The Top Money Advice From Mark Cuban, Dave Ramsey and More of the Most Influential Experts

- Oops!Something went wrong.Please try again later.

- Oops!Something went wrong.Please try again later.

With so much financial advice out there, it's hard to know what's actually essential and what's just white noise. To get the best of the best advice, GOBankingRates asked some of the most trusted financial experts in America to share the one piece of money advice they wish everyone would follow.

Check Out: GOBankingRates' Top 100 Money Experts

More Expert Advice: Tori Dunlap Wants To Dispel This Myth About Investing

Here are the top tips from Mark Cuban, Dave Ramsey and more.

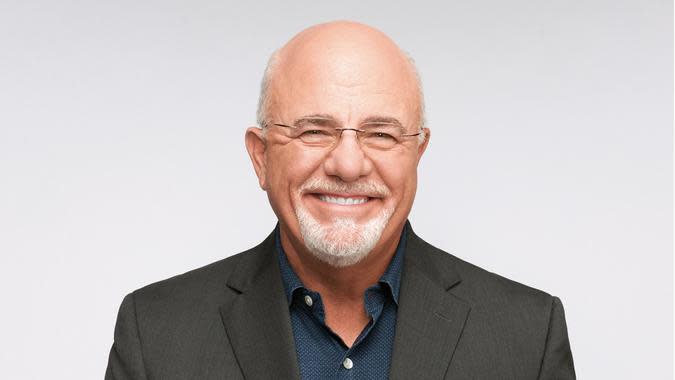

Dave Ramsey, Author of 'The Total Money Makeover' and Host of 'The Ramsey Show'

"The first thing is to have a written plan for your money — aka a budget. If you want to build wealth, you have to plan for it. Next, get out of debt and stay out of debt. Your most powerful wealth-building tool is your income. And when you spend your whole life sending payments to Sallie Mae, banks and credit card companies, you end up with less money to save and invest for your future."

Mark Cuban, Entrepreneur and Shark on 'Shark Tank'

"Don't follow excitement, follow your homework. People tend to chase excitement in markets, thinking if everyone else is buying or selling, they should be too. Instead, we all need to do our homework and have a good reason why we are buying or selling a stock. And when you don't know what to do, do nothing. Over the long haul of decades, the markets will work in your favor."

Barbara Corcoran, Founder of The Corcoran Group and Shark on 'Shark Tank'

"I'm not very good at making money on money, but I'm really good at spending it wisely. I treat myself to 'mad money' in the form of $400 cash each week. I use that money to buy flowers, get a pretzel from the street cart or hail a cab when I don't feel like walking. I spend it on all the little things that make my life that much more enjoyable, and I don't worry about wasting a thing!"

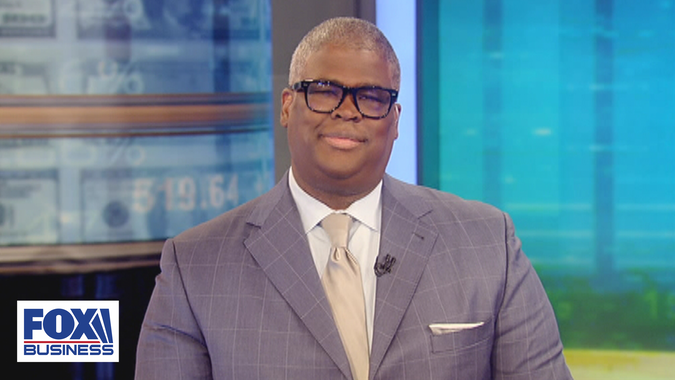

Charles Payne, Host of 'Making Money With Charles Payne'

"Cut spending and save money — we have the money. People like to complain and want to keep up with the Joneses. I went 10 years without a credit card. To this day, I rarely use (a) credit card — (I) only have a mortgage because I was making more with money in the bull market — and when I do, (I) pay them off 100% at the end of the month. The other thing is to commit to learning — read, study and read some more."

Nate O'Brien, YouTuber

"I wish people would pay more attention to the 80/20 rule. Instead of trying to save money on $4 Starbucks coffee, you're better off focusing on the largest expenses, like housing, transportation and food. Eighty percent of expenses come from 20% of purchases."

Andrew Sather, Host of 'The Investing for Beginners Podcast'

"Everyone should at least get started and put something into the stock market, even if you feel you don't have much to save and invest. The most powerful ally you can have as an investor is compound interest over a long period of time. Think of it like rolling a snowball down a hill: At first, you need much effort and there might not be much snow; but, as the ball gets rolling, it naturally picks up more and more snow with little effort."

Mandi Woodruff-Santos, Host of 'MandiMoney'

"It's not enough to save and budget. You have to pursue higher earnings and learn how to invest for long-term growth as well."

Tori Dunlap, Founder of Her First $100K

"My best advice is that personal finance is personal. Sure, there are a lot of great 'standard' principles to follow and we can all learn from each other, but accepting that what works for you may not work for others and vice versa is foundational. I am also a big advocate for shame-free education, so I think it's important, for women especially, to seek out and follow advice that isn't deprivation-based or trying to make them feel guilty about buying a morning latte."

Morgan Housel, Author of 'The Psychology of Money'

"Equally smart and informed people can manage their money differently. There is no one-size-fits-all answer. A lot of money problems come from people not knowing what they want out of life, or following advice that fits someone else's dreams."

Ramit Sethi, Author of 'I Will Teach You To Be Rich'

"No one is coming to save you with money. So getting started is more important than getting everything perfect. For example, many people who write to me have never read a single book on personal finance. Money is one of the most important things in our life, and yet we're confused about terms like '401(k)' and 'asset allocation.' No one really teaches us about money, and we know we're not doing it right, but we're not sure who to trust. The key is to just get started. Follow a simple plan for automatic savings, investing and using your money to live a rich life. You can always tweak it later."

Michelle Singletary, Author of 'The Color of Money' Column

"The one piece of advice that has shaped my financial life came from my grandmother Big Mama. During my first week as a reporter for the Baltimore Evening Sun, I covered a major fire and ended up with a front-page byline. I called Big Mama to tell her about making the front page. The first thing she asked was: Did you make sure that you have money from your paycheck set aside every time you get paid?""That advice from my grandmother — to save something every time you get a paycheck — helped me become a great saver. I wish everyone understood the power of paying yourself first, then living on what's left."

John Liang, @johnsfinancetips on TikTok

"The 'secret' to investing is that there is no secret — the most successful investors are the ones with the most 'boring' portfolios. A low-cost, broad-based market index fund is one of the surest ways to long-term wealth gain. Just buy and hold and let time do the rest. There are countless studies that show us that the professional fund managers on Wall Street fail to consistently (meaning greater than 50% of the time) beat their benchmark market index! Think about that: People getting paid millions a year ... can't even beat the market — then why should retail investors even try? They shouldn't; just be the market."

Taylor Price, @pricelesstay on TikTok

"No matter how much money you currently have, you may build your wealth by improving your financial literacy through researching free, creditable resources online. According to the Global Financial Literacy Center, people who have received a financial education tend to have a higher level of financial literacy. In turn, this can lead to people being less likely to face financial difficulties, and ultimately build wealth."

Erin Lowry, Author of 'Broke Millennial'

"I wish everyone would understand that mastering your money is far more about psychology than anything else. There's so much emphasis on slashing, cutting and deprivation in personal finance advice, but that isn't a way to build a healthy, fulfilling life or a positive relationship with money. It's important to dig into why you react and relate to money the way you do, and use that information to build a foundation and plan that will actually be effective for you."

Danetha Doe, Founder of Money & Mimosas

"Practice money mindfulness by having a weekly money date! A money date is a time to review your spending habits and investment goals. If you want to achieve success in any area of your life, you have to consistently track it. Your money date is a fun way to track your financial progress."

Tonya B. Rapley, Author of 'The Money Manual'

"Spend less than you earn. When it comes to money, you can't outsmart the math. No amount of spreadsheets or financial advice can counter overspending."

John Eringman, @johnefinance on TikTok

"Stop spending money on things to impress other people. Designer clothes and exotic cars will keep you chained to a job you don't like."

Liz Claman, Host of 'The Claman Countdown'

"Start investing as an infant. I'm not kidding. Every newborn should come out screaming, 'Put me in a no-load S&P index, Mom!' Even if it's the $50 Uncle Irving gives you the day you're born, ALL parents should start putting even a small amount every month into the stocks of good quality companies or an S&P index fund. If you can start early, the value of compound growth is put on steroids; the average rate of growth of an investment over a multi-year period is so much more dramatic when you give yourself a longer runway."Jaime Catmull contributed to the reporting for this article.More From GOBankingRatesHow Much Cash To Have Stashed at Home at All Times

See Our List: 100 Most Influential Money Experts

7 Surprisingly Easy Ways To Reach Your Retirement Goals

35 Useless Expenses You Need To Slash From Your Budget Now

This article originally appeared on GOBankingRates.com: The Top Money Advice From Mark Cuban, Dave Ramsey and More of the Most Influential Experts