Top Stock Picks for 2021: Dillard's

Every day for the next two weeks, we're going to highlight one of Schaeffer's top 14 picks for 2021. Up today is an oft-overlooked retail stock. To access the entirety of the 2021 report, click here.

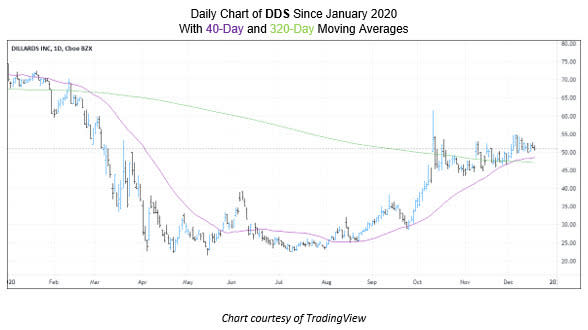

Retail powerhouse Dillard’s (NYSE:DDS) has been one of the many shopping names to struggle to find footing in 2020. But despite the equity’s underperformance of more than 20% in this time frame, optimism has come amid the stock’s impressive climb of more than 140% from its mid-May bottom. Plus, since mid-October, the shares have been consolidating in a rectangle pattern, as the 40-day moving average crosses above the 320-day. With this technical background in place, now is the perfect time to buy calls.

Meanwhile, short interest on the retailer has been declining since rallying off its summer lows. In fact, short interest now accounts for a heavy 39% of DDS’ float, which would take shorts sellers nearly 11 days to cover, at the stock’s average pace of daily trading.

Lastly, and unwinding of bearish sentiment could trigger a fresh round of tailwinds, sending the security even higher in the coming year. First, in the options pits, puts have been popular for short-term traders, with the stock’s SOIR of 1.23 ranking in the 81st annual percentile. In terms of analyst attention, room for upgrades is plentiful, as all five covering brokerage firms sport a tepid "hold" or worse recommendation.

Tony Venosa, CMT, is a Senior Options Strategist at Schaeffer's Investment Research. He's has over 20 years of trading experience under his belt -- including a stint in the mid-'90s clerking in the S&P 500 trading pits in Chicago, plus time spent as a commodity broker and proprietary day trader. A graduate of Miami University with a B.S. in finance and decision sciences, Venosa earned his Chartered Market Technician designation in 2008, and has been part of Schaeffer's in-house research team since 2010.