACC in recent years, meaning the company is not currently creating value for shareholders.

Portfolio overview

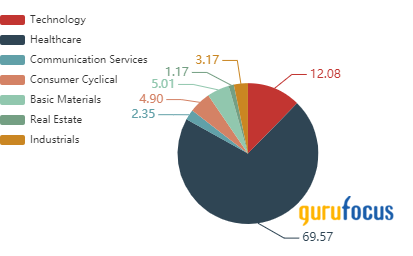

As of the quarter's end, the firm held shares in 56 stocks valued at a total of $4.36 billion. The top holdings were Tenet Healthcare Corp. (NYSE:THC) with 16.72% of the equity portfolio, Bausch Health Companies Inc. (NYSE:BHC) with 7.84% and Takeda Pharmaceutical Co. Ltd. (NYSE:TAK) with 6.37%.

In terms of sector weighting, 69.57% of the equity portfolio was devoted to health care, with technology a distant second place at 12.08%.

Disclosure: Author owns no shares in any of the stocks mentioned. The mention of stocks in this article does not at any point constitute an investment recommendation. Portfolio updates reflect only common stock positions as per the regulatory filings for the quarter in question and may not include changes made after the quarter ended.

Read more here:

Top 4th-Quarter Trades of Tudor Investment Corp

Top 4th-Quarter Buys of Lee Ainslie's Maverick Capital

Top 4th-Quarter Trades of John Rogers' Ariel Investments

Not a Premium Member of GuruFocus? Sign up for a free 7-day trial here.

This article first appeared on GuruFocus.