Top Ranked Income Stocks to Buy for June 22nd

Here are four stocks with buy rank and strong income characteristics for investors to consider today, June 22nd:

Chimera Investment Corporation (CIM): This real estate investment trust operator has witnessed the Zacks Consensus Estimate for its current year earnings increasing 17.6% over the last 60 days.

Chimera Investment Corporation Price and Consensus

Chimera Investment Corporation price-consensus-chart | Chimera Investment Corporation Quote

This Zacks Rank #1 (Strong Buy) company has a dividend yield of 7.78%, compared with the industry average of 6.78%. Its five-year average dividend yield is 11.81%.

Chimera Investment Corporation Dividend Yield (TTM)

Chimera Investment Corporation dividend-yield-ttm | Chimera Investment Corporation Quote

Exxon Mobil Corporation (XOM): This company that explores for and produces crude oil and natural gas has witnessed the Zacks Consensus Estimate for its current year earnings increasing 16.8% over the last 60 days.

Exxon Mobil Corporation Price and Consensus

Exxon Mobil Corporation price-consensus-chart | Exxon Mobil Corporation Quote

This Zacks Rank #1 company has a dividend yield of 5.56%, compared with the industry average of 1.58%. Its five-year average dividend yield is 5.01%.

Exxon Mobil Corporation Dividend Yield (TTM)

Exxon Mobil Corporation dividend-yield-ttm | Exxon Mobil Corporation Quote

Navient Corporation (NAVI): This company that provides education loan management and business processing solutions has witnessed the Zacks Consensus Estimate for its current year earnings increasing 32.4% over the last 60 days.

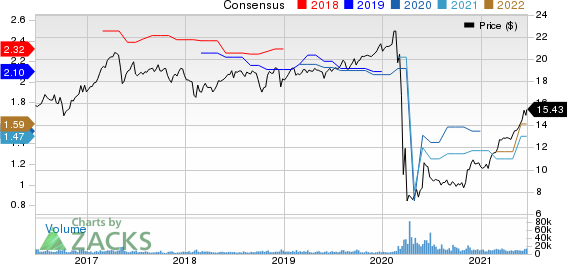

Navient Corporation Price and Consensus

Navient Corporation price-consensus-chart | Navient Corporation Quote

This Zacks Rank #1 company has a dividend yield of 3.32%, compared with the industry average of 0.00%. Its five-year average dividend yield is 5.31%.

Navient Corporation Dividend Yield (TTM)

Navient Corporation dividend-yield-ttm | Navient Corporation Quote

LCNB Corp. (LCNB): This financial holding company has witnessed the Zacks Consensus Estimate for its current year earnings increasing 35.7% over the last 60 days.

LCNB Corporation Price and Consensus

LCNB Corporation price-consensus-chart | LCNB Corporation Quote

This Zacks Rank #1 company has a dividend yield of 4.55%, compared with the industry average of 2.00%. Its five-year average dividend yield is 3.88%.

LCNB Corporation Dividend Yield (TTM)

LCNB Corporation dividend-yield-ttm | LCNB Corporation Quote

See the full list of top ranked stocks here.

Find more top income stocks with some of our great premium screens.

5 Stocks Set to Double

Each was hand-picked by a Zacks expert as the #1 favorite stock to gain +100% or more in 2020. Each comes from a different sector and has unique qualities and catalysts that could fuel exceptional growth.

Most of the stocks in this report are flying under Wall Street radar, which provides a great opportunity to get in on the ground floor.

Today, See These 5 Potential Home Runs >>

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Exxon Mobil Corporation (XOM) : Free Stock Analysis Report

Navient Corporation (NAVI) : Free Stock Analysis Report

LCNB Corporation (LCNB) : Free Stock Analysis Report

Chimera Investment Corporation (CIM) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research