Top Ranked Value Stocks to Buy for February 21st

Here are three stocks with buy rank and strong value characteristics for investors to consider today, February 21st:

Banco Macro S.A. (BMA): This company that provides various banking products and services to individuals and corporate customers has a Zacks Rank #1 (Strong Buy), and seen the Zacks Consensus Estimate for its current year earnings rising 21.4% over the last 60 days.

Macro Bank Inc. Price and Consensus

Macro Bank Inc. price-consensus-chart | Macro Bank Inc. Quote

Banco Macro has a price-to-earnings ratio (P/E) of 3.29 compared with 12.30 for the industry. The company possesses a Value Score of A.

Macro Bank Inc. PE Ratio (TTM)

Macro Bank Inc. pe-ratio-ttm | Macro Bank Inc. Quote

American Equity Investment Life Holding Company (AEL): This provider of life insurance products and services has a Zacks Rank #1 (Strong Buy), and seen the Zacks Consensus Estimate for its current year earnings rising 17.6% over the last 60 days.

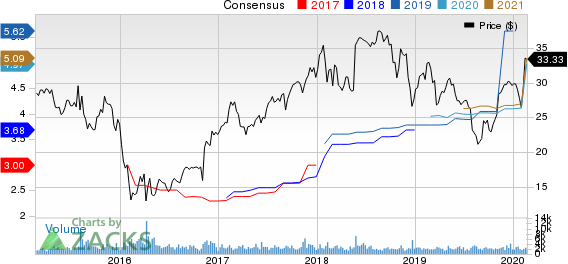

American Equity Investment Life Holding Company Price and Consensus

American Equity Investment Life Holding Company price-consensus-chart | American Equity Investment Life Holding Company Quote

American Equity Investment has a price-to-earnings ratio (P/E) of 6.71 compared with 14.70 for the industry. The company possesses a Value Score of A.

American Equity Investment Life Holding Company PE Ratio (TTM)

American Equity Investment Life Holding Company pe-ratio-ttm | American Equity Investment Life Holding Company Quote

Delta Air Lines, Inc. (DAL): This provider of scheduled air transportation services has a Zacks Rank #2 (Buy), and seen the Zacks Consensus Estimate for its current year earnings rising 2.1% over the last 60 days.

Delta Air Lines, Inc. Price and Consensus

Delta Air Lines, Inc. price-consensus-chart | Delta Air Lines, Inc. Quote

Delta Air Lines has a price-to-earnings ratio (P/E) of 8.01 compared with 19.70 for the industry. The company possesses a Value Score of B.

Delta Air Lines, Inc. PE Ratio (TTM)

Delta Air Lines, Inc. pe-ratio-ttm | Delta Air Lines, Inc. Quote

See the full list of top ranked stocks here

Learn more about the Value score and how it is calculated here.

Find more top income stocks with some of our great premium screens.

More Stock News: This Is Bigger than the iPhone!

It could become the mother of all technological revolutions. Apple sold a mere 1 billion iPhones in 10 years but a new breakthrough is expected to generate more than 27 billion devices in just 3 years, creating a $1.7 trillion market.

Zacks has just released a Special Report that spotlights this fast-emerging phenomenon and 6 tickers for taking advantage of it. If you don't buy now, you may kick yourself in 2020.

Click here for the 6 trades >>

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Delta Air Lines, Inc. (DAL) : Free Stock Analysis Report

Macro Bank Inc. (BMA) : Free Stock Analysis Report

American Equity Investment Life Holding Company (AEL) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research