Top Ranked Growth Stocks to Buy for March 4th

Here are four stocks with buy ranks and strong growth characteristics for investors to consider today, March 4th:

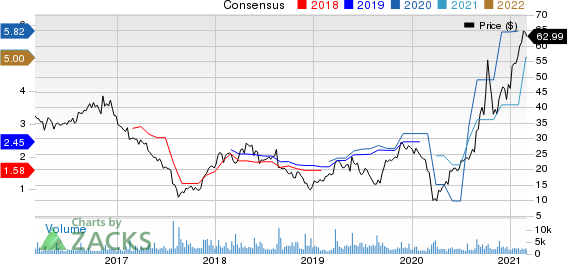

Boise Cascade Company (BCC): This manufacturer of wood products and distributor of building materials carries a Zacks Rank #1 (Strong Buy), has witnessed the Zacks Consensus Estimate for its current year earnings increasing 58.8% over the last 60 days.

Boise Cascade, L.L.C. Price and Consensus

Boise Cascade, L.L.C. price-consensus-chart | Boise Cascade, L.L.C. Quote

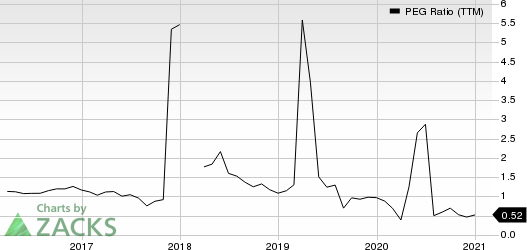

Boise Cascade has a PEG ratio of 0.99 compared with 1.04 for the industry. The company possesses a Growth Score of A.

Boise Cascade, L.L.C. PEG Ratio (TTM)

Boise Cascade, L.L.C. peg-ratio-ttm | Boise Cascade, L.L.C. Quote

Hibbett Sports, Inc. (HIBB): This athletic-inspired fashion products retailer carries a Zacks Rank #1, has witnessed the Zacks Consensus Estimate for its current year earnings increasing 5.4% over the last 60 days.

Hibbett Sports, Inc. Price and Consensus

Hibbett Sports, Inc. price-consensus-chart | Hibbett Sports, Inc. Quote

Hibbett Sports has a PEG ratio of 0.74, compared with 2.82 for the industry. The company possesses a Growth Score of B.

Hibbett Sports, Inc. PEG Ratio (TTM)

Hibbett Sports, Inc. peg-ratio-ttm | Hibbett Sports, Inc. Quote

MaxLinear, Inc. (MXL): This provider of radiofrequency, high-performance analog, and mixed-signal communications systems-on-chip solutions carries a Zacks Rank #1, has witnessed the Zacks Consensus Estimate for its current year earnings increasing 13.4% over the last 60 days.

MaxLinear, Inc Price and Consensus

MaxLinear, Inc price-consensus-chart | MaxLinear, Inc Quote

MaxLinear has a PEG ratio of 0.94, compared with 2.07 for the industry. The company possesses a Growth Score of B.

MaxLinear, Inc PEG Ratio (TTM)

MaxLinear, Inc peg-ratio-ttm | MaxLinear, Inc Quote

Select Medical Holdings Corporation (SEM): This operator of critical illness recovery hospitals, rehabilitation hospitals, outpatient rehabilitation clinics, and occupational health centers carries a Zacks Rank #1, has witnessed the Zacks Consensus Estimate for its current year earnings increasing 47.7% over the last 60 days.

Select Medical Holdings Corporation Price and Consensus

Select Medical Holdings Corporation price-consensus-chart | Select Medical Holdings Corporation Quote

Select Medical Holdings has a PEG ratio of 1.00, compared with 2.28 for the industry. The company possesses a Growth Score of A.

Select Medical Holdings Corporation PEG Ratio (TTM)

Select Medical Holdings Corporation peg-ratio-ttm | Select Medical Holdings Corporation Quote

See the full list of top ranked stocks here.

Learn more about the Growth score and how it is calculated here.

The Hottest Tech Mega-Trend of All

Last year, it generated $24 billion in global revenues. By 2020, it's predicted to blast through the roof to $77.6 billion. Famed investor Mark Cuban says it will produce "the world's first trillionaires," but that should still leave plenty of money for regular investors who make the right trades early.

See Zacks' 3 Best Stocks to Play This Trend >>

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Select Medical Holdings Corporation (SEM) : Free Stock Analysis Report

Hibbett Sports, Inc. (HIBB) : Free Stock Analysis Report

Boise Cascade, L.L.C. (BCC) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research